Citibank 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.94

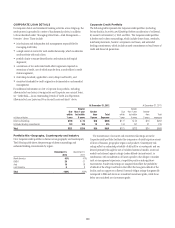

Legacy S&B Securitizations (principally reflected in Citi Holdings—

Special Asset Pool)

During the period 2005 through 2008, S&B, through its legacy business,

sold approximately $66.4 billion of loans through private-label mortgage

securitization trusts. These $66.4 billion of securitization trusts were

composed of approximately $15.4 billion in prime trusts, $12.4 billion

in Alt-A trusts and $38.6 billion in subprime trusts, each as classified

at issuance.

As of December 31, 2012, approximately $19.9 billion of the $66.4 billion

remained outstanding as a result of repayments of approximately

$36.0 billion and cumulative losses (incurred by the issuing trusts) of

approximately $10.5 billion (of which approximately $7.9 billion related to

loans in subprime trusts). The remaining outstanding amount is composed

of approximately $5.1 billion in prime trusts, $4.2 billion in Alt-A trusts and

$10.6 billion in subprime trusts, as classified at issuance. As of December 31,

2012, the remaining outstanding amount had a 90 days or more delinquency

rate of approximately 26.1%.

The mortgages included in the S&B legacy securitizations were primarily

purchased from third-party sellers. In connection with these securitization

transactions, representations and warranties relating to the mortgages were

made by Citi, third-party sellers or both. As of December 31, 2012, where Citi

made representations and warranties and received similar representations

and warranties from third-party sellers, Citi believes that for the majority of

the securitizations backed by prime and Alt-A loan collateral, if Citi received a

repurchase claim for those loans, it would have a back-to-back claim against

financially viable sellers.

The vast majority of the subprime collateral was purchased from third-

party sellers that Citi believes would be unlikely to honor back-to-back claims

because they are no longer financially viable. Citi’s repurchase reserve, to

the extent applicable, takes into account estimated reimbursements to be

received, if any, from third-party sellers.

Repurchase Reserve

Citi has recorded a mortgage repurchase reserve (referred to as the

repurchase reserve) for its potential repurchase or make-whole liability

regarding representation and warranty claims. Citi’s repurchase reserve

primarily relates to whole loan sales to the GSEs and is thus calculated

primarily based on Citi’s historical repurchase activity with the GSEs.

The repurchase reserve relating to Citi’s whole loan sales, and changes in

estimate with respect thereto, are generally recorded in Citi Holdings—

Local Consumer Lending. The repurchase reserve relating to private-label

securitizations, and changes in estimate with respect thereto, are recorded in

Citi Holdings—Special Asset Pool.

Repurchase Reserve—Whole Loan Sales

To date, issues related to (i) misrepresentation of facts by either the borrower

or a third party (e.g., income, employment, debts, etc.), (ii) appraisal

issues (e.g., an error or misrepresentation of value), and (iii) program

requirements (e.g., a loan that does not meet investor guidelines, such as

contractual interest rate) have been the primary drivers of Citi’s repurchases

and make-whole payments to the GSEs. The type of defect that results in a

repurchase or make-whole payment has varied and will likely continue to

vary over time. There has not been a meaningful difference in Citi’s incurred

or estimated loss for any particular type of defect.

The repurchase reserve is based on various assumptions which, as

referenced above, are primarily based on Citi’s historical repurchase activity

with the GSEs. As of December 31, 2012, the most significant assumptions

used to calculate the reserve levels are the: (i) probability of a claim based on

correlation between loan characteristics and repurchase claims; (ii) claims

appeal success rates; and (iii) estimated loss per repurchase or make-whole

payment. In addition, Citi considers reimbursements estimated to be received

from third-party sellers, which are generally based on Citi’s analysis of its

most recent collection trends and the financial solvency or viability of the

third-party sellers, in estimating its repurchase reserve.

During 2012, Citi recorded an additional reserve of $706 million (of

which $164 million was in the fourth quarter of 2012) relating to its whole

loan sales repurchase exposure. The change in estimate in fourth quarter

and full year 2012 primarily resulted from (i) a continued heightened

focus by the GSEs resulting in increasing estimates of repurchase claims,

and (ii) increasing trends in repurchase claims, repurchases/make-whole

payments, and default rates, especially for higher risk loans associated with

servicing sold to a third party in the fourth quarter of 2010. These increases

were partially offset by an improvement in expected recoveries from third-

party sellers. Citi’s claims appeal success rate remained stable during 2012,

with approximately half of repurchase claims successfully appealed and thus

resulting in no loss to Citi. Although the GSEs continued to exhibit elevated

loan documentation requests during 2012, which could ultimately lead to

higher claims and repurchases in future periods, Citi continues to believe

the activity in and change in estimate relating to its repurchase reserve will

remain volatile in the near term.

As referenced above, the repurchase reserve estimation process for

potential whole loan representation and warranty claims relies on various

assumptions that involve numerous estimates and judgments, including

with respect to certain future events, and thus entails inherent uncertainty.

Citi estimates that the range of reasonably possible loss for whole loan sale

representation and warranty claims in excess of amounts accrued as of

December 31, 2012 could be up to $0.6 billion. This estimate was derived

by modifying the key assumptions discussed above to reflect management’s

judgment regarding reasonably possible adverse changes to those

assumptions. Citi’s estimate of reasonably possible loss is based on currently

available information, significant judgment and numerous assumptions that

are subject to change.