Citibank 2012 Annual Report Download - page 289

Download and view the complete annual report

Please find page 289 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

267

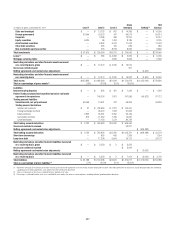

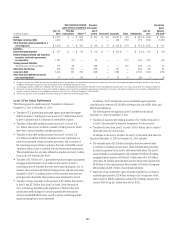

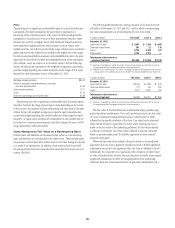

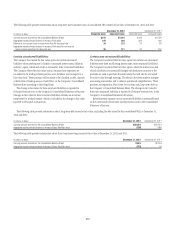

Valuation Techniques and Inputs for Level 3 Nonrecurring Fair Value Measurements

The following table presents the valuation techniques covering the majority of Level 3 nonrecurring fair value measurements and the most significant

unobservable inputs used in those measurements as of December 31, 2012:

Fair Value (1)

(in millions) Methodology Input Low High

Loans held-for-sale $747 Price-based Price $ 63.42 $ 100.00

485 External model Credit spread 40 bps 40 bps

174 Recovery analysis

Other real estate owned 165 Price-based Discount to price 11.00% 50.00%

Price (2) $ 39,774 $15,457,452

Loans (3) 351 Price-based Discount to price 25.00% 34.00%

111 Internal model Price (2) $6,272,242 $86,200,000

Discount rate 6.00% 16.49%

(1) The fair value amounts presented in this table represent the primary valuation technique or techniques for each class of assets or liabilities.

(2) Prices are based on appraised values.

(3) Represents loans held for investment whose carrying amounts are based on the fair value of the underlying collateral.

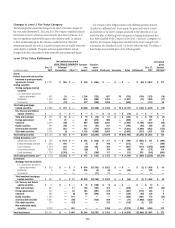

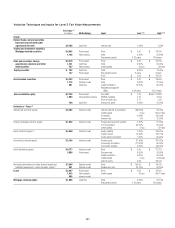

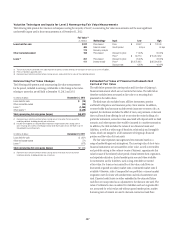

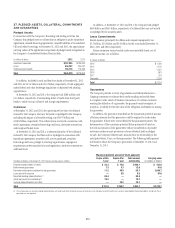

Nonrecurring Fair Value Changes

The following table presents total nonrecurring fair value measurements

for the period, included in earnings, attributable to the change in fair value

relating to assets that are still held at December 31, 2012 and 2011:

In millions of dollars December 31, 2012

Loans held-for-sale $ (19)

Other real estate owned (29)

Loans (1) (1,489)

Other assets (2) (3,340)

Total nonrecurring fair value gains (losses) $(4,877)

(1) Represents loans held for investment whose carrying amount is based on the fair value of the

underlying collateral, including primarily real-estate loans.

(2) Includes the recognition of a $3,340 million impairment charge related to the carrying value of

Citi's remaining 35% interest in the Morgan Stanley Smith Barney joint venture. See Note 15 to the

Consolidated Financial Statements.

In millions of dollars December 31, 2011

Loans held-for-sale $ (201)

Other real estate owned (71)

Loans (1) (973)

Total nonrecurring fair value gains (losses) $(1,245)

(1) Represents loans held for investment whose carrying amount is based on the fair value of the

underlying collateral, including primarily real-estate loans.

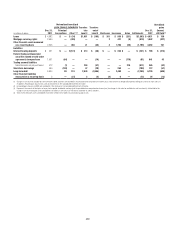

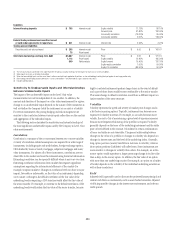

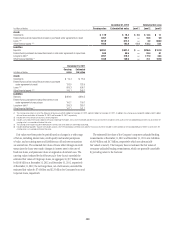

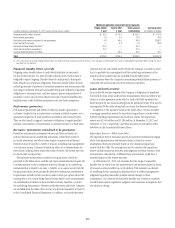

Estimated Fair Value of Financial Instruments Not

Carried at Fair Value

The table below presents the carrying value and fair value of Citigroup’s

financial instruments which are not carried at fair value. The table below

therefore excludes items measured at fair value on a recurring basis

presented in the tables above.

The disclosure also excludes leases, affiliate investments, pension

and benefit obligations and insurance policy claim reserves. In addition,

contract-holder fund amounts exclude certain insurance contracts. Also, as

required, the disclosure excludes the effect of taxes, any premium or discount

that could result from offering for sale at one time the entire holdings of a

particular instrument, excess fair value associated with deposits with no fixed

maturity, and other expenses that would be incurred in a market transaction.

In addition, the table excludes the values of non-financial assets and

liabilities, as well as a wide range of franchise, relationship and intangible

values, which are integral to a full assessment of Citigroup’s financial

position and the value of its net assets.

The fair value represents management’s best estimates based on a

range of methodologies and assumptions. The carrying value of short-term

financial instruments not accounted for at fair value, as well as receivables

and payables arising in the ordinary course of business, approximates fair

value because of the relatively short period of time between their origination

and expected realization. Quoted market prices are used when available

for investments and for liabilities, such as long-term debt not carried

at fair value. For loans not accounted for at fair value, cash flows are

discounted at quoted secondary market rates or estimated market rates if

available. Otherwise, sales of comparable loan portfolios or current market

origination rates for loans with similar terms and risk characteristics are

used. Expected credit losses are either embedded in the estimated future

cash flows or incorporated as an adjustment to the discount rate used. The

value of collateral is also considered. For liabilities such as long-term debt

not accounted for at fair value and without quoted market prices, market

borrowing rates of interest are used to discount contractual cash flows.