Citibank 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

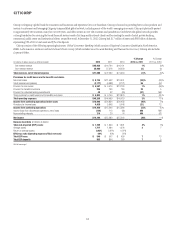

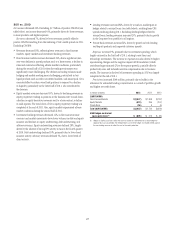

2012 vs. 2011

Net income increased 18%, mainly driven by higher mortgage revenues and

a $2.3 billion decrease in net credit losses, partially offset by a $1.8 billion

reduction in loan loss reserve releases.

Revenues increased 5%, driven by a 38% increase in non-interest revenues

from higher gains on sale of mortgages, partly offset by a 2% decline in

net interest revenues. The higher gains on sale of mortgages were driven

by high volumes of mortgage refinancing activity, due largely to the U.S.

government’s Home Affordable Refinance Program (HARP), as well as

higher margins resulting from the shift to retail as compared to third-party

origination channels. Assuming the continued low interest rate environment,

Citi believes the higher mortgage refinancing volumes could continue into

the first half of 2013. Excluding mortgages, revenue from the retail banking

business was essentially flat, as volume growth and improved mix in the

deposit and lending portfolios was offset by significant spread compression.

Citi expects spread compression to continue to negatively impact revenues

during 2013.

Cards revenues declined 4%. In Citi-branded cards, both average loans

and net interest revenue declined year-over-year, reflecting continued

increased payment rates resulting from consumer deleveraging and the

impact of the look-back provisions of The Credit Card Accountability

Responsibility and Disclosure Act (CARD Act).10 Citi expects the look-back

provisions of the CARD Act will likely have a diminishing impact on the

results of operations of its cards businesses during 2013. In Citi retail

services, net interest revenues improved slightly but were offset by declining

non-interest revenues, driven by improving credit and the resulting impact

on contractual partner payments. Citi expects cards revenues could continue

to be negatively impacted by higher payment rates for consumers, reflecting

ongoing economic uncertainty and deleveraging as well as Citi’s shift to

higher credit quality borrowers.

As part of its U.S. Citi-branded cards business, Citibank, N.A. issues a

co-branded credit card product with American Airlines, the Citi/AAdvantage

card. AMR Corporation and certain of its subsidiaries, including American

Airlines, Inc., filed voluntary petitions for reorganization under Chapter

11 of the U.S. Bankruptcy Code in November 2011. On February 14, 2013,

AMR Corporation and US Airways Group, Inc. announced that the boards of

directors of both companies had approved a merger agreement under which

the companies would be combined. For additional information, see “Risk

Factors—Business and Operational Risks” below.

Expenses increased 3%, primarily due to increased mortgage origination

costs resulting from the higher retail channel mortgage volumes and $100

million of repositioning charges in the fourth quarter of 2012, partially offset

by lower expenses in cards. Expenses continued to be impacted by elevated

legal and related costs.

Provisions decreased 14%, due to lower net credit losses in the cards

portfolio partly offset by continued lower loan loss reserve releases ($2.4

billion in 2012 compared to $4.2 billion in 2011). Assuming no downturn

in the U.S. economic environment, Citi believes credit trends have largely

stabilized in the cards portfolios.

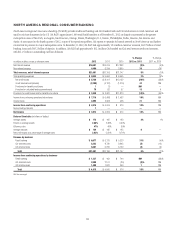

2011 vs. 2010

Net income increased $3.1 billion, driven by higher loan loss reserve releases

and an improvement in net credit losses, partly offset by lower revenues and

higher expenses.

Revenues decreased 7% due to a decrease in net interest and non-interest

revenues. Net interest revenue decreased 5%, driven primarily by lower

cards net interest revenue, which was negatively impacted by the look-back

provision of the CARD Act. In addition, net interest revenue for cards was

negatively impacted by higher promotional balances and lower total average

loans. Non-interest revenue decreased 16%, primarily due to lower gains from

the sale of mortgage loans, as margins declined and Citi held more loans

on-balance sheet, and declining revenues driven by improving credit and the

resulting impact on contractual partner payments in Citi retail services. In

addition, the decline in non-interest revenue reflected lower retail banking

fee income.

Expenses increased 15%, primarily driven by higher investment

spending in the business during the second half of 2011, particularly

in cards marketing and technology, and increases in litigation accruals

related to the interchange fees litigation (see Note 28 to the Consolidated

Financial Statements).

Provisions decreased 66%, primarily due to a loan loss reserve release of

$4.2 billion in 2011, compared to a loan loss reserve release of $1.3 billion in

2010, and lower net credit losses in the cards portfolios (cards net credit losses

declined $5.0 billion, or 38%, from 2010).

10 The CARD Act requires a review once every six months for card accounts where the annual

percentage rate (APR) has been increased since January 1, 2009 to assess whether changes in credit

risk, market conditions or other factors merit a future decline in the APR.