Citibank 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.130

Management may engage an independent valuation specialist to assist

in Citi’s valuation process. Citigroup engaged an independent valuation

specialist in 2011 and 2012 to assist in Citi’s valuation for most of the

reporting units employing both the market approach and DCF method. Citi

believes that the DCF method, using management projections for the selected

reporting units and an appropriate risk-adjusted discount rate, is most

reflective of a market participant’s view of fair values given current market

conditions. For the reporting units where both methods were utilized in 2011

and 2012, the resulting fair values were relatively consistent and appropriate

weighting was given to outputs from both methods.

The DCF method used at the time of each impairment test used discount

rates that Citi believes adequately reflected the risk and uncertainty in the

financial markets generally and specifically in the internally generated cash

flow projections. The DCF method employs a capital asset pricing model in

estimating the discount rate. Citi continues to value the remaining reporting

units where it believes the risk of impairment to be low, using primarily the

market approach.

Citi performed its annual goodwill impairment test as of July 1, 2012.

The results of the 2012 annual impairment test validated that the fair values

exceeded the carrying values for the reporting units that had goodwill at

the testing date. No interim goodwill impairment tests were required to be

performed during 2012, outside of the test performed as of January 1, 2012,

as discussed above.

Since none of Citi’s reporting units are publicly traded, individual

reporting unit fair value determinations cannot be directly correlated to

Citigroup’s common stock price. The sum of the fair values of the reporting

units at July 1, 2012 exceeded the overall market capitalization of Citi as of

July 1, 2012. However, Citi believes that it was not meaningful to reconcile

the sum of the fair values of its reporting units to its market capitalization

due to several factors. The market capitalization of Citigroup reflects the

execution risk in a transaction involving Citigroup due to its size. However,

the individual reporting units’ fair values are not subject to the same level of

execution risk or a business model that is perceived to be as complex.

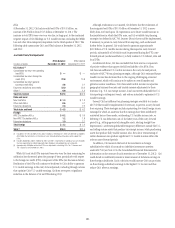

While no impairment was noted in step one of Citi’s Local Consumer

Lending—Cards reporting unit impairment test as of July 1, 2012, goodwill

present in the reporting unit may be particularly sensitive to further

deterioration in economic conditions. Under the market approach for

valuing this reporting unit, the key assumption is the price multiple. The

selection of the multiple considers operating performance and financial

condition such as return on equity and net income growth of Local

Consumer Lending—Cards as compared to those of selected guideline

companies. Among other factors, the level and expected growth in return on

tangible equity relative to those of the guideline companies is considered.

Since the guideline company prices used are on a minority interest basis, the

selection of the multiple considers the guideline acquisition prices, which

reflect control rights and privileges in arriving at a multiple that reflects an

appropriate control premium.

For the Local Consumer Lending—Cards valuation under the income

approach, the assumptions used as the basis for the model include cash flows

for the forecasted period, assumptions embedded in arriving at an estimation

of the terminal year value and discount rate. The cash flows are estimated

based on management’s most recent projections available as of the testing

date, giving consideration to target equity capital requirements based on

selected guideline companies for the reporting unit. In arriving at a terminal

value for Local Consumer Lending—Cards, using 2015 as the terminal

year, the assumptions used included a long-term growth rate. The discount

rate used in the analysis is based on the reporting units’ estimated cost of

equity capital computed under the capital asset pricing model.

If the future were to differ adversely from management’s best estimate

of key economic assumptions and associated cash flows were to decrease

by a small margin, Citi could potentially experience future impairment

charges with respect to the $111 million of goodwill remaining in its Local

Consumer Lending—Cards reporting unit. Any such charge, by itself,

would not negatively affect the Company’s regulatory capital ratios, tangible

common equity (TCE) or liquidity position.

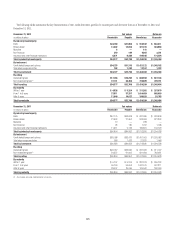

See Note 18 to the Consolidated Financial Statements for additional

information on goodwill, including the changes in the goodwill

balance period-over-period and the reporting unit goodwill balances as

of December 31, 2012.

Income Taxes

Overview

Citi is subject to the income tax laws of the U.S. and its states and local

municipalities, and the foreign jurisdictions in which Citi operates. These

tax laws are complex and are subject to differing interpretations by the

taxpayer and the relevant governmental taxing authorities. Disputes over

interpretations of the tax laws may be subject to review and adjudication by

the court systems of the various tax jurisdictions or may be settled with the

taxing authority upon audit.

In establishing a provision for income tax expense, Citi must make

judgments and interpretations about the application of these inherently

complex tax laws. Citi must also make estimates about when in the future

certain items will affect taxable income in the various tax jurisdictions,

both domestic and foreign. Deferred taxes are recorded for the future

consequences of events that have been recognized in the financial statements

or tax returns, based upon enacted tax laws and rates. Deferred tax assets

(DTAs) are recognized subject to management’s judgment that realization is

more-likely-than-not. See Note 10 to the Consolidated Financial Statements

for a further discussion of Citi’s tax provision and related income tax assets

and liabilities.