Citibank 2012 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.197

For impaired equity method investments that management does not plan

to sell prior to recovery of value and is not likely to be required to sell, the

evaluation of whether an impairment is other-than-temporary is based on

(i) whether and when an equity method investment will recover in value and

(ii) whether the investor has the intent and ability to hold that investment for

a period of time sufficient to recover the value. The determination of whether

the impairment is considered other-than-temporary is based on all of the

following indicators, regardless of the time and extent of impairment:

• Cause of the impairment and the financial condition and near-term

prospects of the issuer, including any specific events that may influence

the operations of the issuer;

• Intent and ability to hold the investment for a period of time sufficient to

allow for any anticipated recovery in market value; and

• Length of time and extent to which fair value has been less than the

carrying value.

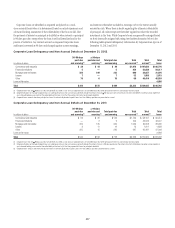

The sections below describe current circumstances related to certain of

the Company’s significant equity method investments, specific impairments

and the Company’s process for identifying credit-related impairments

in its security types with the most significant unrealized losses as of

December 31, 2012.

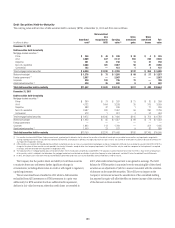

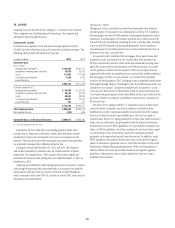

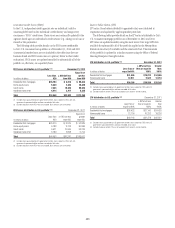

Akbank

In March 2012, Citi decided to reduce its ownership interest in Akbank

T.A.S., an equity investment in Turkey (Akbank), to below 10%. As of

March 31, 2012, Citi held a 20% equity interest in Akbank, which it purchased

in January 2007, accounted for as an equity method investment. As a result

of its decision to sell its share holdings in Akbank, in the first quarter of

2012 Citi recorded an impairment charge related to its total investment

in Akbank amounting to approximately $1.2 billion pretax ($763 million

after-tax). This impairment charge was primarily driven by the recognition

of all net investment foreign currency hedging and translation losses

previously reflected in AOCI as well as a reduction in the carrying value of the

investment to reflect the market price of Akbank’s shares. The impairment

charge was recorded in other-than-temporary impairment losses on

investments in the Consolidated Statement of Income. During the second

quarter of 2012, Citi sold a 10.1% stake in Akbank, resulting in a loss on sale

of $424 million ($274 million after-tax), recorded in Other revenue. As of

December 31, 2012, the remaining 9.9% stake in Akbank is recorded within

marketable equity securities available-for-sale.

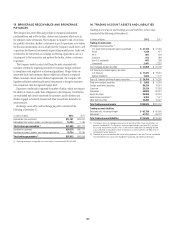

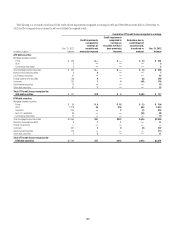

MSSB

On September 17, 2012, Citi sold to Morgan Stanley a 14% interest (the

“14% Interest”) in MSSB, to which Morgan Stanley exercised its purchase

option on June 1, 2012. Morgan Stanley paid to Citi $1.89 billion in cash as

the purchase price of the 14% Interest. The purchase price was based on an

implied 100% valuation of MSSB of $13.5 billion, as agreed between Morgan

Stanley and Citi pursuant to an agreement dated September 11, 2012. The

related approximate $4.5 billion in deposits were transferred to Morgan

Stanley at no premium, as agreed between the parties.

In addition, Morgan Stanley has agreed, subject to obtaining regulatory

approval, to purchase Citi’s remaining 35% interest in MSSB no later than

June 1, 2015 at a purchase price of $4.725 billion, which is based on the

same implied 100% valuation of MSSB of $13.5 billion.

Prior to the September 2012 sale, Citi’s carrying value of its 49% interest

in MSSB was approximately $11.3 billion. As a result of the agreement

entered into with Morgan Stanley on September 11, 2012, Citi recorded

a charge to net income in the third quarter of 2012 of approximately

$2.9 billion after-tax ($4.7 billion pretax), consisting of (i) a charge recorded

in Other revenue of approximately $800 million after-tax ($1.3 billion

pretax), representing a loss on sale of the 14% Interest, and (ii) an

other-than-temporary impairment of the carrying value of its remaining 35%

interest in MSSB of approximately $2.1 billion after-tax ($3.4 billion pretax).

As of December 31, 2012, Citi continues to account for its remaining 35%

interest in MSSB under the equity method, with the carrying value capped at

the agreed selling price of $4.725 billion.

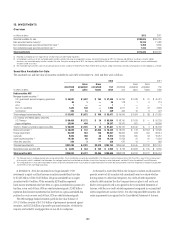

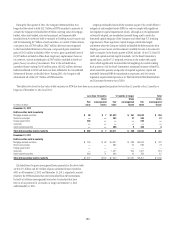

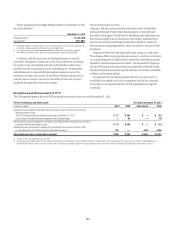

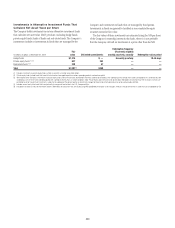

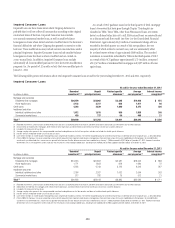

Mortgage-backed securities

For U.S. mortgage-backed securities (and in particular for Alt-A and other

mortgage-backed securities that have significant unrealized losses as a

percentage of amortized cost), credit impairment is assessed using a cash

flow model that estimates the cash flows on the underlying mortgages, using

the security-specific collateral and transaction structure. The model estimates

cash flows from the underlying mortgage loans and distributes those cash

flows to various tranches of securities, considering the transaction structure

and any subordination and credit enhancements that exist in that structure.

The cash flow model incorporates actual cash flows on the mortgage-backed

securities through the current period and then projects the remaining cash

flows using a number of assumptions, including default rates, prepayment

rates and recovery rates (on foreclosed properties).

Management develops specific assumptions using as much market data

as possible and includes internal estimates as well as estimates published

by rating agencies and other third-party sources. Default rates are projected

by considering current underlying mortgage loan performance, generally

assuming the default of (i) 10% of current loans, (ii) 25% of 30–59 day

delinquent loans, (iii) 70% of 60–90 day delinquent loans and (4) 100%

of 91+ day delinquent loans. These estimates are extrapolated along a

default timing curve to estimate the total lifetime pool default rate. Other

assumptions contemplate the actual collateral attributes, including

geographic concentrations, rating agency loss projections, rating actions and

current market prices.