Citibank 2012 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

190

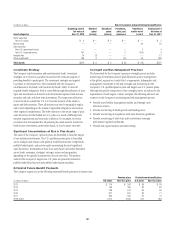

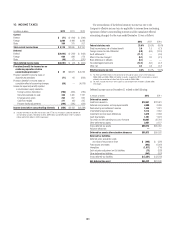

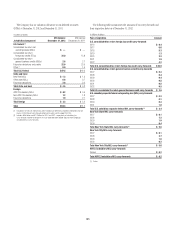

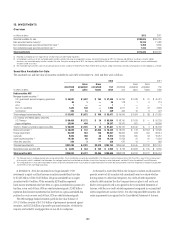

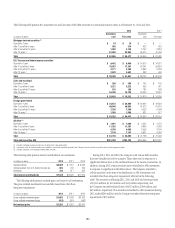

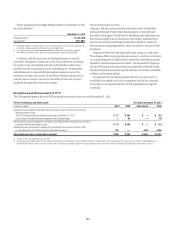

15. INVESTMENTS

Overview

In millions of dollars 2012 2011

Securities available-for-sale $288,695 $265,204

Debt securities held-to-maturity (1) 10,130 11,483

Non-marketable equity securities carried at fair value (2) 5,768 8,836

Non-marketable equity securities carried at cost (3) 7,733 7,890

Total investments $312,326 $293,413

(1) Recorded at amortized cost less impairment for securities that have credit-related impairment.

(2) Unrealized gains and losses for non-marketable equity securities carried at fair value are recognized in earnings. During the third quarter of 2012, the Company sold EMI Music resulting in a total $1.5 billion

decrease in non-marketable equity securities carried at fair value. During the second quarter of 2012, the Company sold EMI Music Publishing resulting in a total of $1.3 billion decrease in non-marketable equity

securities carried at fair value.

(3) Non-marketable equity securities carried at cost primarily consist of shares issued by the Federal Reserve Bank, Federal Home Loan Banks, foreign central banks and various clearing houses of which Citigroup is a member.

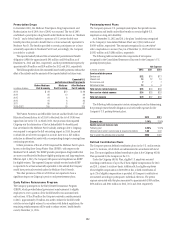

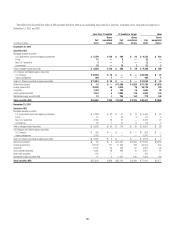

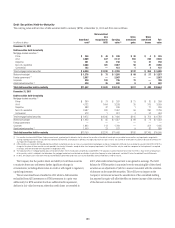

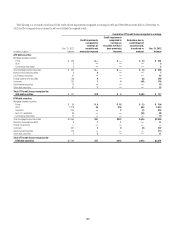

Securities Available-for-Sale

The amortized cost and fair value of securities available-for-sale (AFS) at December 31, 2012 and 2011 were as follows:

2012 2011

In millions of dollars

Amortized

cost

Gross

unrealized

gains

Gross

unrealized

losses

Fair

value

Amortized

cost

Gross

unrealized

gains

Gross

unrealized

losses

Fair

value

Debt securities AFS

Mortgage-backed securities (1)

U.S. government-sponsored agency guaranteed $ 46,001 $1,507 $ 163 $ 47,345 $ 44,394 $ 1,438 $ 51 $ 45,781

Prime 85 1 — 86 118 1 6 113

Alt-A 1 — — 1 1 — — 1

Non-U.S. residential 7,442 148 — 7,590 4,671 9 22 4,658

Commercial 436 16 3 449 465 16 9 472

Total mortgage-backed securities $ 53,965 $ 1,672 $ 166 $ 55,471 $ 49,649 $ 1,464 $ 88 $ 51,025

U.S. Treasury and federal agency securities

U.S. Treasury $ 64,456 $ 1,172 $ 34 $ 65,594 $ 48,790 $ 1,439 $ — $ 50,229

Agency obligations 25,844 404 1 26,247 34,310 601 2 34,909

Total U.S. Treasury and federal agency securities $ 90,300 $1,576 $ 35 $ 91,841 $ 83,100 $2,040 $ 2 $ 85,138

State and municipal (2) $ 20,020 $ 132 $1,820 $ 18,332 $ 16,819 $ 134 $ 2,554 $ 14,399

Foreign government 93,259 918 130 94,047 84,360 558 404 84,514

Corporate 9,302 398 26 9,674 10,005 305 53 10,257

Asset-backed securities (1) 14,188 85 143 14,130 11,053 31 81 11,003

Other debt securities 256 2 — 258 670 13 — 683

Total debt securities AFS $281,290 $4,783 $2,320 $283,753 $255,656 $ 4,545 $ 3,182 $257,019

Marketable equity securities AFS $ 4,643 $ 444 $ 145 $ 4,942 $ 6,722 $ 1,658 $ 195 $ 8,185

Total securities AFS $285,933 $ 5,227 $2,465 $288,695 $262,378 $ 6,203 $ 3,377 $265,204

(1) The Company invests in mortgage-backed and asset-backed securities. These securitizations are generally considered VIEs. The Company’s maximum exposure to loss from these VIEs is equal to the carrying amount

of the securities, which is reflected in the table above. For mortgage-backed and asset-backed securitizations in which the Company has other involvement, see Note 22 to the Consolidated Financial Statements.

(2) The unrealized losses on state and municipal debt securities are primarily attributable to the result of yields on taxable fixed income instruments decreasing relatively faster than the general tax-exempt municipal yields

and the effects of fair value hedge accounting.

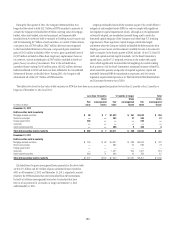

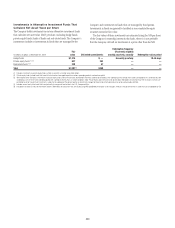

At December 31, 2012, the amortized cost of approximately 3,500

investments in equity and fixed-income securities exceeded their fair value

by $2.465 billion. Of the $2.465 billion, the gross unrealized loss on equity

securities was $145 million. Of the remainder, $238 million represents

fixed-income investments that have been in a gross-unrealized-loss position for

less than a year and, of these, 98% are rated investment grade; $2.082 billion

represents fixed-income investments that have been in a gross-unrealized-loss

position for a year or more and, of these, 92% are rated investment grade.

The AFS mortgage-backed securities portfolio fair value balance of

$55.471 billion consists of $47.345 billion of government-sponsored agency

securities, and $8.126 billion of privately sponsored securities, of which the

majority are backed by mortgages that are not Alt-A or subprime.

As discussed in more detail below, the Company conducts and documents

periodic reviews of all securities with unrealized losses to evaluate whether

the impairment is other than temporary. Any credit-related impairment

related to debt securities that the Company does not plan to sell and is not

likely to be required to sell is recognized in the Consolidated Statement of

Income, with the non-credit-related impairment recognized in accumulated

other comprehensive income (AOCI). For other impaired debt securities, the

entire impairment is recognized in the Consolidated Statement of Income.