Citibank 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324

|

|

8

Citi’s Global Consumer Banking (GCB) serves more than

100 million clients across the world through its unique

footprint and capabilities, its presence in and understanding

of local markets, and the ability to deliver a consistent and

enhanced banking experience.

Strategically positioned in the world’s top cities with the

highest consumer banking growth potential, Global Consumer

Banking operates across Citi’s four regions — Asia Pacific;

Europe, the Middle East and Africa; Latin America; and North

America. The primary business lines are Credit Cards, Retail

Banking, Mortgage and Commercial Banking.

The collective GCB businesses account for $337 billion in

deposits, $295 billion in loans, $154 billion in assets under

management in Retail Banking and approximately 4,0001

branches worldwide.

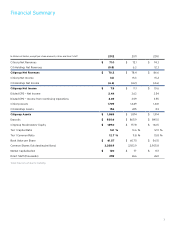

Global Consumer Banking earnings continued to grow in 2012.

Pretax operating earnings increased by 48% to $10.1 billion —

nearly half of Citi overall. Net income2 grew 6% to $8.1 billion

— its highest level ever. Revenues of $40 billion, over the last

12 months, reached a new milestone. Additionally, average

loans grew 5% globally, with 9% international growth and

2% growth in North America.

Credit Cards

Citi is the world’s largest credit card issuer, with 134 million

accounts, $363 billion in annual purchase sales and $150

billion in receivables across Citi Branded Cards and Citi Retail

Services credit cards.

1

Approximately 4,000 total branches do not include ~600 Banco

de Chile branches.

2

Pretax earnings minus loan loss reserve releases minus fourth

quarter repositioning charges.

Operating in 38 countries, with more than 55 million accounts

in circulation, Citi Branded Cards provides payment and credit

solutions to consumers and small businesses around the

world. The business has annual purchase sales of $292 billion

and a loan portfolio of $111 billion. In 2012, Citi became the first

non-domestic credit card issuer in China. New rewards credit

cards were introduced in El Salvador, the Philippines, Taiwan,

the United Arab Emirates and the U.S. Citi also introduced new

co-brand cards for travelers with partners Hilton® HHonorsTM,

American Airlines AAdvantage®, AirAsia and Thai Airways.

Citi is continually expanding the ways in which card members

can integrate rewards and social networking, including the

ThankYou® Points sharing app, which is the first application

on Facebook that enables members to share and combine

points. This year, Banamex was the first financial institution

in Mexico to introduce MasterCard® PayPassTM, a contactless

card payment platform.

Citi Retail Services provides consumer and commercial credit

card products, services and retail solutions to leading national

and regional retailers across the U.S. Citi Retail Services

serves nearly 79 million accounts for a number of iconic

brands, including The Home Depot, Macy’s, Sears, Shell and

ExxonMobil. In 2012, Retail Services renewed its long-standing

relationship with CITGO, launched a product with ExxonMobil

and announced new relationships with OfficeMax, Ford Motor

Company and BrandSource. The business has purchase sales

of $71.5 billion and a loan portfolio of $38.6 billion.

Global Consumer Banking

Highlights

Customer Experience

Putting the customer at the center of everything we do

is critical to our success. GCB is focused on listening to

customers in order to recognize their needs and provide

genuine solutions to help reduce the complexities of their

financial lives. Our fundamental GCB performance measure

is provided through Net Promoter Score, and we continue

to improve.

• In the U.S., Citibank launched Plain Talk About Your

Products, a user-friendly guide for current and prospective

checking customers.

Citi Commercial Bank leverages our presence in the world’s

fastest growing cities and our global capabilities to deliver

tailored solutions to an international client base.