Citibank 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

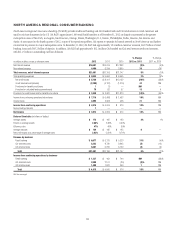

The international RCB revenue growth year-over-year, excluding the

impact of FX translation, was driven by 9% revenue growth in Latin America

RCB and 2% revenue growth in EMEA RCB. Asia RCB revenues were flat

year-over-year, primarily reflecting spread compression in some countries

in the region and the impact of regulatory actions in certain countries,

particularly Korea. International RCB average deposits grew 2% versus the

prior year, average retail loans increased 11%, investment sales grew 12%,

average card loans grew 6%, and international card purchase sales grew 10%,

all excluding the impact of FX translation.

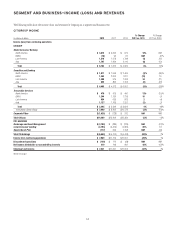

In Securities and Banking, fixed income markets revenues of

$14.0 billion, excluding CVA/DVA,7 increased 28% from the prior year,

reflecting higher revenues in rates and currencies and credit-related and

securitized products. Equity markets revenues of $2.4 billion in 2012,

excluding CVA/DVA, increased 1% driven by improved derivatives performance

as well as the absence in the current year of proprietary trading losses,

partially offset by lower cash equity volumes.

Investment banking revenues rose 10% from the prior year to $3.6 billion,

principally driven by higher revenues in debt underwriting and advisory

activities, partially offset by lower equity underwriting revenues. Lending

revenues of $997 million were down 45% from the prior year, reflecting

$698 million in losses on hedges related to accrual loans as credit spreads

tightened during 2012 (compared to a $519 million gain in the prior

year as spreads widened). Excluding the mark-to-market impact of loan

hedges related to accrual loans, lending revenues rose 31% year-over-year to

$1.7 billion reflecting growth in the Corporate loan portfolio and improved

spreads in most regions. Private Bank revenues of $2.3 billion increased 8%

from the prior year, excluding CVA/DVA, driven primarily by growth in North

America lending and deposits.

In Transaction Services, the increase in revenues year-over-year,

excluding the impact of FX translation, was driven by growth in Treasury

and Trade Solutions, which was partially offset by a decline in Securities

and Fund Services. Excluding the impact of FX translation, Treasury

and Trade Solutions revenues were up 8%, driven by growth in trade as

end-of-period trade loans grew 23%, partially offset by ongoing spread

compression given the low interest rate environment. Securities and Fund

Services revenues were down 2%, excluding the impact of FX translation,

mostly reflecting lower market volumes as well as spread compression

on deposits.

Citicorp end-of-period loans increased 7% year-over-year to $540 billion,

with 3% growth in Consumer loans, primarily in Latin America, and 11%

growth in Corporate loans.

Citi Holdings8

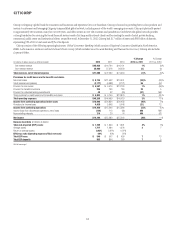

Citi Holdings net loss was $6.6 billion compared to a net loss of $4.2 billion

in 2011. The increase in the net loss was driven by the $4.7 billion pretax

($2.9 billion after-tax) loss on MSSB described above. In addition, Citi

Holdings results included $77 million in repositioning charges in the

fourth quarter of 2012, compared to $60 million in the fourth quarter of

2011. Excluding the loss on MSSB, CVA/DVA9 and the repositioning charges

in the fourth quarters of 2012 and 2011, Citi Holdings net loss decreased

to $3.7 billion compared to a net loss of $4.2 billion in the prior year, as

revenue declines and lower loan loss reserve releases were more than offset by

lower operating expenses and lower net credit losses. These improved results

in 2012 reflected the continued decline in Citi Holdings assets.

Citi Holdings revenues decreased to $(833) million from $6.3 billion

in the prior year. Excluding CVA/DVA and the loss on MSSB, Citi Holdings

revenues were $3.7 billion in 2012 compared to $6.2 billion in the prior year.

Special Asset Pool revenues, excluding CVA/DVA, were $(657) million in 2012,

compared to $473 million in the prior year, largely due to lower non-interest

revenue resulting from lower gains on asset sales. Local Consumer Lending

revenues of $4.4 billion declined 20% from the prior year primarily due to the

24% decline in average assets. Brokerage and Asset Management revenues,

excluding the loss on MSSB, were $(15) million, compared to $282 million

in the prior year, mostly reflecting higher funding costs. Net interest revenues

declined 30% year-over-year to $2.6 billion, largely driven by continued

declining loan balances in Local Consumer Lending. Non-interest

revenues, excluding the loss on MSSB and CVA/DVA, were $1.1 billion versus

$2.5 billion in the prior year, principally reflecting lower gains on asset sales

within the Special Asset Pool.

As noted above, Citi Holdings assets declined 31% year-over-year to

$156 billion as of the end of 2012. Also at the end of 2012, Citi Holdings

assets comprised approximately 8% of total Citigroup GAAP assets and 15%

of risk-weighted assets (as defined under current regulatory guidelines).

Local Consumer Lending continued to represent the largest segment

within Citi Holdings, with $126 billion of assets as of the end of 2012, of

which approximately 73% consisted of mortgages in North America real

estate lending.

8 Citi Holdings includes Local Consumer Lending, Special Asset Pool and Brokerage and Asset

Management. See “Citi Holdings” below for additional information on the results of operations for each

of the businesses in Citi Holdings.

9 CVA/DVA in Citi Holdings, recorded in the Special Asset Pool, was $157 million in 2012, compared to

$74 million in the prior year.

7 For the summary of CVA/DVA by business within Securities and Banking for 2012 and comparable

periods, see “Citicorp—Institutional Clients Group.”