Citibank 2012 Annual Report Download - page 288

Download and view the complete annual report

Please find page 288 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

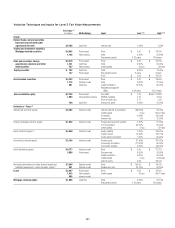

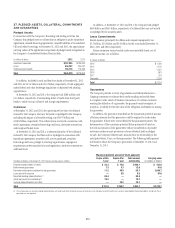

266

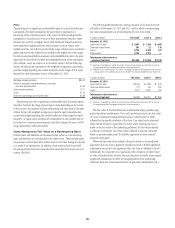

Price

The price input is a significant unobservable input for certain fixed income

instruments. For these instruments, the price input is expressed as a

percentage of the notional amount, with a price of $100 meaning that the

instrument is valued at par. For most of these instruments, the price varies

between zero to $100, or slightly above $100. Relatively illiquid assets that

have experienced significant losses since issuance, such as certain asset-

backed securities, are at the lower end of the range, whereas most investment

grade corporate bonds will fall in the middle to the higher end of the range.

For certain structured debt instruments with embedded derivatives, the price

input may be above $100 to reflect the embedded features of the instrument

(for example, a step-up coupon or a conversion option). For the following

classes of fixed income instruments, the weighted average price input below

provides insight regarding the central tendencies of the ranges of this input

reported for each instrument class as of December 31, 2012:

Mortgage-backed securities $86.02

State and municipal, foreign government, corporate,

and other debt securities 90.95

Asset-backed securities 79.71

Loans 91.25

Short-term borrowings and long-term debt 93.38

The price input is also a significant unobservable input for certain equity

securities; however, the range of price inputs varies depending on the nature

of the position, the number of shares outstanding and other factors. Because

of these factors, the weighted average price input for equity securities does

not provide insight regarding the central tendencies of the ranges for equity

securities, as equity prices are generally independent of one another and are

not subject to a common measurement scale (for example, the zero to $100

range applicable to debt instruments).

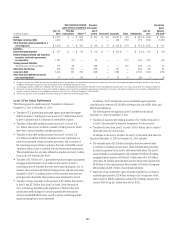

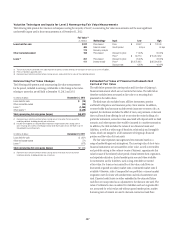

Items Measured at Fair Value on a Nonrecurring Basis

Certain assets and liabilities are measured at fair value on a nonrecurring

basis and therefore are not included in the tables above. These include assets

measured at cost that have been written down to fair value during the periods

as a result of an impairment. In addition, these assets include loans held-

for-sale and other real estate owned that are measured at the lower of cost or

market (LOCOM).

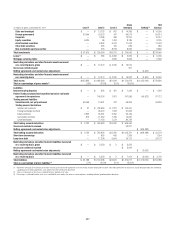

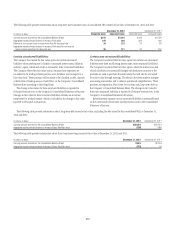

The following table presents the carrying amounts of all assets that were

still held as of December 31, 2012 and 2011, and for which a nonrecurring

fair value measurement was recorded during the year then ended:

In millions of dollars Fair value Level 2 Level 3

December 31, 2012

Loans held-for-sale $ 2,647 $ 1,159 $ 1,488

Other real estate owned 201 22 179

Loans (1) 5,732 5,160 572

Other assets (2) 4,725 4,725 —

Total assets at fair value on a

nonrecurring basis $13,305 $11,066 $ 2,239

(1) Represents impaired loans held for investment whose carrying amount is based on the fair value of

the underlying collateral, including primarily real-estate secured loans.

(2) Represents Citi’s remaining 35% investment in the Morgan Stanley Smith Barney joint venture whose

carrying amount is the agreed purchase price. See Note 15 to the Consolidated Financial Statements.

In millions of dollars Fair value Level 2 Level 3

December 31, 2011

Loans held-for-sale $2,644 $1,668 $ 976

Other real estate owned 271 88 183

Loans (1) 3,911 3,185 726

Total assets at fair value on a

nonrecurring basis $6,826 $4,941 $1,885

(1) Represents impaired loans held for investment whose carrying amount is based on the fair value of

the underlying collateral, including primarily real-estate secured loans.

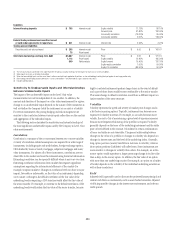

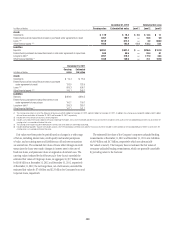

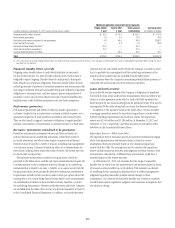

The fair value of loans-held-for-sale is determined where possible using

quoted secondary-market prices. If no such quoted price exists, the fair value

of a loan is determined using quoted prices for a similar asset or assets,

adjusted for the specific attributes of that loan. Fair value for the other real

estate owned is based on appraisals. For loans whose carrying amount is

based on the fair value of the underlying collateral, the fair values depend

on the type of collateral. Fair value of the collateral is typically estimated

based on quoted market prices if available, appraisals or other internal

valuation techniques.

Where the fair value of the related collateral is based on an unadjusted

appraised value, the loan is generally classified as Level 2. Where significant

adjustments are made to the appraised value, the loan is classified as Level 3.

Additionally, for corporate loans, appraisals of the collateral are often based

on sales of similar assets; however, because the prices of similar assets require

significant adjustments to reflect the unique features of the underlying

collateral, these fair value measurements are generally classified as Level 3.