Citibank 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

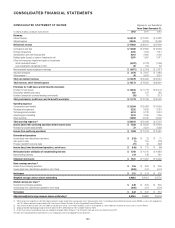

DTAs

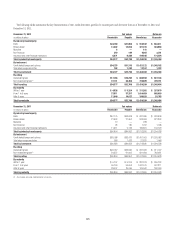

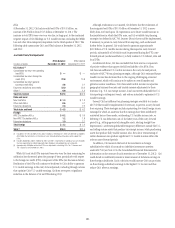

At December 31, 2012, Citi had recorded net DTAs of $55.3 billion, an

increase of $3.8 billion from $51.5 billion at December 31, 2011. The

increase in total DTAs year-over-year was due, in large part, to the continued

negative impact of Citi Holdings on U.S. taxable income, including the MSSB

loss and other-than-temporary impairment in the third quarter of 2012. The

following table summarizes Citi’s net DTAs balance at December 31, 2012

and 2011:

Jurisdiction/Component

DTAs balance DTAs balance

In billions of dollars December 31, 2012 December 31, 2011

U.S. federal (1)

Consolidated tax return net operating

loss (NOL) $ — $ —

Consolidated tax return foreign tax

credit (FTC) 22.0 15.8

Consolidated tax return general

business credit (GBC) 2.6 2.1

Future tax deductions and credits 22.0 23.0

Other (2) 0.9 1.4

Total U.S. federal $47.5 $42.3

State and local

New York NOLs $ 1.3 $ 1.3

Other state NOLs 0.6 0.7

Future tax deductions 2.6 2.2

Total state and local $ 4.5 $ 4.2

Foreign

APB 23 subsidiary NOLs $ 0.2 $ 0.5

Non-APB 23 subsidiary NOLs 1.2 1.8

Future tax deductions 1.9 2.7

Total foreign $ 3.3 $ 5.0

Total (3) $55.3 $51.5

(1) Included in the net U.S. federal DTAs of $47.5 billion at December 31, 2012 are deferred tax liabilities

of $2 billion that will reverse in the relevant carry-forward period and may be used to support the

DTAs.

(2) Includes $0.8 billion and $1.2 billion for 2012 and 2011, respectively, of subsidiary tax carry-forwards

that are expected to be utilized separately from Citigroup’s consolidated tax carry-forwards.

(3) Approximately $40 billion of the total DTAs was deducted in calculating Citi’s Tier 1 Common and

Tier 1 Capital as of December 31, 2012.

While Citi’s net total DTAs increased year-over-year, the time remaining for

utilization has shortened, given the passage of time, particularly with respect

to the foreign tax credit (FTC) component of the DTAs (see discussion below).

Realization of the DTAs will continue to be driven by Citi’s ability to generate

U.S. taxable earnings in the carry-forward periods, including through actions

that optimize Citi’s U.S. taxable earnings. Citi does not expect a significant

reduction in the balance of its net DTAs during 2013.

Although realization is not assured, Citi believes that the realization of

the recognized net DTAs of $55.3 billion at December 31, 2012 is more-

likely-than-not based upon (i) expectations as to future taxable income in

the jurisdictions in which the DTAs arise, and (ii) available tax planning

strategies (as defined in ASC 740, Income Taxes) that would be implemented,

if necessary, to prevent a carry-forward from expiring, each as discussed

further below. In general, Citi would need to generate approximately

$112 billion of U.S. taxable income during the respective carry-forward

periods, substantially all of which must be generated during the FTC carry-

forward periods (as discussed below), to fully realize its U.S. federal, state and

local DTAs.

As referenced above, Citi has concluded that there are two components

of positive evidence that support the full realizability of its DTAs. First,

Citi forecasts sufficient U.S. taxable income in the carry-forward periods,

exclusive of ASC 740 tax planning strategies, although Citi’s estimated future

taxable income has decreased due to the ongoing challenging economic

environment, which will continue to be subject to overall market and

global economic conditions. Citi’s forecasted taxable income incorporates

geographic business forecasts and taxable income adjustments to those

forecasts (e.g., U.S. tax exempt income, loan loss reserves deductible for U.S.

tax reporting in subsequent years), and actions intended to optimize its U.S.

taxable earnings.

Second, Citi has sufficient tax planning strategies available to it under

ASC 740 that would be implemented, if necessary, to prevent a carry-forward

from expiring. These strategies include repatriating low-taxed foreign source

earnings for which an assertion that the earnings have been indefinitely

reinvested has not been made, accelerating U.S. taxable income into, or

deferring U.S. tax deductions out of, the latter years of the carry-forward

period (e.g., selling appreciated intangible assets, electing straight-line

depreciation), accelerating deductible temporary differences outside the U.S.,

and selling certain assets that produce tax-exempt income, while purchasing

assets that produce fully taxable income. Also, the sale or restructuring of

certain businesses can produce significant U.S. taxable income within the

relevant carry-forward periods.

In addition, Citi monitors the level of its investments in foreign

subsidiaries for which it has made an indefinite investment assertion

under ASC 740 (see Note 10 to the Consolidated Financial Statements for

information on the amount of such assertions as of December 31, 2012). Citi

could decide to indefinitely reinvest a lesser amount of its future earnings in

these foreign subsidiaries. Such a decision would increase Citi’s tax provision

on these foreign subsidiary earnings to the higher U.S. tax rate and thus

reduce Citi’s after-tax earnings.