Citibank 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

FUNDING AND LIQUIDITY

Overview

Citi’s funding and liquidity objectives generally are to maintain liquidity

to fund its existing asset base as well as grow its core businesses in Citicorp,

while at the same time maintain sufficient excess liquidity, structured

appropriately, so that it can operate under a wide variety of market

conditions, including market disruptions for both short- and long-term

periods. Citigroup’s primary liquidity objectives are established by entity, and

in aggregate, across three major categories:

• the non-bank, which is largely composed of the parent holding company

(Citigroup) and Citi’s broker-dealer subsidiaries (collectively referred to in

this section as “non-bank”);

• Citi’s significant Citibank entities, which consist of Citibank, N.A. units

domiciled in the U.S., Western Europe, Hong Kong, Japan and Singapore

(collectively referred to in this section as “significant Citibank entities”);

and

• other Citibank and Banamex entities.

At an aggregate level, Citigroup’s goal is to ensure that there is sufficient

funding in amount and tenor to ensure that aggregate liquidity resources are

available for these entities. The liquidity framework requires that entities be

self-sufficient or net providers of liquidity, including in conditions established

under their designated stress tests.

Citi’s primary sources of funding include (i) deposits via Citi’s bank

subsidiaries, which are Citi’s most stable and lowest cost source of long-term

funding, (ii) long-term debt (primarily senior and subordinated debt) issued

at the non-bank level and certain bank subsidiaries, and (iii) stockholders’

equity. These sources may be supplemented by short-term borrowings,

primarily in the form of secured financing transactions (securities loaned or

sold under agreements to repurchase, or repos).

As referenced above, Citigroup works to ensure that the structural tenor

of these funding sources is sufficiently long in relation to the tenor of its

asset base. The key goal of Citi’s asset/liability management is to ensure that

there is excess tenor in the liability structure so as to provide excess liquidity

to fund the assets. The excess liquidity resulting from a longer-term tenor

profile can effectively offset potential decreases in liquidity that may occur

under stress. This excess funding is held in the form of aggregate liquidity

resources, as described below.

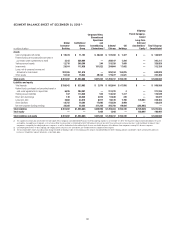

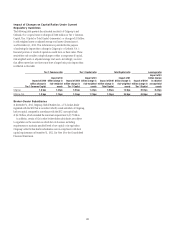

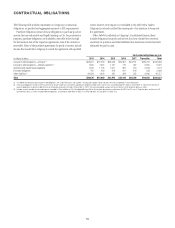

Aggregate Liquidity Resources

Non-bank Significant Citibank Entities

Other Citibank and

Banamex Entities Total

In billions of dollars

Dec. 31,

2012

Sept. 30,

2012

Dec. 31,

2011

Dec. 31,

2012

Sept. 30,

2012

Dec. 31,

2011

Dec. 31,

2012

Sept. 30,

2012

Dec. 31,

2011

Dec. 31,

2012

Sept. 30,

2012

Dec. 31,

2011

Available cash at central banks $33.2 $50.9 $29.1 $ 26.5 $ 72.7 $ 70.7 $13.3 $15.9 $ 27.6 $ 73.0 $139.5 $127.4

Unencumbered liquid securities 31.3 26.8 69.3 173.3 164.0 129.5 76.2 73.9 79.3 280.8 264.7 278.1

Total $64.5 $77.7 $98.4 $199.8 $236.7 $200.2 $89.5 $89.8 $106.9 $353.8 $404.2 $405.5

All amounts in the table above are as of period-end and may increase or

decrease intra-period in the ordinary course of business.

As set forth in the table above, Citigroup’s aggregate liquidity resources

totaled approximately $353.8 billion at December 31, 2012, compared to

$404.2 billion at September 30, 2012 and $405.5 billion at December 31,

2011. During 2011 and the first half of 2012, Citi consciously maintained

an excess liquidity position given uncertainties in both the global economic

outlook and the pace of its balance sheet deleveraging. In the second half

of 2012, as these uncertainties showed signs of abating, Citi purposefully

began to decrease its liquidity resources, primarily through long-term debt

reductions and limiting deposit growth, as well as through increased lending

to both Consumer and Corporate clients.

As discussed in more detail below, this reduction in excess liquidity in turn

contributed to a reduction in overall cost of funds, and thus improved Citi’s

net interest margin, which increased to 2.88% for full year 2012 from 2.86%

for full year 2011 (see “Deposits” and “Market Risk—Interest Revenue/

Expense and Yields” below, respectively).

At December 31, 2012, Citigroup’s non-bank aggregate liquidity

resources totaled approximately $64.5 billion, compared to $77.7 billion at

September 30, 2012 and $98.4 billion at December 31, 2011. These amounts

included unencumbered liquid securities and cash held in Citi’s U.S. and

non-U.S. broker-dealer entities. The purposeful decrease in aggregate

liquidity resources of Citi’s non-bank entities year-over-year and quarter-

over-quarter was primarily due to the continued pay down and runoff of

long-term debt, including Temporary Liquidity Guarantee Program (TLGP)

debt, which fully matured by the end of 2012.

Citigroup’s significant Citibank entities had approximately

$199.8 billion of aggregate liquidity resources as of December 31, 2012,

compared to $236.7 billion at September 30, 2012 and $200.2 billion at

December 31, 2011. The decrease in aggregate liquidity resources during

the fourth quarter of 2012 was primarily due to an anticipated reduction in

episodic deposits and the expiration of the Transaction Account Guarantee

(TAG) program (see “Deposits” below), as well as the repayment of

remaining TLGP borrowings and a reduction in secured borrowings. As of

December 31, 2012, the significant Citibank entities’ liquidity resources

included $26.5 billion of cash on deposit with major central banks

(including the U.S. Federal Reserve Bank, European Central Bank, Bank