Citibank 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

(overnight, one week, two weeks, one month, three months, one year),

and liquidity limits are set accordingly. To monitor the liquidity of a unit,

those stress tests and potential mismatches may be calculated with varying

frequencies, with several important tests performed daily.

Given the range of potential stresses, Citi maintains a series of contingency

funding plans on a consolidated basis as well as for individual entities. These

plans specify a wide range of readily available actions that are available in a

variety of adverse market conditions, or idiosyncratic disruptions.

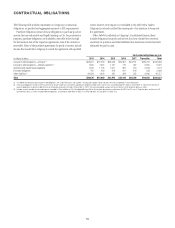

Credit Ratings

Citigroup’s funding and liquidity, including its funding capacity, its ability

to access the capital markets and other sources of funds, as well as the cost of

these funds, and its ability to maintain certain deposits, is partially dependent

on its credit ratings. The table below indicates the ratings for Citigroup,

Citibank, N.A. and Citigroup Global Markets Inc. (a broker-dealer subsidiary

of Citigroup) as of December 31, 2012.

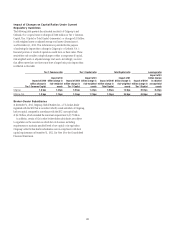

Citi’s Debt Ratings as of December 31, 2012

Citigroup Inc. Citibank, N.A.

Citigroup Global

Markets Inc.

Senior

debt

Commercial

paper

Long-

term

Short-

term

Long-

term

Fitch Ratings (Fitch) A F1 A F1 NR

Moody’s Investors Service (Moody’s) Baa2 P-2 A3 P-2 NR

Standard & Poor’s (S&P) A- A-2 A A-1 A

NR Not rated.

Recent Credit Rating Developments

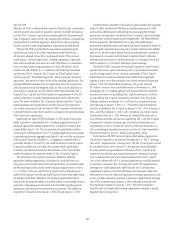

On December 5, 2012, S&P concluded its annual review of Citi with no

changes to the ratings and outlooks on Citigroup and its subsidiaries. On

October 16, 2012, S&P noted that Citi’s ratings remain unchanged despite

the change in senior management. At the same time, S&P maintained

a negative outlook on the ratings. These ratings continue to receive two

notches of government support uplift, in line with other large banks.

On October 16, 2012, Fitch noted the change in Citi’s senior management

as an unexpected, but credit-neutral, event that would likely have no

material impact on the credit profile of Citibank, N.A. or its ratings in the

near term. On October 10, 2012, Fitch affirmed the long- and short-term

ratings of “A/F1” and the Viability Rating of “a-” for Citigroup and Citibank,

N.A. and, as of that date, the rating outlook by Fitch was stable. This rating

action was taken in conjunction with Fitch’s periodic review of the 13 global

trading and universal banks.

On February 12, 2013, Moody’s changed the rating outlook on Citibank,

N.A. from negative to stable, and affirmed the long-term ratings. The

negative outlook was assigned on October 16, 2012, following changes in

Citi’s senior management. Moody’s maintained the negative outlook on the

long-term ratings of Citigroup Inc. On October 16, 2012, Moody’s affirmed

the long- and short-term ratings of Citigroup and Citibank, N.A.

Potential Impacts of Ratings Downgrades

Ratings downgrades by Moody’s, Fitch or S&P could negatively impact

Citigroup’s and/or Citibank, N.A.’s funding and liquidity due to reduced

funding capacity, including derivatives triggers, which could take the form of

cash obligations and collateral requirements.

The following information is provided for the purpose of analyzing the

potential funding and liquidity impact to Citigroup and Citibank, N.A. of

a hypothetical, simultaneous ratings downgrade across all three major

rating agencies. This analysis is subject to certain estimates, estimation

methodologies, and judgments and uncertainties, including without

limitation those relating to potential ratings limitations certain entities may

have with respect to permissible counterparties, as well as general subjective

counterparty behavior (e.g., certain corporate customers and trading

counterparties could re-evaluate their business relationships with Citi, and

limit the trading of certain contracts or market instruments with Citi).

Moreover, changes in counterparty behavior could impact Citi’s funding

and liquidity as well as the results of operations of certain of its businesses.

Accordingly, the actual impact to Citigroup or Citibank, N.A. is unpredictable

and may differ materially from the potential funding and liquidity impacts

described below.

For additional information on the impact of credit rating changes on Citi

and its applicable subsidiaries, see “Risk Factors—Liquidity Risks” below.