Citibank 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.151

When Citi’s monitoring of the loan indicates that the guarantor’s

wherewithal to pay is uncertain or has deteriorated, there is either no

change in the risk rating, because the guarantor’s credit support was never

initially factored in, or the risk rating is adjusted to reflect that uncertainty

or deterioration. Accordingly, a guarantor’s ultimate failure to perform or

a lack of legal enforcement of the guarantee does not materially impact

the allowance for loan losses, as there is typically no further significant

adjustment of the loan’s risk rating at that time. Where Citi is not seeking

performance under the guarantee contract, it provides for loans losses as if

the loans were non-performing and not guaranteed.

Consumer loans

For Consumer loans, each portfolio of non-modified smaller-balance,

homogeneous loans is independently evaluated by product type (e.g.,

residential mortgage, credit card, etc.) for impairment in accordance

with ASC 450-20. The allowance for loan losses attributed to these loans

is established via a process that estimates the probable losses inherent in

the specific portfolio. This process includes migration analysis, in which

historical delinquency and credit loss experience is applied to the current

aging of the portfolio, together with analyses that reflect current and

anticipated economic conditions, including changes in housing prices and

unemployment trends. Citi’s allowance for loan losses under ASC 450-20

only considers contractual principal amounts due, except for credit card

loans where estimated loss amounts related to accrued interest receivable are

also included.

Management also considers overall portfolio indicators, including

historical credit losses, delinquent, non-performing, and classified loans,

trends in volumes and terms of loans, an evaluation of overall credit quality,

the credit process, including lending policies and procedures, and economic,

geographical, product and other environmental factors.

Separate valuation allowances are determined for impaired smaller-

balance homogeneous loans whose terms have been modified in a troubled

debt restructuring (TDR). Long-term modification programs as well as short-

term (less than 12 months) modifications originated beginning January 1,

2011 that provide concessions (such as interest rate reductions) to borrowers

in financial difficulty are reported as TDRs. In addition, loans included in

the U.S. Treasury’s Home Affordable Modification Program (HAMP) trial

period at December 31, 2011 are reported as TDRs. The allowance for loan

losses for TDRs is determined in accordance with ASC 310-10-35 considering

all available evidence, including, as appropriate, the present value of the

expected future cash flows discounted at the loan’s original contractual

effective rate, the secondary market value of the loan and the fair value

of collateral less disposal costs. These expected cash flows incorporate

modification program default rate assumptions. The original contractual

effective rate for credit card loans is the pre-modification rate, which may

include interest rate increases under the original contractual agreement with

the borrower.

Where short-term concessions have been granted prior to January 1, 2011,

the allowance for loan losses is materially consistent with the requirements

of ASC 310-10-35.

Valuation allowances for commercial market loans, which are classifiably

managed Consumer loans, are determined in the same manner as for

Corporate loans and are described in more detail in the following section.

Generally, an asset-specific component is calculated under ASC 310-10-35

on an individual basis for larger-balance, non-homogeneous loans that are

considered impaired and the allowance for the remainder of the classifiably

managed Consumer loan portfolio is calculated under ASC 450 using a

statistical methodology, supplemented by management adjustment.

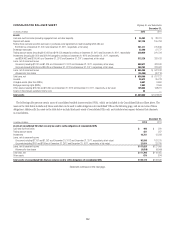

Reserve Estimates and Policies

Management provides reserves for an estimate of probable losses inherent

in the funded loan portfolio on the Consolidated Balance Sheet in the

form of an allowance for loan losses. These reserves are established in

accordance with Citigroup’s credit reserve policies, as approved by the

Audit Committee of the Board of Directors. Citi’s Chief Risk Officer and

Chief Financial Officer review the adequacy of the credit loss reserves each

quarter with representatives from the risk management and finance staffs

for each applicable business area. Applicable business areas include those

having classifiably managed portfolios, where internal credit-risk ratings

are assigned (primarily Institutional Clients Group and Global Consumer

Banking) or modified Consumer loans, where concessions were granted due

to the borrowers’ financial difficulties.

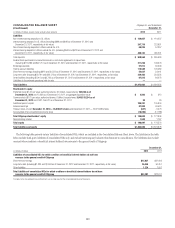

The above-mentioned representatives for these business areas present

recommended reserve balances for their funded and unfunded lending

portfolios along with supporting quantitative and qualitative data. The

quantitative data include:

Estimated probable losses for non-performing, non-homogeneous

exposures within a business line’s classifiably managed portfolio and

impaired smaller-balance homogeneous loans whose terms have

been modified due to the borrowers’ financial difficulties, and it was

determined that a concession was granted to the borrower. Consideration

may be given to the following, as appropriate, when determining this

estimate: (i) the present value of expected future cash flows discounted at the

loan’s original effective rate; (ii) the borrower’s overall financial condition,

resources and payment record; and (iii) the prospects for support from

financially responsible guarantors or the realizable value of any collateral.

In the determination of the allowance for loan losses for TDRs, management

considers a combination of historical re-default rates, the current economic

environment and the nature of the modification program when forecasting

expected cash flows. When impairment is measured based on the present

value of expected future cash flows, the entire change in present value is

recorded in the Provision for loan losses.