Citibank 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

Repurchase Reserve—Private-Label Securitizations

Investors in private-label securitizations may seek recovery for alleged

breaches of representations and warranties, as well as losses caused by

non-performing loans more generally, through repurchase claims or

through litigation premised on a variety of legal theories. Citi considers

litigation relating to private-label securitizations as part of its contingencies

analysis. For additional information, see Note 28 to the Consolidated

Financial Statements.

During 2012, Citi continued to receive significant levels of inquiries and

demands for loan files, as well as requests to toll (extend) the applicable

statutes of limitation for, among others, representation and warranty claims

relating to its private-label securitizations. These inquiries, demands and

requests have come from trustees of securitization trusts and others. Citi

also has received repurchase claims for breaches of representations and

warranties related to private-label securitizations. These claims have been

received at an unpredictable rate, although the number of claims increased

substantially during 2012 and is expected to remain elevated, particularly

given the level of inquiries, demands and requests noted above.

Of the repurchase claims received, Citi believes some are based on a review

of the underlying loan files, while others are not based on such a review. In

either case, upon receipt of a claim, Citi typically requests that it be provided

with the underlying detail supporting the claim; however, to date, Citi has

received little or no response to these requests for information. As a result,

the vast majority of the repurchase claims received on Citi’s private-label

securitizations remain unresolved (see the “Unresolved Claims” table below).

Citi expects unresolved repurchase claims for private-label securitizations to

continue to increase because new claims and requests for loan files continue

to be received, while there has been little progress to date in resolving these

repurchase claims.

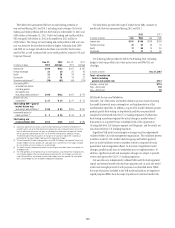

Citi cannot reasonably estimate probable losses from future repurchase

claims for private-label securitizations because the claims to date have been

received at an unpredictable rate, the factual basis for those claims is unclear,

and very few such claims have been resolved. Rather, at the present time, Citi

records reserves related to private-label securitizations repurchase claims

based on estimated losses arising from those claims received that appear to

be based on a review of the underlying loan files. During 2012, Citi recorded

a reserve of $244 million (of which $9 million was in the fourth quarter of

2012) relating to such claims. The estimation reflected in this reserve is based

on currently available information and relies on various assumptions that

involve numerous estimates and judgments that are inherently uncertain

and subject to change. If actual experiences differ from Citi’s assumptions,

future provisions may differ substantially from Citi’s current reserve.

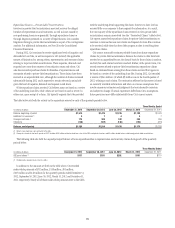

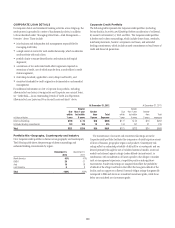

The table below sets forth the activity in the repurchase reserve for each of the quarterly periods below:

Three Months Ended

In millions of dollars December 31, 2012 September 30, 2012 June 30, 2012 March 31, 2012 December 31, 2011

Balance, beginning of period $1,516 $1,476 $1,376 $1,188 $1,076

Additions for new sales (1) 6 7 4 6 7

Change in estimate (2) 173 200 242 335 306

Utilizations (130) (167) (146) (153) (201)

Balance, end of period $1,565 $1,516 $1,476 $1,376 $1,188

(1) Reflects new whole loan sales, primarily to the GSEs.

(2) Change in estimate for the fourth quarter of 2012 includes $164 million related to whole loan sales to the GSEs and private investors and $9 million related to loans sold through private-label securitizations.

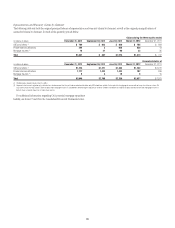

The following table sets forth the unpaid principal balance of loans repurchased due to representation and warranty claims during each of the quarterly

periods below:

Three Months Ended

In millions of dollars December 31, 2012 September 30, 2012 June 30, 2012 March 31, 2012 December 31, 2011

GSEs and others (1) $157 $105 $202 $101 $110

(1) Predominantly related to claims from the GSEs.

In addition to the amounts set forth in the table above, Citi recorded

make-whole payments of $92 million, $118 million, $91 million,

$107 million and $148 million for the quarterly periods ended December 31,

2012, September 30, 2012, June 30, 2012, March 31, 2012 and December 31,

2011, respectively. Nearly all of these make-whole payments were to the GSEs.