Citibank 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

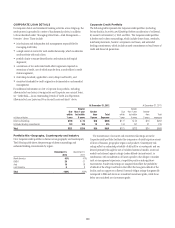

As noted above, if the modified loan under the refinancing is not

accounted for as a TDR, the impact to Citi of the refinancing concession will

be recognized over a period of years in the form of lower interest income.

Citi estimates the forgone future interest income as a result of the refinance

concessions under the national mortgage settlement was approximately

$20 million during 2012, of which $13 million was recorded in the fourth

quarter of 2012. Citi estimates the total amount of expected forgone future

interest income could be approximately $50 million annually. However, this

estimate could change based on the response rate of borrowers who qualify

and the subsequent borrower payment behavior.

Independent Foreclosure Review Settlement

On January 7, 2013, Citi, along with other major mortgage servicers

operating under consent orders dated April 13, 2011 with the Federal

Reserve Board and the OCC, entered into a settlement agreement with

those regulators to modify the requirements of the independent foreclosure

review mandated by the consent orders. Under the settlement, Citi agreed

to pay approximately $305 million into a qualified settlement fund and

offer $487 million of mortgage assistance to borrowers in accordance with

agreed criteria. Upon completion of Citi’s payment and mortgage assistance

obligations under the agreement, the Federal Reserve Board and the OCC

have agreed to deem the requirements of the independent foreclosure

review under the consent orders satisfied. As a result of the settlement, Citi

recorded a $305 million charge in the fourth quarter of 2012. Citi believes

that its loan loss reserves as of December 31, 2012 are sufficient to cover any

mortgage assistance under the settlement and there will be no incremental

financial impact.

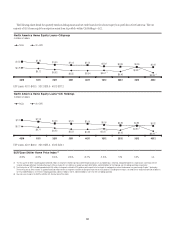

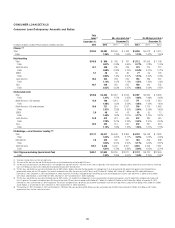

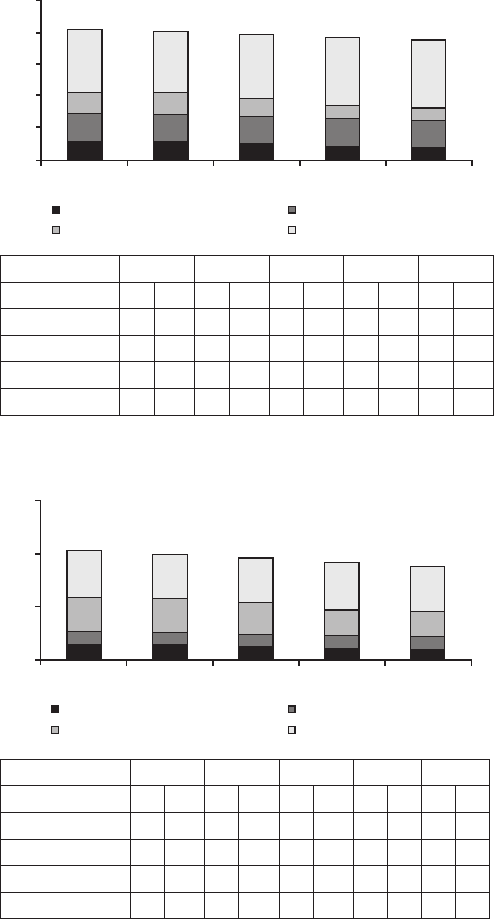

Consumer Mortgage FICO and LTV

The following charts detail the quarterly trends of the unpaid principal

balances for Citi’s residential first mortgage and home equity loan portfolios

by risk segment (FICO and LTV) and the 90+ day delinquency rates for

those risk segments. For example, in the fourth quarter of 2012, residential

first mortgages had $7.1 billion of balances with refreshed FICO < 660 and

refreshed LTV > 100%. Approximately 17.5% of these loans in this segment

were over 90+ days past due.

