Citibank 2012 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.186

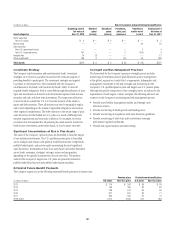

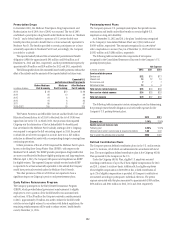

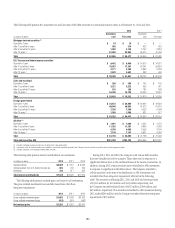

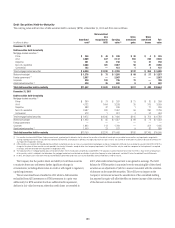

While Citi’s net total DTAs increased year-over-year, the time remaining

for utilization has shortened, given the passage of time, particularly with

respect to the foreign tax credit (FTC) component of the DTAs. Realization of

the DTAs will continue to be driven by Citi’s ability to generate U.S. taxable

earnings in the carry-forward periods, including through actions that

optimize Citi’s U.S. taxable earnings.

Although realization is not assured, Citi believes that the realization of

the recognized net DTAs of $55.3 billion at December 31, 2012 is more-

likely-than-not based upon expectations as to future taxable income in the

jurisdictions in which the DTAs arise and available tax planning strategies

(as defined in ASC 740, Income Taxes) that would be implemented, if

necessary, to prevent a carry-forward from expiring. In general, Citi would

need to generate approximately $112 billion of U.S. taxable income during

the respective carry-forward periods, substantially all of which must be

generated during the FTC carry-forward periods, to fully realize its U.S.

federal, state and local DTAs. Citi’s net DTAs will decline primarily as

additional domestic GAAP taxable income is generated.

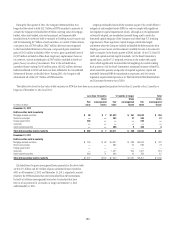

Citi has concluded that there are two components of positive evidence

that support the full realization of its DTAs. First, Citi forecasts sufficient

U.S. taxable income in the carry-forward periods, exclusive of ASC 740 tax

planning strategies, although Citi’s estimated future taxable income has

decreased due to the ongoing challenging economic environment, which will

continue to be subject to overall market and global economic conditions.

Citi’s forecasted taxable income incorporates geographic business forecasts

and taxable income adjustments to those forecasts (e.g., U.S. tax exempt

income, loan loss reserves deductible for U.S. tax reporting in subsequent

years), as well as actions intended to optimize its U.S. taxable earnings.

Second, Citi has sufficient tax planning strategies available to it under

ASC 740 that would be implemented, if necessary, to prevent a carry-forward

from expiring. These strategies include repatriating low taxed foreign source

earnings for which an assertion that the earnings have been indefinitely

reinvested has not been made, accelerating U.S. taxable income into, or

deferring U.S. tax deductions out of, the latter years of the carry-forward

period (e.g., selling appreciated intangible assets, electing straight-line

depreciation), accelerating deductible temporary differences outside the

U.S., and selling certain assets that produce tax-exempt income, while

purchasing assets that produce fully taxable income. In addition, the sale

or restructuring of certain businesses can produce significant U.S. taxable

income within the relevant carry-forward periods.

Based upon the foregoing discussion, Citi believes the U.S. federal and

New York state and city NOL carry-forward period of 20 years provides

enough time to fully utilize the DTAs pertaining to the existing NOL carry-

forwards and any NOL that would be created by the reversal of the future net

deductions that have not yet been taken on a tax return.

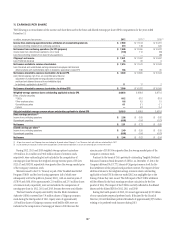

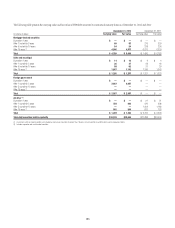

The U.S. FTC carry-forward period is 10 years and represents the most

time sensitive component of Citi’s DTAs. Utilization of FTCs in any year is

restricted to 35% of foreign source taxable income in that year. However,

overall domestic losses that Citi has incurred of approximately $63 billion as

of December 31, 2012 are allowed to be reclassified as foreign source income

to the extent of 50% of domestic source income produced in subsequent

years. Resulting foreign source income would cover the FTCs being carried

forward. Citi believes the foreign source taxable income limitation will not be

an impediment to the FTC carry-forward usage as long as Citi can generate

sufficient domestic taxable income within the 10-year carry-forward period.

Citi believes that it will generate sufficient U.S. taxable income within the

10-year carry-forward period referenced above to be able to fully utilize the

FTC carry-forward, in addition to any FTCs produced in such period.