Citibank 2012 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.251

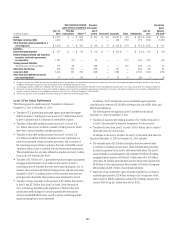

If quoted market prices are not available, fair value is based upon

internally developed valuation techniques that use, where possible, current

market-based parameters, such as interest rates, currency rates, option

volatilities, etc. Items valued using such internally generated valuation

techniques are classified according to the lowest level input or value driver

thatissignificanttothevaluation.Thus,anitemmaybeclassifiedasLevel3

even though there may be some significant inputs that are readily observable.

The Company may also apply a price-based methodology, which utilizes,

where available, quoted prices or other market information obtained from

recent trading activity in positions with the same or similar characteristics to

the position being valued. The market activity and the amount of the bid-ask

spread are among the factors considered in determining the liquidity of

markets and the relevance of observed prices from those markets. If relevant

and observable prices are available, those valuations may be classified as

Level2.Whenlessliquidityexistsforasecurityorloan,aquotedpriceis

stale, a significant adjustment to the price of a similar security is necessary

to reflect differences in the terms of the actual security or loan being valued,

or prices from independent sources are insufficient to corroborate the

valuation, the “price” inputs are considered unobservable and the fair value

measurementsareclassifiedasLevel3.

Fair value estimates from internal valuation techniques are verified,

where possible, to prices obtained from independent vendors or brokers.

Vendorsandbrokers’valuationsmaybebasedonavarietyofinputsranging

from observed prices to proprietary valuation models.

The following section describes the valuation methodologies used by

the Company to measure various financial instruments at fair value,

including an indication of the level in the fair value hierarchy in which each

instrument is generally classified. Where appropriate, the description includes

details of the valuation models, the key inputs to those models and any

significant assumptions.

Market valuation adjustments

LiquidityadjustmentsareappliedtoitemsinLevel2andLevel3ofthefair

value hierarchy to ensure that the fair value reflects the liquidity or illiquidity

of the market. The liquidity reserve may utilize the bid-offer spread for an

instrument as one of the factors.

Counterparty credit-risk adjustments are applied to derivatives, such as

over-the-counter uncollateralized derivatives, where the base valuation uses

market parameters based on the relevant base interest rate curves. Not all

counterparties have the same credit risk as that implied by the relevant base

curve, so it is necessary to consider the market view of the credit risk of a

counterparty in order to estimate the fair value of such an item.

Bilateral or “own” credit-risk adjustments are applied to reflect the

Company’s own credit risk when valuing derivatives and liabilities measured

at fair value. Counterparty and own credit adjustments consider the expected

future cash flows between Citi and its counterparties under the terms of

the instrument and the effect of credit risk on the valuation of those cash

flows, rather than a point-in-time assessment of the current recognized net

asset or liability. Furthermore, the credit-risk adjustments take into account

the effect of credit-risk mitigants, such as pledged collateral and any legal

right of offset (to the extent such offset exists) with a counterparty through

arrangements such as netting agreements.

Generally, the unit of account for a financial instrument is the individual

financial instrument. The Company applies market valuation adjustments that

are consistent with the unit of account, which does not include adjustment due

to the size of the Company’s position, except as follows. ASC 820-10 permits an

exception, through an accounting policy election, to measure the fair value

of a portfolio of financial assets and financial liabilities on the basis of the net

open risk position when certain criteria are met. Citi has elected to measure

certain portfolios of financial instruments, such as derivatives, that meet those

criteria on the basis of the net open risk position. The Company applies market

valuation adjustments, including adjustments to account for the size of the

net open risk position, consistent with market participant assumptions and in

accordance with the unit of account.

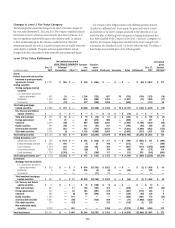

Valuation Process for Level 3 Fair Value Measurements

Price verification procedures and related internal control procedures are

governed by the Citigroup Pricing and Price Verification Policy and

Standards, which is jointly owned by Finance and Risk Management.

Finance has implemented the ICG Securities and Banking Pricing and

Price Verification Standards and Procedures to facilitate compliance with

this policy.

For fair value measurements of substantially all assets and liabilities held

by the Company, individual business units are responsible for valuing the

trading account assets and liabilities, and Product Control within Finance

performs independent price verification procedures to evaluate those fair

value measurements. Product Control is independent of the individual

business units and reports into the Global Head of Product Control. It has

the final authority over the independent valuation of financial assets and

liabilities. Fair value measurements of assets and liabilities are determined

using various techniques, including, but not limited to, discounted cash

flows and internal models, such as option and correlation models.

Based on the observability of inputs used, Product Control classifies the

inventoryasLevel1,Level2orLevel3ofthefairvaluehierarchy.When

a position involves one or more significant inputs that are not directly

observable, additional price verification procedures are applied. These

procedures may include reviewing relevant historical data, analyzing profit

and loss, valuing each component of a structured trade individually, and

benchmarking, among others.