0

20

40

60

80

100

4Q123Q122Q121Q124Q11

11.2 11.3 9.9 7.8 7.1

17.8 16.8 17.0 17.9 17.5

13.2 13.9 11.5 8.4 7.8

39.6 38.8 40.6 42.8 43.0

Residential First Mortgages

In billions of dollars

FICO < 660, LTV > 100% FICO < 660, LTV ≤ 100%

FICO ≥ 660, LTV > 100% FICO ≥ 660, LTV ≤ 100%

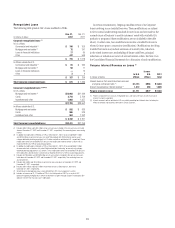

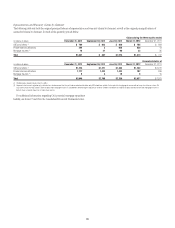

In millions of dollars 4Q11 1Q12 2Q12 3Q12 4Q12

Res Mortgage—90+ DPD $ % $ % $ % $ % $ %

FICO ≥ 660, LTV ≤ 100% 143 0.4% 128 0.3% 160 0.4% 158 0.4% 167 0.4%

FICO ≥ 660, LTV > 100% 157 1.2% 164 1.2% 185 1.6% 120 1.4% 113 1.4%

FICO < 660, LTV ≤ 100% 1,916 10.7% 1,759 10.4% 1,777 10.5% 1,892 10.6% 1,776 10.1%

FICO < 660, LTV > 100% 1,842 16.5% 1,943 17.2% 1,812 18.4% 1,420 18.3% 1,245 17.5%

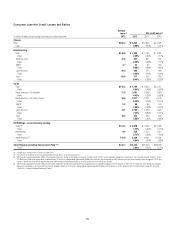

0

20

40

60

4Q123Q122Q121Q124Q11

5.4 5.4 4.8 3.9 3.7

5.0 4.6 4.6 5.0 4.8

12.8 13.0 12.0 9.7 9.4

17.9 16.6 16.9 17.9 17.3

Home Equity Loans

In billions of dollars

FICO < 660, CLTV > 100% FICO < 660, CLTV ≤ 100%

FICO ≥ 660, CLTV > 100% FICO ≥ 660, CLTV ≤ 100%

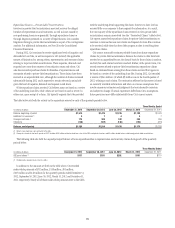

In millions of dollars 4Q11 1Q12 2Q12 3Q12 4Q12

Home Equity—90+ DPD $ % $ % $ % $ % $ %

FICO ≥ 660, CLTV ≤ 100% 18 0.1% 19 0.1% 23 0.1% 25 0.1% 26 0.1%

FICO ≥ 660, CLTV > 100% 20 0.2% 23 0.2% 25 0.2% 19 0.2% 21 0.2%

FICO < 660, CLTV ≤ 100% 381 7.6% 336 7.2% 352 7.6% 394 8.0% 395 8.2%

FICO < 660, CLTV > 100% 553 10.3% 504 9.3% 454 9.5% 385 9.9% 359 9.6%

Notes:

– Data appearing in the tables above have been sourced from Citi’s risk systems and, as such, may not

reconcile with disclosures elsewhere generally due to differences in methodology or variations in the

manner in which information is captured. Citi has noted such variations in instances where it believes

they could be material to reconcile to the information presented elsewhere.

– Tables exclude loans in Canada and Puerto Rico, loans guaranteed by U.S. government agencies

(residential first mortgages table only), loans recorded at fair value (residential first mortgages table only)

and loans subject to LTSCs.

– Balances exclude deferred fees/costs.

– Tables exclude balances for which FICO or LTV data is unavailable. For residential first mortgages,

balances for which such data is unavailable include $0.4 billion in each of the periods presented. For

home equity loans, balances for which such data is unavailable include $0.2 billion in each of the

periods presented.