Citibank 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.127

Regardless of the classification of the securities as AFS or HTM, Citi

assesses each position with an unrealized loss for OTTI.

Management assesses equity method investments with fair value less

than carrying value for OTTI, as discussed in Note 15 to the Consolidated

Financial Statements. For investments that management does not plan to sell

prior to recovery of value, or Citi is not likely to be required to sell, various

factors are considered in assessing OTTI. For investments that Citi plans to

sell prior to recovery of value, or would likely be required to sell and there

is no expectation that the fair value will recover prior to the expected sale

date, the full impairment would be recognized in the Consolidated Statement

of Income. The following paragraphs discuss Citi’s significant OTTI equity

method investments during 2012.

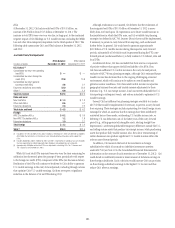

Akbank

In March 2012, Citi decided to reduce its ownership interest in Akbank T.A.S.,

an equity investment in Turkey (Akbank), to below 10%. As of March 31,

2012, Citi held a 20% equity interest in Akbank, which it purchased in

January 2007, accounted for as an equity method investment. As a result

of its decision to sell its share holdings in Akbank, in the first quarter of

2012 Citi recorded an impairment charge related to its total investment

in Akbank amounting to approximately $1.2 billion pretax ($763 million

after-tax). This impairment charge was primarily driven by the recognition

of all respective net investment foreign currency hedging and translation

losses previously reflected in AOCI as well as a reduction in carrying value

of the investment to reflect the market price of Akbank’s shares. The

impairment charge was recorded in other-than-temporary impairment losses

on investments in the Consolidated Statement of Income. During the second

quarter of 2012, Citi sold a 10.1% stake in Akbank, resulting in a loss on sale

of $424 million ($274 million after-tax), recorded within other revenue. As of

December 31, 2012, the remaining 9.9% stake in Akbank is recorded within

marketable equity securities available-for-sale.

MSSB

On September 17, 2012, Citi sold to Morgan Stanley a 14% interest (14%

Interest) in MSSB to which Morgan Stanley exercised its purchase option

on June 1, 2012. Morgan Stanley paid to Citi $1.89 billion in cash as the

purchase price of the 14% Interest. The purchase price was based on an

implied 100% valuation of MSSB of $13.5 billion, as agreed between Morgan

Stanley and Citi pursuant to an agreement dated September 11, 2012 (for

additional information, see Citi’s Form 8-K filed with the U.S. Securities

and Exchange Commission on September 11, 2012 and “Citi Holdings—

Brokerage and Asset Management” above). The related approximate

$4.5 billion in deposits were transferred to Morgan Stanley at no premium, as

agreed between the parties.

In addition, Morgan Stanley has agreed, subject to obtaining regulatory

approval, to purchase Citi’s remaining 35% interest in MSSB no later than

June 1, 2015 at a purchase price of $4.725 billion, which is based on the

same implied 100% valuation of MSSB of $13.5 billion.

Prior to the September 2012 sale, Citi’s carrying value of its 49% interest in

MSSB was approximately $11.3 billion. As a result of the agreement entered

into with Morgan Stanley on September 11, 2012, Citi recorded a charge

to net income in the third quarter of 2012 of approximately $2.9 billion

after-tax ($4.7 billion pretax), consisting of (i) a charge recorded within

Other revenue of approximately $800 million after-tax ($1.3 billion pretax),

representing a loss on sale of the 14% Interest, and (ii) an other-than-

temporary impairment of the carrying value of its remaining 35% interest in

MSSB of approximately $2.1 billion after-tax ($3.4 billion pretax).

As of December 31, 2012, Citi continues to account for its remaining 35%

interest in MSSB under the equity method, with the carrying value capped at

the agreed selling price of $4.725 billion.

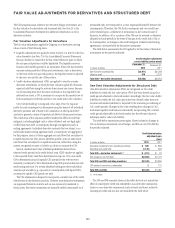

CVA/DVA Methodology

ASC 820-10 requires that Citi’s own credit risk be considered in determining

the market value of any Citi liability carried at fair value. These liabilities

include derivative instruments as well as debt and other liabilities for which

the fair value option has been elected. The credit valuation adjustment (CVA)

is recognized on the Consolidated Balance Sheet as a reduction or increase in

the associated derivative asset or liability to arrive at the fair value (carrying

value) of the derivative asset or liability. The debt valuation adjustment

(DVA) is recognized on the balance sheet as a reduction or increase in

the associated fair value option debt liability to arrive at the fair value of

the liability. For additional information, see “Fair Value Adjustments for

Derivatives and Structured Debt” above.

Allowance for Credit Losses

Allowance for Funded Lending Commitments

Management provides reserves for an estimate of probable losses inherent

in the funded loan portfolio on the Consolidated Balance Sheet in the

form of an allowance for loan losses. These reserves are established in

accordance with Citigroup’s credit reserve policies, as approved by the

Audit Committee of the Board of Directors. Citi’s Chief Risk Officer and

Chief Financial Officer review the adequacy of the credit loss reserves each

quarter with representatives from the risk management and finance staffs

for each applicable business area. Applicable business areas include those

having classifiably managed portfolios, where internal credit-risk ratings

are assigned (primarily Institutional Clients Group and Global Consumer

Banking), or modified Consumer loans, where concessions were granted due

to the borrowers’ financial difficulties.

The above-mentioned representatives covering these respective business

areas present recommended reserve balances for their funded and unfunded

lending portfolios along with supporting quantitative and qualitative data.

The quantitative data include: