Citibank 2012 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168

Director Compensation

Non-employee directors receive part of their compensation in the form of

deferred stock awards that vest in two years, and may elect to receive part of

their retainer in the form of a stock payment, which they may elect to defer.

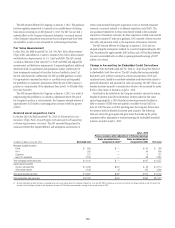

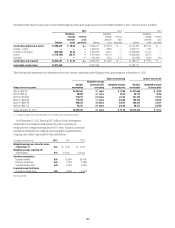

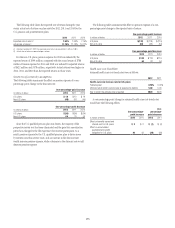

A summary of the status of Citigroup’s unvested stock awards that are not

subject to variable accounting at December 31, 2012 and changes during the

12 months ended December 31, 2012 are presented below:

Unvested stock awards Shares

Weighted-average

grant date

fair value

Unvested at January 1, 2012 50,213,124 $50.90

New awards 33,452,028 30.51

Cancelled awards (2,342,822) 39.15

Vested awards (1) (17,345,405) 62.12

Unvested at December 31, 2012 63,976,925 $37.62

(1) The weighted-average fair value of the vestings during 2012 was approximately $32.78 per share.

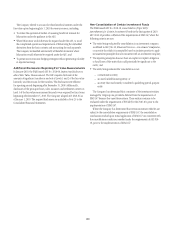

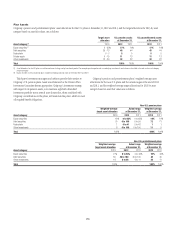

A summary of the status of Citigroup’s unvested stock awards that are

subject to variable accounting at December 31, 2012, and changes during the

12 months ended December 31, 2012, are presented below:

Unvested stock awards Shares

Weighted-average

award issuance

fair value

Unvested at January 1, 2012 5,290,798 $49.30

New awards 2,219,213 30.55

Cancelled awards (377,358) 43.92

Vested awards (1) (1,168,429) 50.16

Unvested at December 31, 2012 5,964,224 $42.50

(1) The weighted-average fair value of the vestings during 2012 was approximately $29.18 per share.

At December 31, 2012, there was $886 million of total unrecognized

compensation cost related to unvested stock awards, net of the forfeiture

provision. That cost is expected to be recognized over a weighted-average

period of 2.1 years. However, the cost of awards subject to variable accounting

will fluctuate with changes in Citigroup’s common stock price.

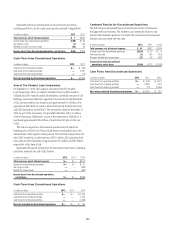

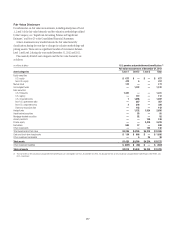

Stock Option Programs

While the Company no longer grants options as part of its annual incentive

award programs, Citigroup may grant stock options to employees or directors

on a one-time basis, as sign-on awards or as retention awards, as referenced

above. All stock options are granted on Citigroup common stock with exercise

prices that are no less than the fair market value at the time of grant (which

is defined under the 2009 Stock Incentive Plan to be the NYSE closing price

on the trading day immediately preceding the grant date or on the grant

date for grants to executive officers). Vesting periods and other terms and

conditions of sign-on and retention option grants tend to vary by grant.

Beginning in 2009, Citigroup eliminated the stock option election for all

directors and employees (except certain CAP participants who were permitted

to make a stock option election for awards made in 2009). This stock option

election allowed participants to trade a certain percentage of their annual

incentive that would otherwise be granted in CAP shares and elect to have the

award delivered instead as a stock option.

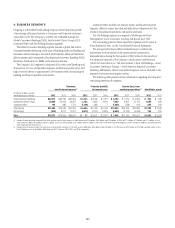

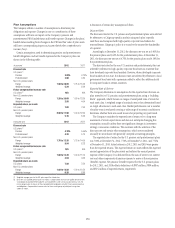

On February 14, 2011, Citigroup granted options exercisable for

approximately 2.9 million shares of Citigroup common stock to certain of

its executive officers. The options have six-year terms and vest in three equal

annual installments beginning on February 14, 2012. The exercise price

of the options is $49.10, which was the closing price of a share of Citigroup

common stock on the grant date. On any exercise of the options before the

fifth anniversary of the grant date, the shares received on exercise (net of the

amount required to pay taxes and the exercise price) are subject to a one-

year transfer restriction.

On April 20, 2010, Citigroup made an option grant to a group of

employees who were not eligible for the October 29, 2009 broad-based grant

described below. The options were awarded with an exercise price equal to

the NYSE closing price of a share of Citigroup common stock on the trading

day immediately preceding the date of grant ($48.80). The options vest in

three annual installments beginning on October 29, 2010. The options have

a six-year term.

On October 29, 2009, Citigroup made a broad-based option grant to

employees worldwide. The options have a six-year term, and generally vest in

three equal installments over three years, beginning on the first anniversary of

the grant date. The options were awarded with an exercise price equal to the

NYSE closing price on the trading day immediately preceding the date of grant

($40.80). The CEO and other employees whose 2009 compensation was subject

to structures approved by the Special Master did not participate in this grant.

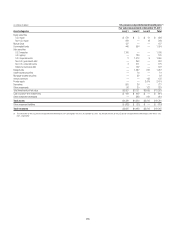

In January 2009, members of Citigroup’s Management Executive

Committee received 10% of their awards as performance-priced stock

options, with an exercise price that placed the awards significantly “out of

the money” on the date of grant. Half of each executive’s options have an

exercise price of $178.50 and half have an exercise price of $106.10. The

options were granted on a day on which the NYSE closing price of a share of

Citigroup common stock was $45.30. The options have a 10-year term and

vest ratably over a four-year period.

Generally, all other options granted from 2003 through 2009 have six-

year terms and vest ratably over three- or four-year periods; however, options

granted to directors provided for cliff vesting. All outstanding options granted

prior to 2009 are significantly out of the money.

Prior to 2003, Citigroup options had 10-year terms and generally vested

at a rate of 20% per year over five years (with the first vesting date occurring

12 to 18 months following the grant date). All outstanding options that were

granted prior to 2003 expired in 2012.

From 1997 to 2002, a broad base of employees participated in annual

option grant programs. The options vested over five-year periods, or cliff

vested after five years, and had 10-year terms but no reload features. No

grants have been made under these programs since 2002 and all options that

remained outstanding expired in 2012.

All unvested options granted to former CEO Vikram Pandit, including

premium-priced stock options granted on May 17, 2011, were cancelled upon

his resignation in October 2012.