Citibank 2012 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

201

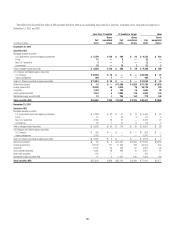

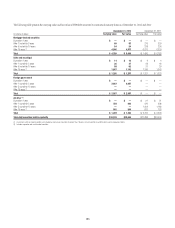

16. LOANS

Citigroup loans are reported in two categories—Consumer and Corporate.

These categories are classified primarily according to the segment and

subsegment that manages the loans.

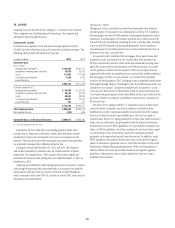

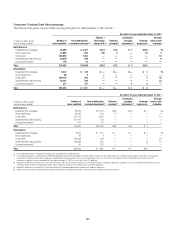

Consumer Loans

Consumer loans represent loans and leases managed primarily by the

Global Consumer Banking and Local Consumer Lending businesses. The

following table provides information by loan type:

In millions of dollars 2012 2011

Consumer loans

In U.S. offices

Mortgage and real estate (1) $125,946 $139,177

Installment, revolving credit, and other 14,070 15,616

Cards 111,403 117,908

Commercial and industrial 5,344 4,766

Lease financing —1

$256,763 $277,468

In offices outside the U.S.

Mortgage and real estate (1) $ 54,709 $ 52,052

Installment, revolving credit, and other 36,182 34,613

Cards 40,653 38,926

Commercial and industrial 20,001 19,975

Lease financing 781 711

$152,326 $146,277

Total Consumer loans $409,089 $423,745

Net unearned income (418) (405)

Consumer loans, net of unearned income $408,671 $423,340

(1) Loans secured primarily by real estate.

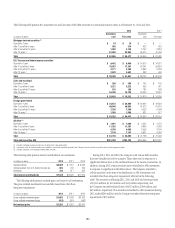

Included in the loan table above are lending products whose terms

may give rise to additional credit issues. Credit cards with below-market

introductory interest rates and interest-only loans are examples of such

products. These products are closely managed using credit techniques that

are intended to mitigate their additional inherent risk.

During the years ended December 31, 2012 and 2011, the Company

sold and/or reclassified (to held-for-sale) $4.3 billion and $21.0 billion,

respectively, of Consumer loans. The Company did not have significant

purchases of Consumer loans during the years ended December 31, 2012 or

December 31, 2011.

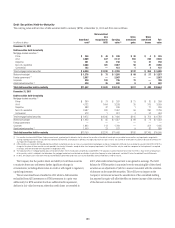

Citigroup has established a risk management process to monitor, evaluate

and manage the principal risks associated with its Consumer loan portfolio.

Credit quality indicators that are actively monitored include delinquency

status, consumer credit scores (FICO), and loan to value (LTV) ratios, each as

discussed in more detail below.

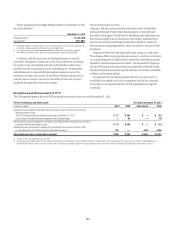

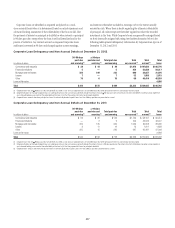

Delinquency Status

Delinquency status is carefully monitored and considered a key indicator

of credit quality of Consumer loans. Substantially all of the U.S. residential

first mortgage loans use the MBA method of reporting delinquencies, which

considers a loan delinquent if a monthly payment has not been received by

the end of the day immediately preceding the loan’s next due date. All other

loans use the OTS method of reporting delinquencies, which considers a

loan delinquent if a monthly payment has not been received by the close of

business on the loan’s next due date.

As a general policy, residential first mortgages, home equity loans and

installment loans are classified as non-accrual when loan payments are

90 days contractually past due. Credit cards and unsecured revolving loans

generally accrue interest until payments are 180 days past due. As a result

of OCC guidance issued in the first quarter of 2012, home equity loans in

regulated bank entities are classified as non-accrual if the related residential

first mortgage is 90 days or more past due. As a result of OCC guidance

issued in the third quarter of 2012, mortgage loans in regulated bank entities

discharged through Chapter 7 bankruptcy, other than FHA-insured loans, are

classified as non-accrual. Commercial market loans are placed on a cash

(non-accrual) basis when it is determined, based on actual experience and

a forward-looking assessment of the collectability of the loan in full, that the

payment of interest or principal is doubtful or when interest or principal is

90 days past due.

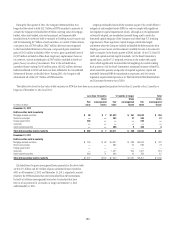

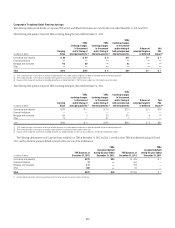

The policy for re-aging modified U.S. Consumer loans to current status

varies by product. Generally, one of the conditions to qualify for these

modifications is that a minimum number of payments (typically ranging

from one to three) be made. Upon modification, the loan is re-aged to

current status. However, re-aging practices for certain open-ended Consumer

loans, such as credit cards, are governed by Federal Financial Institutions

Examination Council (FFIEC) guidelines. For open-ended Consumer loans

subject to FFIEC guidelines, one of the conditions for the loan to be re-aged

to current status is that at least three consecutive minimum monthly

payments, or the equivalent amount, must be received. In addition, under

FFIEC guidelines, the number of times that such a loan can be re-aged is

subject to limitations (generally once in 12 months and twice in five years).

Furthermore, Federal Housing Administration (FHA) and Department of

Veterans Affairs (VA) loans are modified under those respective agencies’

guidelines, and payments are not always required in order to re-age a

modified loan to current.