Citibank 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

LOCAL CONSUMER LENDING

Local Consumer Lending (LCL) includes a substantial portion of Citigroup’s North America mortgage business (see “North America Consumer Mortgage

Lending” below), CitiFinancial North America (consisting of the OneMain and CitiFinancial Servicing businesses), remaining student loans and credit card

portfolios, and other local consumer finance businesses globally (including Western European cards and retail banking and Japan Consumer Finance). At

December 31, 2012, LCL consisted of approximately $126 billion of assets (with approximately $123 billion in North America), or approximately 81% of Citi

Holdings assets, and thus represents the largest segment within Citi Holdings. The North America assets primarily consist of residential mortgages (residential

first mortgages and home equity loans), which stood at $92 billion as of December 31, 2012.

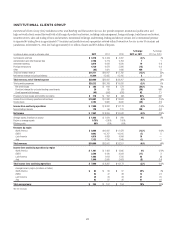

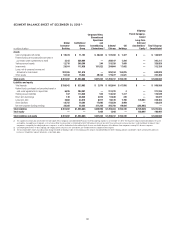

In millions of dollars, except as otherwise noted 2012 2011 2010

% Change

2012 vs. 2011

% Change

2011 vs. 2010

Net interest revenue $ 3,335 $ 4,268 $ 7,143 (22)% (40)%

Non-interest revenue 1,031 1,174 1,667 (12) (30)

Total revenues, net of interest expense $ 4,366 $ 5,442 $ 8,810 (20)% (38)%

Total operating expenses $ 4,465 $ 5,442 $ 5,798 (18)% (6)%

Net credit losses $ 5,870 $ 7,504 $11,928 (22)% (37)%

Credit reserve build (release) (1,410) (1,419) (765) 1(85)

Provision for benefits and claims 651 731 743 (11) (2)

Provisions for credit losses and for benefits and claims $ 5,111 $ 6,816 $11,906 (25)% (43)%

(Loss) from continuing operations before taxes $(5,210) (6,816) $ (8,894) 24% 23%

Benefits for income taxes (2,017) (2,403) (3,529) 16 32

(Loss) from continuing operations $(3,193) $(4,413) $ (5,365) 28% 18%

Noncontrolling interests —2 8 (100) (75)

Net (loss) $(3,193) $(4,415) $ (5,373) 28% 18%

Balance sheet data (in billions of dollars)

Average assets $ 142 $ 186 $ 280 (24)% (34)%

Return on average assets (2.25)% (2.37)% (1.92)%

Efficiency ratio 102% 100% 66%

EOP assets $ 126 $ 157 $ 206 (20) (24)

Net credit losses as a percentage of average loans 4.72% 4.69% 5.16%

2012 vs. 2011

The net loss decreased by 28%, driven mainly by the improved credit

environment primarily in North America mortgages.

Revenues decreased 20%, primarily due to a 22% net interest revenue

decline resulting from a 24% decline in loan balances. This decline was

driven by continued asset sales, divestitures and run-off. Non-interest

revenue decreased 12%, primarily due to portfolio run-off, partially offset

by a lower repurchase reserve build. The repurchase reserve build was

$700 million compared to $945 million in 2011 (see “Managing Global

Risk—Credit Risk—Citigroup Residential Mortgages—Representations and

Warranties” below).

Expenses decreased 18%, driven by lower volumes and divestitures. Legal

and related expenses in LCL remained elevated due to the previously disclosed

$305 million charge in the fourth quarter of 2012, related to the settlement

agreement reached with the Federal Reserve Board and OCC regarding the

independent foreclosure review process required by the Federal Reserve

Board and OCC consent orders entered into in April 2011 (see “Managing

Global Risk—Credit Risk—North America Consumer Mortgage Lending—

Independent Foreclosure Review Settlement” below). In addition, legal and

related expenses were elevated due to additional reserves related to payment

protection insurance (PPI) (see “Payment Protection Insurance” below) and

other legal and related matters impacting the business.

Provisions decreased 25%, driven primarily by the improved credit

environment in North America mortgages, lower volumes and divestitures.

Net credit losses decreased by 22%, despite being impacted by incremental

charge-offs of approximately $635 million in the third quarter of 2012

relating to OCC guidance regarding the treatment of mortgage loans

where the borrower has gone through Chapter 7 bankruptcy (see Note 1 to

the Consolidated Financial Statements) and $370 million of incremental

charge-offs in the first quarter of 2012 related to previously deferred principal

balances on modified mortgages related to anticipated forgiveness of

principal in connection with the national mortgage settlement. Substantially

all of these charge-offs were offset by reserve releases. In addition, net credit

losses in 2012 were negatively impacted by an additional aggregate amount