Citibank 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324

|

|

5

Yet our company — and our industry — still face significant

economic, political and regulatory headwinds. Growth likely

will be uneven. There is reason for optimism that the U.S.

recovery will pick up steam and that the emerging markets

will regain some of their strong, pre-crisis momentum. But

prospects for Europe remain mixed.

Politically, we’ve just lived through a year of elections and

transitions around the globe. Public pressures — intense during

the crisis — remain, showing that as an industry we still have a

long way to go toward regaining public trust.

The regulatory challenges alone are enormous. Our bank is

well-capitalized, even under the stricter Basel III criteria. But

beyond capitalization, the sheer scope of regulation we now

face is vast. One thing is certain: there’s no appetite among

regulators for us — or any large bank — to grow inorganically.

That dynamic, however, can work to our advantage. We need

to be less concerned by mergers and acquisitions among

our peers trying to replicate our footprint — but we must

be especially focused on getting the best out of the mix of

businesses that we have.

These and other changes are redefining every relationship

this company has: with our clients and customers, with our

regulators, with our employees and with the communities we

serve — and above all with you, our investors.

In addition, two legacy issues are not yet behind our company

and will take us time to resolve.

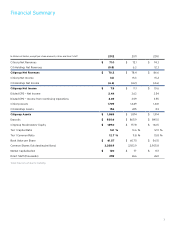

Citi Holdings creates a disproportionate drag on net income

and ties up a significant amount of capital. We’ve made good

progress here. In 2012, we reduced the size of Holdings by a

further 31%; at the end of the fourth quarter, it made up only

8% of our balance sheet, down from a peak of about 40%. Yet

it still represents a disproportionate 23% of our risk-weighted

assets under Basel III. A quick, economically viable resolution

of the remaining portfolio does not exist. I have considered

and understand the issue in detail — it does not make sense to

destroy capital simply for the sake of speed. We will continue

to manage these assets and our associated expenses in

an economically rational way while taking advantage of all

reasonable opportunities to reduce them more expeditiously.

Our deferred tax assets (DTA) also tie up a significant amount

of book capital that doesn’t earn any returns — indeed,

moving this off our books requires that we generate earnings,

specifically in the U.S. In 2012, our DTA went in the wrong

direction and rose by nearly $4 billion. One of my top areas of

focus will be to begin to turn that trend around, but utilizing

a substantial portion of our DTA will likely take longer than

resolving Holdings.

What this means for us in practice is that about one-third of

our capital is not available to us to generate the returns you

expect and deserve. Thus, with the remainder, we have to be

better than good and better even than our peers. There is no

margin for error. My management team understands what’s

at stake.

I’m often asked how I would judge my tenure as CEO a success

— what do I want the company to look like down the road?

First, I want Citi to generate consistent, quality earnings. We’ll

accomplish this by driving client relationships and building

revenues organically in our core businesses. The future of our

franchise depends on consistently generating quality earnings

from our core business activities. Specifically, I want to see us

generate risk-adjusted returns above our cost of capital.

Michael L. Corbat

Chief Executive Officer