Citibank 2012 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

247

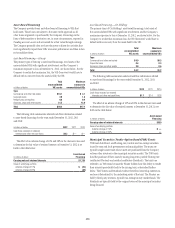

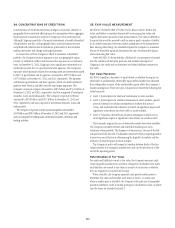

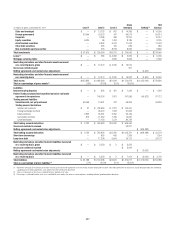

The pretax change in Accumulated other comprehensive income (loss) from cash flow hedges is presented below:

Year ended December 31,

In millions of dollars 2012 2011 2010

Effective portion of cash flow hedges included in AOCI

Interest rate contracts $ (322) $(1,827) $ (469)

Foreign exchange contracts 143 81 (570)

Total effective portion of cash flow hedges included in AOCI $ (179) $(1,746) $(1,039)

Effective portion of cash flow hedges reclassified from AOCI to earnings

Interest rate contracts $ (837) $(1,227) $(1,396)

Foreign exchange contracts (180) (257) (500)

Total effective portion of cash flow hedges reclassified from AOCI to earnings (1) $(1,017) $(1,484) $(1,896)

(1) Included primarily in Other revenue and Net interest revenue on the Consolidated Income Statement.

For cash flow hedges, any changes in the fair value of the end-user

derivative remaining in Accumulated other comprehensive income (loss)

on the Consolidated Balance Sheet will be included in earnings of future

periods to offset the variability of the hedged cash flows when such cash

flows affect earnings. The net loss associated with cash flow hedges expected

to be reclassified from Accumulated other comprehensive income (loss)

within 12 months of December 31, 2012 is approximately $1.0 billion. The

maximum length of time over which forecasted cash flows are hedged is

10 years.

The after-tax impact of cash flow hedges on AOCI is shown in Note 21 to

the Consolidated Financial Statements.

Net investment Hedges

Consistent with ASC 830-20, Foreign Currency Matters—Foreign Currency

Transactions (formerly SFAS 52, Foreign Currency Translation), ASC 815

allows hedging of the foreign currency risk of a net investment in a foreign

operation. Citigroup uses foreign currency forwards, options and foreign-

currency-denominated debt instruments to manage the foreign exchange

risk associated with Citigroup’s equity investments in several non-U.S.-dollar-

functional-currency foreign subsidiaries. Citigroup records the change in the

carrying amount of these investments in the Foreign currency translation

adjustment account within Accumulated other comprehensive income

(loss). Simultaneously, the effective portion of the hedge of this exposure is

also recorded in the Foreign currency translation adjustment account and

the ineffective portion, if any, is immediately recorded in earnings.

For derivatives designated as net investment hedges, Citigroup follows

the forward-rate method from FASB Derivative Implementation Group Issue

H8 (now ASC 815-35-35-16 through 35-26), “Foreign Currency Hedges:

Measuring the Amount of Ineffectiveness in a Net Investment Hedge.”

According to that method, all changes in fair value, including changes

related to the forward-rate component of the foreign currency forward

contracts and the time value of foreign currency options, are recorded in the

Foreign currency translation adjustment account within Accumulated

other comprehensive income (loss).

For foreign-currency-denominated debt instruments that are designated

as hedges of net investments, the translation gain or loss that is recorded in

the Foreign currency translation adjustment account is based on the spot

exchange rate between the functional currency of the respective subsidiary

and the U.S. dollar, which is the functional currency of Citigroup. To the

extent the notional amount of the hedging instrument exactly matches the

hedged net investment and the underlying exchange rate of the derivative

hedging instrument relates to the exchange rate between the functional

currency of the net investment and Citigroup’s functional currency (or, in the

case of a non-derivative debt instrument, such instrument is denominated in

the functional currency of the net investment), no ineffectiveness is recorded

in earnings.

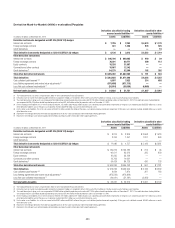

The pretax gain (loss) recorded in the Foreign currency translation

adjustment account within Accumulated other comprehensive income

(loss), related to the effective portion of the net investment hedges, is

$(3,829) million, $904 million, and $(3,620) million, for the years ended

December 31, 2012, 2011, and 2010, respectively.

c redit Derivatives

A credit derivative is a bilateral contract between a buyer and a seller

under which the seller agrees to provide protection to the buyer against the

credit risk of a particular entity (“reference entity” or “reference credit”).

Credit derivatives generally require that the seller of credit protection make

payments to the buyer upon the occurrence of predefined credit events

(commonly referred to as “settlement triggers”). These settlement triggers

are defined by the form of the derivative and the reference credit and are

generally limited to the market standard of failure to pay on indebtedness

and bankruptcy of the reference credit and, in a more limited range of

transactions, debt restructuring. Credit derivative transactions referring to

emerging market reference credits will also typically include additional

settlement triggers to cover the acceleration of indebtedness and the risk of

repudiation or a payment moratorium. In certain transactions, protection

may be provided on a portfolio of reference credits or asset-backed securities.

The seller of such protection may not be required to make payment until a

specified amount of losses has occurred with respect to the portfolio and/or

may only be required to pay for losses up to a specified amount.

The Company makes markets and trades a range of credit derivatives.

Through these contracts, the Company either purchases or writes protection

on either a single name or a portfolio of reference credits. The Company

also uses credit derivatives to help mitigate credit risk in its Corporate

and Consumer loan portfolios and other cash positions, and to facilitate

client transactions.