Citibank 2012 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212

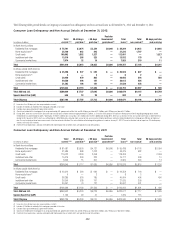

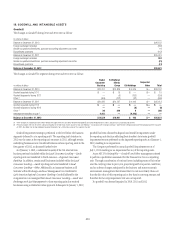

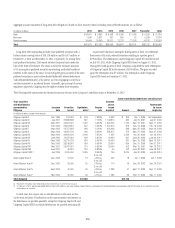

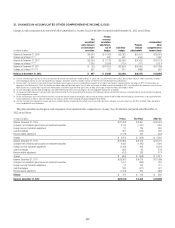

17. ALLOWANCE FOR CREDIT LOSSES

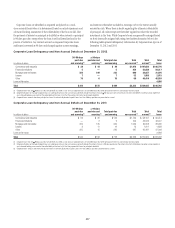

In millions of dollars 2012 2011 2010

Allowance for loan losses at beginning of year $ 30,115 $40,655 $ 36,033

Gross credit losses (1)(2) (17,478) (23,164) (34,491)

Gross recoveries 2,902 3,126 3,632

Net credit losses (NCLs) $(14,576) $ (20,038) $ (30,859)

NCLs $ 14,576 $ 20,038 $ 30,859

Net reserve builds (releases) (1) (1,882) (8,434) (6,523)

Net specific reserve builds (releases) (2) (1,846) 169 858

Total provision for credit losses $ 10,848 $ 11,773 $ 25,194

Other, net (3) (932) (2,275) 10,287

Allowance for loan losses at end of year $ 25,455 $ 30,115 $ 40,655

Allowance for credit losses on unfunded lending commitments at beginning of year (4) $ 1,136 $ 1,066 $ 1,157

Provision for unfunded lending commitments (16) 51 (117)

Other, net (1) 19 26

Allowance for credit losses on unfunded lending commitments at end of year (4) $ 1,119 $ 1,136 $ 1,066

Total allowance for loans, leases, and unfunded lending commitments $ 26,574 $ 31,251 $ 41,721

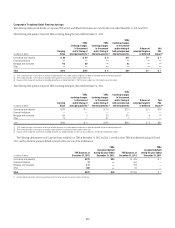

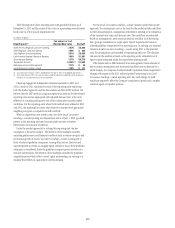

(1) 2012 includes approximately $635 million of incremental charge-offs related to OCC guidance issued in the third quarter of 2012, which required mortgage loans to borrowers that have gone through Chapter 7 of the

U.S. Bankruptcy Code to be written down to collateral value. There was a corresponding approximate $600 million release in the third quarter of 2012 allowance for loan losses related to these charge-offs. 2012 also

includes a benefit to charge-offs of approximately $40 million related to finalizing the impact of this OCC guidance in the fourth quarter of 2012.

(2) 2012 includes approximately $370 million of incremental charge-offs related to previously deferred principal balances on modified loans in the first quarter of 2012. These charge-offs were related to anticipated

forgiveness of principal in connection with the national mortgage settlement. There was a corresponding approximate $350 million reserve release in the first quarter of 2012 related to these charge-offs.

(3) 2012 includes reductions of approximately $875 million related to the sale or transfer to held-for-sale of various U.S. loan portfolios. 2011 includes reductions of approximately $1.6 billion related to the sale or transfer

to held-for-sale of various U.S. loan portfolios, approximately $240 million related to the sale of the Egg Banking PLC credit card business, approximately $72 million related to the transfer of the Citi Belgium business

to held-for-sale and approximately $290 million related to FX translation. 2010 primarily includes an addition of $13.4 billion related to the impact of consolidating entities in connection with Citi’s adoption of SFAS

166/167 (see Note 1 to the Consolidated Financial Statements), reductions of approximately $2.7 billion related to the sale or transfer to held-for-sale of various U.S. loan portfolios and approximately $290 million

related to the transfer of a U.K. first mortgage portfolio to held-for-sale.

(4) Represents additional credit loss reserves for unfunded lending commitments and letters of credit recorded in Other liabilities on the Consolidated Balance Sheet.

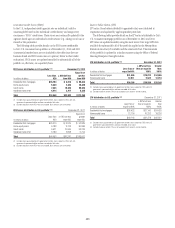

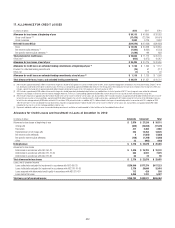

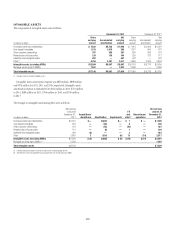

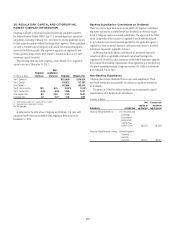

Allowance for Credit Losses and Investment in Loans at December 31, 2012

In millions of dollars Corporate Consumer Total

Allowance for loan losses at beginning of year $ 2,879 $ 27,236 $ 30,115

Charge-offs (640) (16,838) (17,478)

Recoveries 417 2,485 2,902

Replenishment of net charge-offs 223 14,353 14,576

Net reserve builds (releases) 2 (1,884) (1,882)

Net specific reserve builds (releases) (138) (1,708) (1,846)

Other 33 (965) (932)

Ending balance $ 2,776 $ 22,679 $ 25,455

Allowance for loan losses

Determined in accordance with ASC 450-20 $ 2,429 $ 15,703 $ 18,132

Determined in accordance with ASC 310-10-35 284 6,941 7,225

Determined in accordance with ASC 310-30 63 35 98

Total allowance for loan losses $ 2,776 $ 22,679 $ 25,455

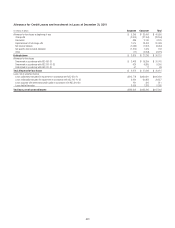

Loans, net of unearned income

Loans collectively evaluated for impairment in accordance with ASC 450-20 $239,849 $377,374 $617,223

Loans individually evaluated for impairment in accordance with ASC 310-10-35 2,776 29,640 32,416

Loans acquired with deteriorated credit quality in accordance with ASC 310-30 112 426 538

Loans held at fair value 4,056 1,231 5,287

Total loans, net of unearned income $246,793 $408,671 $655,464