Citibank 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

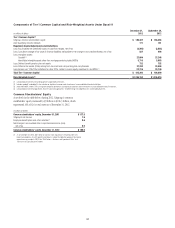

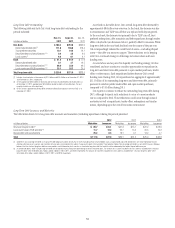

Long-Term Debt Outstanding

The following table sets forth Citi’s total long-term debt outstanding for the

periods indicated:

In billions of dollars

Dec. 31,

2012

Sept. 30,

2012

Dec. 31,

2011

Non-bank $ 188.3 $210.0 $245.6

Senior/subordinated debt (1) 171.0 186.8 216.4

Trust preferred securities 10.1 10.6 16.1

Securitized debt and securitizations (1)(2) 0.4 3.5 4.0

Local country (1) 6.8 9.1 9.1

Bank $ 51.2 $ 61.9 $ 77.9

Senior/subordinated debt 0.1 3.7 10.5

Securitized debt and securitizations (1)(2) 26.0 32.0 46.5

Local country and FHLB borrowings (1)(3) 25.1 26.2 20.9

Total long-term debt $ 239.5 $271.9 $323.5

(1) Includes structured notes in the amount of $27.5 billion and $23.4 billion as of December 31, 2012,

and December 31, 2011, respectively.

(2) Of the approximate $26.4 billion of total bank and non-bank securitized debt and securitizations as

of December 31, 2012, approximately $23.0 billion related to credit card securitizations, the vast

majority of which was at the bank level.

(3) Of this amount, approximately $16.3 billion related to collateralized advances from the FHLB as of

December 31, 2012.

As set forth in the table above, Citi’s overall long-term debt decreased by

approximately $84 billion year-over-year. In the bank, the decrease was due

to securitization and TLGP run-off that was replaced with deposit growth.

In the non-bank, the decrease was primarily due to TLGP run-off, trust

preferred redemptions, debt maturities and debt repurchases through tender

offers or buybacks (see discussion below), partially offset by issuances. While

long-term debt in the non-bank declined over the course of the past year,

Citi correspondingly reduced its overall level of assets—including illiquid

assets—that debt was meant to support. These reductions are in keeping

with Citi’s continued strategy to deleverage its balance sheet and lower

funding costs.

As noted above and as part of its liquidity and funding strategy, Citi has

considered, and may continue to consider, opportunities to repurchase its

long-term and short-term debt pursuant to open market purchases, tender

offers or other means. Such repurchases further decrease Citi’s overall

funding costs. During 2012, Citi repurchased an aggregate of approximately

$11.1 billion of its outstanding long-term and short-term debt, primarily

pursuant to selective public tender offers and open market purchases,

compared to $3.3 billion during 2011.

Citi expects to continue to reduce its outstanding long-term debt during

2013, although it expects such reductions to occur at a more moderate

rate as compared to 2012. These reductions could occur through natural

maturities as well as repurchases, tender offers, redemptions and similar

means, depending upon the overall economic environment.

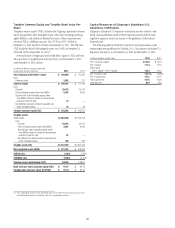

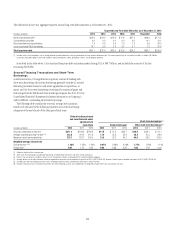

Long-Term Debt Issuances and Maturities

The table below details Citi’s long-term debt issuances and maturities (including repurchases) during the periods presented:

2012 2011 2010

In billions of dollars Maturities Issuances Maturities Issuances Maturities Issuances

Structural long-term debt (1) $ 80.7 $15.1 $47.3 $15.1 $41.2 $18.9

Local country level, FHLB and other (2) 11.7 12.2 25.7 15.2 20.5 10.2

Secured debt and securitizations 25.2 0.5 16.1 0.7 14.2 4.7

Total $ 117.6 $27.8 $89.1 $31.0 $75.9 $33.8

(1) Citi defines structural long-term debt as its long-term debt (original maturities of one year or more), excluding certain structured debt, such as equity-linked and credit-linked notes, with early redemption features

effective within one year. Issuances and maturities of these notes are included in this table in “Local country level, FHLB and other.” See footnote 2 below. Structural long-term debt is a non-GAAP measure. Citigroup

believes that the structural long-term debt measure provides useful information to its investors as it excludes long-term debt that could in fact be redeemed by the holders thereof within one year.

(2) As referenced above, “other” includes long-term debt not considered structural long-term debt relating to certain structured notes. The amounts of issuances included in this line, and thus excluded from “structural

long-term debt,” were $2.0 billion, $3.7 billion, and $3.3 billion in 2012, 2011, and 2010, respectively. The amounts of maturities included in this line, and thus excluded from “structural long-term debt,” were

$2.4 billion, $2.4 billion, and $3.0 billion, in 2012, 2011, and 2010, respectively.