Citibank 2012 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.122

At December 31, 2012, Citi had cumulative translation losses

related to its investment in Argentina, net of qualifying net investment

hedges, of approximately $1.04 billion (pretax), which were recorded

in stockholders’ equity. The cumulative translation losses would not be

reclassified into earnings unless realized upon sale or liquidation of Citi’s

Argentine operations.

While Citi currently uses the Argentine peso as the functional currency for

its operations in Argentina, an increase in inflation resulting in a cumulative

three-year inflation rate of 100% or more would result in a change in the

functional currency to the U.S. dollar. Official inflation statistics published

by INDEC, the Argentine government’s statistics institute, suggest an

annual inflation rate of approximately 10% for each of the three years

ended December 31, 2012, whereas private institutions, economists, and

local labor unions calculate the inflation rate to be closer to 25% annually

over the same period. Additionally, the International Monetary Fund (IMF)

issued a declaration of censure against Argentina on February 1, 2013 in

connection with its inaccurate inflation statistics and has called on Argentina

to adopt remedial measures to address those inaccuracies. A change in the

functional currency to the U.S. dollar would result in future devaluations

of the Argentine peso being recorded in earnings for Citi’s Argentine peso-

denominated assets and liabilities.

As noted above, Citi hedges currency risk in its net investment in Argentina

to the extent possible and prudent. Suitable hedging alternatives have

become less available and more expensive and may not be available to offset

any future currency devaluations that could occur. At December 31, 2012,

Citi hedged approximately $200 million of its net investment using foreign

currency forwards that are recorded as net investment hedges under ASC

815. This compared to approximately $230 million and $300 million as

of December 31, 2011 and September 30, 2012, respectively. The decrease

in the net investment hedge year-over-year and sequentially was driven by

significantly increased hedging costs.

In addition, as of December 31, 2012, Citi hedged foreign currency risk

associated with its net investment by holding in its Argentine operations both

U.S.-dollar-denominated net monetary assets of approximately $280 million

(compared to $110 million and $200 million as of December 31, 2011

and September 30, 2012, respectively) and foreign currency futures with a

notional value of approximately $170 million (compared to $100 million as

of September 30, 2012), neither of which qualify as net investment hedges

under ASC 815.

The ongoing economic and political situation in Argentina could lead

to further governmental intervention or regulatory restrictions on foreign

investments in Argentina, including the potential redenomination of

certain U.S.-dollar assets and liabilities into Argentine pesos, which could be

accompanied by a devaluation of the Argentine peso. Any redenomination

could occur at different rates (asymmetric redenomination) and/or

rates other than the official foreign exchange rate. The U.S.-dollar assets

and liabilities subject to redenomination, as well as any gains or losses

resulting from redenomination, are subject to substantial uncertainty

(see “Country Risk—Redenomination and Devaluation Risk” above

for a general discussion of redenomination and devaluation risk). As of

December 31, 2012, Citi had aggregate U.S.-dollar-denominated assets in

Argentina of approximately $1.5 billion.

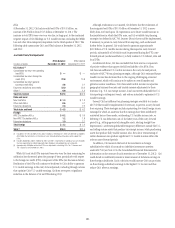

Venezuela

Since 2003, the Venezuelan government has enacted foreign exchange

controls. Under these controls, the Venezuelan government’s Foreign

Currency Administration Commission (CADIVI) purchases and sells foreign

currency at an official foreign exchange rate fixed by the government (as of

December 31, 2012, the official exchange rate was fixed at 4.3 bolivars to one

U.S. dollar). These restrictions have limited Citi’s ability to obtain U.S. dollars

in Venezuela at the official foreign currency rate. Citi has not been able to

acquire U.S. dollars from CADIVI since 2008.

Citi uses the official exchange rate to re-measure foreign currency

transactions in the financial statements of its Venezuelan operations (which

use the U.S. dollar as the functional currency) into U.S. dollars, as the official

exchange rate is the only rate legally available in the country, despite the

limited availability of U.S. dollars from CADIVI and although the official rate

may not necessarily be reflective of economic reality. Re-measurement of

Citi’s bolivar-denominated assets and liabilities due to change in the official

exchange rate is recorded in earnings.

At December 31, 2012, Citi’s net investment in Venezuela was approximately

$340 million (compared to $250 million at December 31, 2011 and

$300 million at September 30, 2012), which included net monetary assets

denominated in Venezuelan bolivars of approximately $290 million

(compared to $240 million at December 31, 2011 and $270 million at

September 30, 2012).

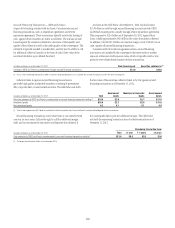

On February 8, 2013 the Venezuelan government devalued the official

exchange rate from 4.3 bolivars per dollar to 6.3 bolivars per dollar.

This devaluation resulted in a foreign exchange loss of approximately

$100 million (pretax) on Citi Venezuela’s net bolivar-denominated assets

that will be recorded in earnings in the first quarter of 2013. Subsequent to

the devaluation, Citi’s net investment in Venezuela declined to approximately

$240 million, and Citi’s net bolivar-denominated assets declined to

approximately $190 million.