Citibank 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

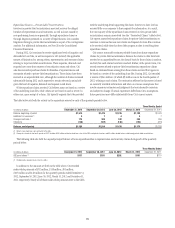

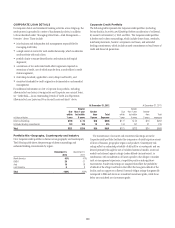

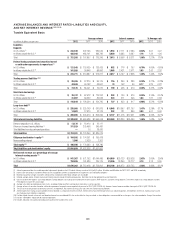

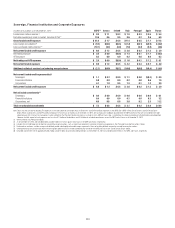

The table below summarizes VAR for Citi-wide trading portfolios at

year end and during 2012 and 2011, including yearly averages. Citi’s total

trading and credit portfolios VAR was $118 million at December 31, 2012 and

$183 million at December 31, 2011. Daily total trading and credit portfolios

VAR averaged $148 million in 2012 and ranged from $111 million to

$199 million. The change in total trading and credit portfolios VAR year-over-

year was driven by the fact that the relatively higher volatilities from 2008

and 2009 are no longer included in the three-year volatility time horizon

used for VAR, as well as reduced risk in the credit portfolios related to CVA and

Corporate Treasury.

In millions of dollars

Dec. 31,

2012

2012

Average

Dec. 31,

2011

2011

Average

Interest rate $116 $122 $147 $ 187

Foreign exchange 33 38 37 45

Equity 32 29 36 46

Commodity 11 15 16 22

Covariance adjustment (1) (76) (82) (89) (124)

Total trading VAR—

all market risk factors,

including general

and specific risk

(excluding credit portfolios) (2) $116 $122 $147 $ 176

Specific risk-only

component (3) $ 31 $ 24 $ 21 $ 25

Total trading VAR—general

market factors only

(excluding credit portfolios) (2) $ 85 $ 98 $126 $ 151

Incremental impact of

credit portfolios (4) $ 2 $ 26 $ 36 $ 13

Total trading and

credit portfolios VAR $118 $148 $183 $ 189

(1) Covariance adjustment (also known as diversification benefit) equals the difference between the

total VAR and the sum of the VARs tied to each individual risk type. The benefit reflects the fact that

the risks within each and across risk types are not perfectly correlated and, consequently, the total

VAR on a given day will be lower than the sum of the VARs relating to each individual risk type.

The determination of the primary drivers of changes to the covariance adjustment is made by an

examination of the impact of both model parameter and position changes.

(2) The total trading VAR includes trading positions from S&B, Citi Holdings and Corporate Treasury, but

excludes hedges to the loan portfolio, fair value option loans, and DVA/CVA, net of hedges. Available

for sale securities and accrual exposures are not included.

(3) The specific risk-only component represents the level of equity and fixed income issuer-specific risk

embedded in VAR.

(4) The credit portfolios are composed of mark-to-market positions associated with non-trading business

units including Corporate Treasury, the derivative counterparty CVA, net of hedges. Derivative own-

credit CVA and DVA are not included. It also includes hedges to the loan portfolio, fair value option

loans, and tail hedges that are not explicitly hedging the trading book.

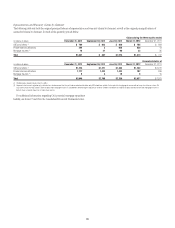

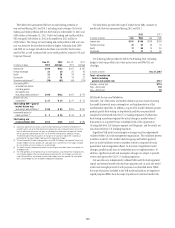

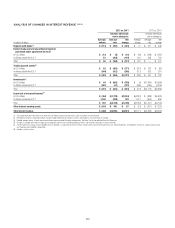

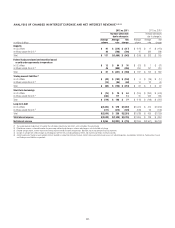

The table below provides the range of market factor VARs, inclusive of

specific risk that was experienced during 2012 and 2011.

2012 2011

In millions of dollars Low High Low High

Interest rate $ 101 $ 149 $ 138 $ 238

Foreign exchange 25 53 28 72

Equity 17 59 19 85

Commodity 9 21 14 36

The following table provides the VAR for S&B during 2012, excluding

hedges to the loan portfolio, fair value option loans and DVA/CVA, net

of hedges.

In millions of dollars Dec. 31, 2012

Total—all market risk

factors, including

general and specific risk $112

Average—during year $ 115

High—during year 145

Low—during year 92

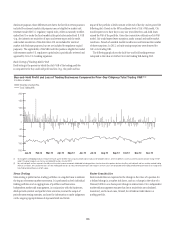

VAR Model Review and Validation

Generally, Citi’s VAR review and model validation process entails reviewing

the model framework, major assumptions, and implementation of the

mathematical algorithm. In addition, as part of the model validation process,

product specific back-testing on hypothetical portfolios are periodically

completed and reviewed with Citi’s U.S. banking regulators. Furthermore,

back-testing is performed against the actual change in market value of

transactions on a quarterly basis at multiple levels of the organization

(trading desk level, ICG business segment and Citigroup), and the results are

also shared with the U.S. banking regulators.

Significant VAR model and assumption changes must be independently

validated within Citi’s risk management organization. This validation process

includes a review by Citi’s model validation group and further approval

from its model validation review committee, which is composed of senior

quantitative risk management officers. In the event of significant model

changes, parallel model runs are undertaken prior to implementation. In

addition, significant model and assumption changes are subject to periodic

reviews and approval by Citi’s U.S. banking regulators.

Citi uses the same independently validated VAR model for both regulatory

capital and external market risk disclosure purposes and, as such, the model

review and oversight process for both purposes is as described above. While

the scope of positions included in the VAR model calculations for regulatory

capital purposes differs from the scope of positions for external market risk