Citibank 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.90

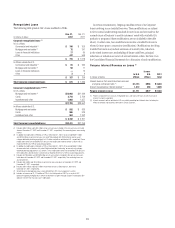

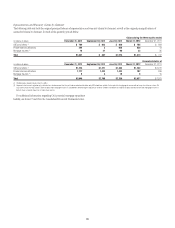

Similar to residential first mortgages discussed above, the general

improvement in refreshed CLTV percentages at December 31, 2012 was

primarily the result of improvements in HPI across substantially all

metropolitan statistical areas, thereby increasing values used in the

determination of CLTV. For the reasons described under “North America

Consumer Mortgage Quarterly Credit Trends—Delinquencies and Net

Credit Losses—Home Equity Loans” above, Citi has experienced, and could

continue to experience, increased delinquencies and thus increased net credit

losses in certain of these states and/or regions going forward.

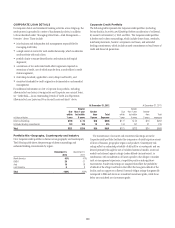

National Mortgage Settlement

Under the national mortgage settlement, entered into by Citi and other

financial institutions in February 2012, Citi is required to provide

(i) customer relief in the form of loan modifications for delinquent

borrowers, including principal reductions, and other loss mitigation

activities to be completed over three years, with a required settlement value

of $1.4 billion; and (ii) refinancing concessions to enable current borrowers

whose properties are worth less than the balance of their loans to reduce

their interest rates, also to be completed over three years, with a required

settlement value of $378 million. Citi commenced loan modifications

under the settlement, including principal reductions, in March 2012 and

commenced the refinancing process in June 2012.

If Citi does not provide the required amount of financial relief in the form

of loan modifications and other loss mitigation activities for delinquent

borrowers or refinancing concessions under the national mortgage

settlement, Citi will be required to make cash payments. Citi is required to

complete 75% of its required relief by March 1, 2014. Failure to meet 100%

of the commitment by March 1, 2015 will result in Citi paying an amount

equal to 125% of the shortfall. Failure to meet the two-year commitment

noted above and then failure to meet the three-year commitment will result

in an amount equal to 140% of the three-year shortfall. Citi continues to

believe that its obligations will be fully met in the form of financial relief to

homeowners; no cash payments are currently expected.

Loan Modifications/Loss Mitigation for Delinquent Borrowers

All of the loan modifications for delinquent borrowers receiving relief

toward the $1.4 billion in settlement value are either currently accounted

for as TDRs or will become TDRs at the time of modification. The loan

modifications have been, and will continue to be, primarily performed

under the HAMP and Citi’s CSM loan modification programs (see Note 16

to the Consolidated Financial Statements). The loss mitigation activities

include short sales for residential first mortgages and home equity loans,

extinguishments and other loss mitigation activities. Based on the nature of

the loss mitigation activities (e.g., short sales and extinguishments), these

activities have not impacted, nor are they expected to have an incremental

impact on, Citi’s TDRs.

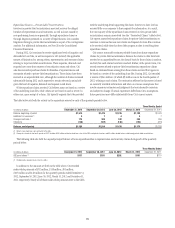

Through December 31, 2012, Citi has assisted approximately 34,000

customers under the loan-modification and other loss-mitigation activities

provisions of the national mortgage settlement, resulting in an aggregate

principal reduction of approximately $2.4 billion that is potentially eligible

for inclusion in the settlement value. Net credit losses of approximately

$500 million have been incurred to date relating to the loan modifications

under the national mortgage settlement, all of which were offset by loan

loss reserve releases (including approximately $370 million of incremental

charge-offs related to anticipated forgiveness of principal in connection

with the national mortgage settlement in the first quarter). Citi currently

anticipates an impact to net credit losses associated with the national

mortgage settlement to continue into the first half of 2013. Citi continues to

believe that its loan loss reserves as of December 31, 2012 are sufficient to

cover the required customer relief to delinquent borrowers under the national

mortgage settlement.

Like other financial institutions party to the national mortgage

settlement, Citi does not receive dollar-for-dollar settlement value for the

relief it provides under the national mortgage settlement in all cases. As

a result, Citi anticipates that the relief provided will be higher than the

settlement value.

Refinancing Concessions for Current Borrowers

The refinancing concessions are to be offered to residential first mortgage

borrowers whose properties are worth less than the value of their loans, who

have been current in the prior 12 months, who have not had a modification,

bankruptcy or foreclosure proceeding during the prior 24 months, and whose

loans have a current interest rate greater than 5.25%. As of December 31,

2012, Citi has provided refinance concessions under the national mortgage

settlement to approximately 13,000 customers holding loans with a total

unpaid principal balance of $2.3 billion, thus reducing their interest rate to

5.25% for the remaining life of the loan.

Citi accounts for the refinancing concessions under the settlement

based on whether the particular borrower is determined to be experiencing

financial difficulty based on certain underwriting criteria. When a

refinancing concession is granted to a borrower who is experiencing

financial difficulty, the loan is accounted for as a TDR. Otherwise, the impact

of the refinancing concessions is recognized over a period of years in the

form of lower interest income. As of December 31, 2012, approximately

5,000 customers holding loans with a total unpaid principal balance of

$741 million and who were provided refinance concessions have been

accounted for as TDRs. These refinancing concessions have not had a

material impact on the fair value of the modified mortgage loans.