Citibank 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

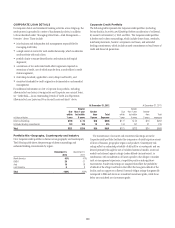

Citi’s residential first mortgages with an LTV above 100% has declined by

39% since year end 2011, and high LTV loans with FICO scores of less than

660 decreased by 37% to $7.1 billion. The residential first mortgage portfolio

has migrated to a higher FICO and lower LTV distribution as a result of asset

sales, home price appreciation and principal forgiveness. Loans 90+ days

past due have declined by approximately 32%, or $0.6 billion, year-over-year

to approximately $1.2 billion. The decline in 90+ days past due residential

mortgages with refreshed FICO scores of less than 660 as well as higher LTVs

primarily can be attributed to asset sales and modification programs, offset

by the lengthening of the foreclosure process, as discussed in the sections

above. Citi’s home equity loans with a CLTV above 100% have declined by

28% since year end 2011, and high CLTV loans with FICO scores of less than

660 decreased by 31% to approximately $3.7 billion. The CLTV improvement

was primarily the result of home price appreciation.

Residential first mortgages historically have experienced higher

delinquency rates, as compared to home equity loans, despite the fact that

home equity loans are typically in junior lien positions and residential first

mortgages are typically in a first lien position. Citi believes this difference is

primarily because residential first mortgages are written down to collateral

value less cost to sell at 180 days past due and remain in the delinquency

population until full disposition through sale, repayment or foreclosure;

however, home equity loans are generally fully charged off at 180 days

past due and thus removed from the delinquency calculation. In addition,

due to the longer timelines to foreclose on a residential first mortgage

(see “Foreclosures” above), these loans tend to remain in the delinquency

statistics for a longer period and, consequently, the 90 days or more

delinquencies of these loans remain higher.

Mortgage Servicing Rights

To minimize credit and liquidity risk, Citi sells most of the conforming

mortgage loans it originates but retains the servicing rights. These sale

transactions create an intangible asset referred to as mortgage servicing

rights (MSRs), which are recorded at fair value on Citi’s Consolidated

Balance Sheet. The fair value of MSRs is primarily affected by changes in

prepayments of mortgages that result from shifts in mortgage interest rates.

Specifically, the fair value of MSRs declines with increased prepayments,

and declines in or continued low interest rates tend to lead to increased

prepayments. In managing this risk, Citi economically hedges a significant

portion of the value of its MSRs through the use of interest rate derivative

contracts, forward purchase and sale commitments of mortgage-backed

securities and purchased securities classified as trading account assets.

Citi’s MSRs totaled $1.9 billion as of December 31, 2012, compared

to $1.9 billion and $2.6 billion at September 30, 2012 and December 31,

2011, respectively. The decrease in the value of Citi’s MSRs from year-end

2011 primarily reflected the impact from lower interest rates in addition to

amortization as well as an increase in servicing costs related to the servicing

of the loans remaining in Citi Holdings. As the mix of loans remaining in

Citi Holdings has gradually shifted to more delinquent, non-performing

loans, the cost for servicing those loans has increased. As of December 31,

2012, approximately $1.3 billion of MSRs were specific to Citicorp, with the

remainder to Citi Holdings.

For additional information on Citi’s MSRs, see Note 22 to the Consolidated

Financial Statements.

Citigroup Residential Mortgages—Representations and

Warranties

Overview

In connection with Citi’s sales of residential mortgage loans to the U.S.

government-sponsored entities (GSEs) and, in most cases, other mortgage

loan sales and private-label securitizations, Citi makes representations

and warranties that the loans sold meet certain requirements. The specific

representations and warranties made by Citi in any particular transaction

depend on, among other things, the nature of the transaction and the

requirements of the investor (e.g., whole loan sale to the GSEs versus loans

sold through securitization transactions), as well as the credit quality of the

loan (e.g., prime, Alt-A or subprime).

These sales expose Citi to potential claims for breaches of its

representations and warranties. In the event of a breach of its representations

and warranties, Citi could be required either to repurchase the mortgage

loans with the identified defects (generally at unpaid principal balance plus

accrued interest) or to indemnify (“make whole”) the investors for their

losses on these loans. To the extent Citi made representation and warranties

on loans it purchased from third-party sellers that remain financially viable,

Citi may have the right to seek recovery of repurchase losses or make whole

payments from the third party based on representations and warranties made

by the third party to Citi (a “back-to-back” claim).