Citibank 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

Credit Costs

Citi’s total provisions for credit losses and for benefits and claims

of $11.7 billion declined 8% from the prior year. Net credit losses of

$14.6 billion were down 27% from 2011, largely reflecting improvements

in North America cards and Local Consumer Lending and the Special

Asset Pool within Citi Holdings. Consumer net credit losses declined 22% to

$14.4 billion reflecting improvements in North America Citi-branded cards

and Citi retail services in Citicorp and Local Consumer Lending within

Citi Holdings. Corporate net credit losses decreased 86% year-over-year to

$223 million, driven primarily by continued credit improvement in both the

Special Asset Pool in Citi Holdings and Securities and Banking in Citicorp.

The net release of allowance for loan losses and unfunded lending

commitments was $3.7 billion in 2012, 55% lower than 2011. Of the

$3.7 billion net reserve release, $2.1 billion was attributable to Citicorp

compared to a $4.9 billion release in the prior year. The decline in the

Citicorp reserve release year-over-year mostly reflected a lower reserve release

in North America Citi-branded cards and Citi retail services and Securities

and Banking. The $1.6 billion net reserve release in Citi Holdings was down

from $3.3 billion in the prior year, due primarily to lower releases within

the Special Asset Pool, reflecting the decline in assets. Of the $3.7 billion

net reserve release, $3.6 billion related to Consumer, with the remainder

in Corporate.

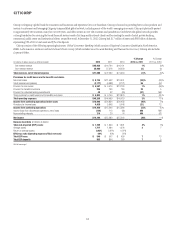

Capital and Loan Loss Reserve Positions

Citigroup’s Tier 1 Capital and Tier 1 Common ratios were 14.1% and

12.7% as of December 31, 2012, respectively, compared to 13.6% and 11.8%

in the prior year. Citi’s estimated Tier 1 Common ratio under Basel III

was 8.7% at December 31, 2012, up slightly from an estimated 8.6% at

September 30, 2012.4

Citigroup’s total allowance for loan losses was $25.5 billion at year end, or

3.9% of total loans, compared to $30.1 billion, or 4.7%, at the end of the prior

year. The decline in the total allowance for loan losses reflected the continued

wind-down of Citi Holdings and overall continued improvement in the credit

quality of Citi’s loan portfolios.

The Consumer allowance for loan losses was $22.7 billion, or 5.6% of

total Consumer loans, at year end, compared to $27.2 billion, or 6.5% of

total loans, at December 31, 2011. Total non-accrual assets increased 3%

to $12.0 billion as compared to December 31, 2011. Corporate non-accrual

loans declined 28% to $2.3 billion, reflecting continued credit improvement.

Consumer non-accrual loans increased $1.4 billion, or 17%, to $9.2 billion

versus the prior year. The increase in Consumer non-accrual loans

predominantly reflected the Office of the Comptroller of the Currency (OCC)

guidance issued in the third quarter of 2012 regarding the treatment of

mortgage loans where the borrower has gone through Chapter 7 bankruptcy,

which added $1.5 billion to Consumer non-accrual loans (of which

approximately $1.3 billion were current).

4 Citi’s estimated Basel III Tier 1 Common ratio is a non-GAAP financial measure. For additional

information on Citi’s estimated Basel III Tier 1 Common Capital and Tier 1 Common ratio, including the

calculation of these measures, see “Capital Resources and Liquidity—Capital Resources” below.

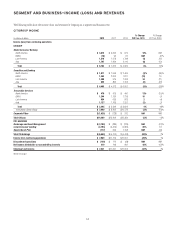

Citicorp5

Citicorp net income decreased 8% from the prior year to $14.1 billion. The

decrease largely reflected the impact of CVA/DVA and higher legal and

related costs and repositioning charges, partially offset by lower provisions

for income taxes. CVA/DVA, recorded in Securities and Banking, was

$(2.5) billion in 2012, compared to $1.7 billion in the prior year. Within

Citicorp, repositioning charges were $951 million ($604 million after-tax) in

the fourth quarter 2012, versus $368 million ($237 million after-tax) in the

prior year period. Excluding CVA/DVA, the impact of minority investments,

the repositioning charges in the fourth quarters of 2012 and 2011, and the

tax benefit in the third quarter of 2012, Citicorp net income increased 9%

from the prior year to $15.6 billion, primarily driven by growth in revenues

and lower net credit losses partially offset by lower loan loss reserve releases

and higher taxes.

Citicorp revenues, net of interest expense, were $71 billion in 2012, down

1% versus the prior year. Excluding CVA/DVA and the impact of minority

investments, Citicorp revenues were $73.4 billion in 2012, 5% higher

than 2011. Global Consumer Banking (GCB) revenues of $40.2 billion

increased 3% versus the prior year. North America RCB revenues grew

5% to $21.1 billion. International RCB revenues (consisting of Asia RCB,

Latin America RCB and EMEA RCB) increased 1% year-over-year to

$19.1 billion. Excluding the impact of FX translation,6 international RCB

revenues increased 5% year-over-year. Securities and Banking revenues

were $19.7 billion in 2012, down 8% year-over-year. Securities and Banking

revenues, excluding CVA/DVA, were $22.2 billion, or 13%, higher than the

prior year. Transaction Services revenues were $10.9 billion, up 3% from

the prior year, but up 5% excluding the impact of FX translation. Corporate/

Other revenues, excluding the impact of minority investments, declined 80%

from the prior year mainly reflecting the absence of hedging gains.

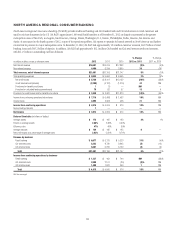

In North America RCB, the revenue growth year-over-year was driven by

higher mortgage revenues, partially offset by lower revenues in Citi-branded

cards and Citi retail services, mostly driven by lower average card loans.

North America RCB average deposits of $154 billion grew 6% year-over-year

and average retail loans of $41 billion grew 19%. Average card loans of

$109 billion declined 3%, driven by increased payment rates resulting from

consumer deleveraging, and card purchase sales of $232 billion were roughly

flat. Citi retail services revenues were also negatively impacted by improving

credit trends, which increased contractual partner payments.

5 Citicorp includes Citi’s three operating businesses—Global Consumer Banking, Securities and

Banking and Transaction Services—as well as Corporate/Other. See “Citicorp” below for additional

information on the results of operations for each of the businesses in Citicorp.

6 For the impact of FX translation on 2012 results of operations for each of EMEA RCB, Latin America

RCB, Asia RCB and Transaction Services, see the table accompanying the discussion of each

respective business’ results of operations below.