Citibank 2012 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.170

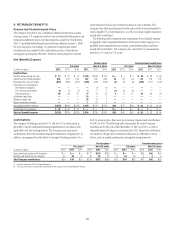

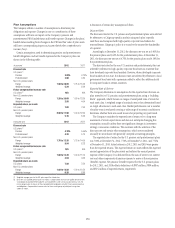

Profit Sharing Plan

In October 2010, the Committee approved awards under the 2010 Key

Employee Profit Sharing Plan (KEPSP), which may entitle participants to

profit-sharing payments based on an initial performance measurement

period of January 1, 2010 through December 31, 2012. Generally, if a

participant remains employed and all other conditions to vesting and

payment are satisfied, the participant will be entitled to an initial payment

in 2013, as well as a holdback payment in 2014 that may be reduced

based on performance during the subsequent holdback period (generally,

January 1, 2013 through December 31, 2013). If the vesting and performance

conditions are satisfied, a participant’s initial payment will equal two-thirds

of the product of the cumulative pretax income of Citicorp (as defined in the

KEPSP) for the initial performance period and the participant’s applicable

percentage. The initial payment will be paid after January 20, 2013 but no

later than March 15, 2013.

The participant’s holdback payment, if any, will equal the product

of (i) the lesser of cumulative pretax income of Citicorp for the initial

performance period and cumulative pretax income of Citicorp for the

initial performance period and the holdback period combined (generally,

January 1, 2010 through December 31, 2013), and (ii) the participant’s

applicable percentage, less the initial payment; provided that the holdback

payment may not be less than zero. The holdback payment, if any, will be

paid after January 20, 2014 but no later than March 15, 2014. The holdback

payment, if any, will be credited with notional interest during the holdback

period. It is intended that the initial payment and holdback payment will

be paid in cash; however, awards may be paid in Citigroup common stock

if required by regulatory authority. Regulators have required that U.K.

participants receive at least 50% of their initial payment and at least 50% of

their holdback payment, if any, in shares of Citigroup common stock that

will be subject to a six-month sales restriction. Clawbacks apply to the award.

Independent risk function employees were not eligible to participate in

the KEPSP, as the independent risk function participates in the determination

of whether payouts will be made under the KEPSP. Instead, key employees

in the independent risk function were eligible to receive deferred cash

retention awards, which vest two-thirds on January 20, 2013 and one-third

on January 20, 2014. The deferred cash awards incentivize key risk employees

to contribute to the Company’s long-term profitability by ensuring that

the Company’s risk profile is properly aligned with its long-term strategies,

objectives and risk appetite, thereby, aligning the employees’ interests with

those of Company shareholders.

On February 14, 2011, the Committee approved grants of awards under

the 2011 KEPSP to certain executive officers, and on May 17, 2011 to the

then-CEO Vikram Pandit. These awards have a performance period of

January 1, 2011 to December 31, 2012 and other terms of the awards are

similar to the 2010 KEPSP. The KEPSP award granted to Mr. Pandit was

cancelled upon his resignation in October 2012.

Expense recognized in 2012 in respect of the KEPSP was $246 million.

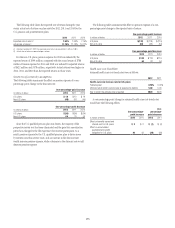

Performance Share Units

Certain executive officers were awarded a target number of performance

share units (PSUs) on February 19, 2013 for performance in 2012. PSUs will

be earned only to the extent that Citigroup attains specified performance

goals relating to Citigroup’s return on assets and relative total shareholder

return against peers over a three-year period covering 2013, 2014 and 2015.

The actual number of PSUs ultimately earned could vary from zero, if

performance goals are not met, to as much as 150% of target, if performance

goals are meaningfully exceeded. The value of each PSU is equal to the value

of one share of Citi common stock. The value of the award will fluctuate

with changes in Citigroup’s share price and the attainment of the specified

performance goals, until it is settled solely in cash after the end of the

performance period.

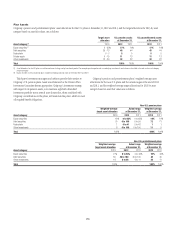

Variable Incentive Compensation

Citigroup has various incentive plans globally that are used to motivate and

reward performance primarily in the areas of sales, operational excellence

and customer satisfaction. These programs are reviewed on a periodic basis to

ensure that they are structured appropriately, aligned to shareholder interests

and adequately risk balanced. For the years ended December 31, 2012 and

2011, Citigroup expensed $670 million and $1.0 billion, respectively, for

these plans globally.