Citibank 2012 Annual Report Download - page 309

Download and view the complete annual report

Please find page 309 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.287

On November 27, 2012, the court entered an order granting preliminary

approval of the proposed class settlements and provisionally certified two

classes for settlement purposes only. The court scheduled a final approval

hearing for September 12, 2013. Several large merchants and associations

have stated publicly that they intend to object to or opt out of the settlement,

and have appealed from the court’s preliminary approval of the proposed

class settlements.

Visa and MasterCard have also entered into a settlement agreement

with merchants that filed individual, non-class actions. While Citigroup

and Related Parties are not parties to the individual merchant non-class

settlement agreement, they are contributing to that settlement, and

the agreement provides for a release of claims against Citigroup and

Related Parties.

Additional information concerning these consolidated actions is publicly

available in court filings under the docket number MDL 05-1720 (E.D.N.Y.)

(Gleeson, J.).

Regulatory Review of Consumer “Add-On” Products

Certain of Citi’s consumer businesses, including its Citi-branded and retail

services cards businesses, offer or have in the past offered or participated

in the marketing, distribution, or servicing of products, such as payment

protection and identity monitoring, that are ancillary to the provision of

credit to the consumer (add-on products). These add-on products have been

the subject of enforcement actions against other institutions by regulators,

including the Consumer Financial Protection Bureau (CFPB), the OCC, and

the FDIC, that have resulted in orders to pay restitution to customers and

penalties in substantial amounts. Certain state attorneys general also have

filed industry-wide suits under state consumer protection statutes, alleging

deceptive marketing practices in connection with the sale of payment

protection products and demanding restitution and statutory damages for in-

state customers. In light of the current regulatory focus on add-on products

and the actions regulators have taken in relation to other credit card issuers,

one or more regulators may order that Citi pay restitution to customers

and/or impose penalties or other relief arising from Citi’s marketing,

distribution, or servicing of add-on products.

Parmalat Litigation and Related Matters

On July 29, 2004, Dr. Enrico Bondi, the Extraordinary Commissioner

appointed under Italian law to oversee the administration of various

Parmalat companies, filed a complaint in New Jersey state court against

Citigroup and Related Parties alleging, among other things, that the

defendants “facilitated” a number of frauds by Parmalat insiders. On

October 20, 2008, following trial, a jury rendered a verdict in Citigroup’s

favor on Parmalat’s claims and in favor of Citibank, N.A. on three

counterclaims. Parmalat has exhausted all appeals, and the judgment is now

final. Additional information concerning this matter is publicly available in

court filings under docket number A-2654-08T2 (N.J. Sup. Ct.).

Prosecutors in Parma and Milan, Italy, have commenced criminal

proceedings against certain current and former Citigroup employees (along

with numerous other investment banks and certain of their current and former

employees, as well as former Parmalat officers and accountants). In the event

of an adverse judgment against the individuals in question, the authorities

could seek administrative remedies against Citigroup. On April 18, 2011, the

Milan criminal court acquitted the sole Citigroup defendant of market-rigging

charges. The Milan prosecutors have appealed part of that judgment and seek

administrative remedies against Citigroup, which may include disgorgement

of 70 million Euro and a fine of 900,000 Euro. Additionally, the Parmalat

administrator filed a purported civil complaint against Citigroup in the context

of the Parma criminal proceedings, which seeks 14 billion Euro in damages.

In January 2011, certain Parmalat institutional investors filed a civil complaint

seeking damages of approximately 130 million Euro against Citigroup and

other financial institutions.

Allied Irish Bank Litigation

In 2003, Allied Irish Bank (AIB) filed a complaint in the United States District

Court for the Southern District of New York seeking to hold Citibank, N.A.

and Bank of America, N.A., former prime brokers for AIB’s subsidiary Allfirst

Bank (Allfirst), liable for losses incurred by Allfirst as a result of fraudulent

and fictitious foreign currency trades entered into by one of Allfirst’s traders.

AIB seeks compensatory damages of approximately $500 million, plus

punitive damages, from Citibank, N.A. and Bank of America, N.A. collectively.

In 2006, the court granted in part and denied in part defendants’ motion

to dismiss. In 2009, AIB filed an amended complaint. In 2012, the parties

completed discovery and the court granted Citibank, N.A.’s motion to strike

AIB’s demand for a jury trial. Citibank, N.A. also filed a motion for summary

judgment, which is pending. AIB has announced a settlement with Bank

of America, N.A. for an undisclosed amount, leaving Citibank, N.A. as the

sole remaining defendant. Additional information concerning this matter

is publicly available in court filings under docket number 03 Civ. 3748

(S.D.N.Y.) (Batts, J.).

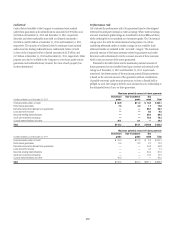

Settlement Payments

Payments required in settlement agreements described above have been

made or are covered by existing litigation accruals.

* * *

Additional matters asserting claims similar to those described above may be

filed in the future.