Citibank 2012 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

158

The ASU became effective for Citigroup on January 1, 2012. The guidance

has been applied prospectively to transactions or modifications of existing

transactions occurring on or after January 1, 2012. The ASU has not had a

material effect on the Company’s financial statements. A nominal amount

of the Company’s repurchase transactions that would previously have been

accounted for as sales is now accounted for as financing transactions.

Fair Value Measurement

In May 2011, the FASB issued ASU No. 2011-04, Fair Value Measurement

(Topic 820): Amendments to Achieve Common Fair Value Measurement

and Disclosure Requirements in U.S. GAAP and IFRS. The ASU created

a common definition of fair value for U.S. GAAP and IFRS and aligned the

measurement and disclosure requirements. It required significant additional

disclosures both of a qualitative and quantitative nature, particularly for

those instruments measured at fair value that are classified in Level 3 of

the fair value hierarchy. Additionally, the ASU provided guidance on when

it is appropriate to measure fair value on a portfolio basis and expanded

the prohibition on valuation adjustments where the size of the Company’s

position is a characteristic of the adjustment from Level 1 to all levels of the

fair value hierarchy.

The ASU became effective for Citigroup on January 1, 2012. As a result of

implementing the prohibition on valuation adjustments where the size of

the Company’s position is a characteristic, the Company released reserves of

approximately $125 million, increasing pretax income in the first quarter

of 2012.

Deferred Asset Acquisition Costs

In October 2010, the FASB issued ASU No. 2010-26, Financial Services –

Insurance (Topic 944): Accounting for Costs Associated with Acquiring

or Renewing Insurance Contracts. The ASU amended the guidance for

insurance entities that required deferral and subsequent amortization of

certain costs incurred during the acquisition of new or renewed insurance

contracts, commonly referred to as deferred acquisition costs (DAC). The

new guidance limited DAC to those costs directly related to the successful

acquisition of insurance contracts; all other acquisition-related costs must be

expensed as incurred. Under prior guidance, DAC consisted of those costs that

vary with, and primarily relate to, the acquisition of insurance contracts.

The ASU became effective for Citigroup on January 1, 2012 and was

adopted using the retrospective method. As a result of implementing the ASU,

DAC was reduced by approximately $165 million and a $58 million deferred

tax asset was recorded with an offset to opening retained earnings of $107

million (net of tax).

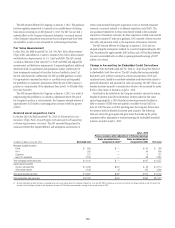

Change in Accounting for Embedded Credit Derivatives

In March 2010, the FASB issued ASU No. 2010-11, Scope Exception Related

to Embedded Credit Derivatives. The ASU clarifies that certain embedded

derivatives, such as those contained in certain securitizations, CDOs and

structured notes, should be considered embedded credit derivatives subject to

potential bifurcation and separate fair value accounting. The ASU allows any

beneficial interest issued by a securitization vehicle to be accounted for under

the fair value option at transition on July 1, 2010.

As set forth in the table below, the Company elected to account for certain

beneficial interests issued by securitization vehicles under the fair value

option beginning July 1, 2010. Beneficial interests previously classified as

held-to-maturity (HTM) were reclassified to available-for-sale (AFS) on

June 30, 2010 because, as of that reporting date, the Company did not have

the intent to hold the beneficial interests until maturity. The following

table also shows the gross gains and gross losses that make up the pretax

cumulative-effect adjustment to retained earnings for reclassified beneficial

interests, recorded on July 1, 2010:

July 1, 2010

Pretax cumulative effect adjustment to Retained earnings

In millions of dollars at June 30, 2010 Amortized cost

Gross unrealized losses

recognized in AOCI (1)

Gross unrealized gains

recognized in AOCI Fair value

Mortgage-backed securities

Prime $ 390 $ — $ 49 $ 439

Alt-A 550 — 54 604

Subprime 221 — 6 227

Non-U.S. residential 2,249 — 38 2,287

Total mortgage-backed securities $ 3,410 $ — $147 $ 3,557

Asset-backed securities

Auction rate securities $ 4,463 $401 $ 48 $ 4,110

Other asset-backed 4,189 19 164 4,334

Total asset-backed securities $ 8,652 $420 $212 $ 8,444

Total reclassified debt securities $12,062 $420 $359 $12,001

(1) All reclassified debt securities with gross unrealized losses were assessed for other-than-temporary-impairment as of June 30, 2010, including an assessment of whether the Company intends to sell the security. For

securities that the Company intends to sell, impairment charges of $176 million were recorded in earnings in the second quarter of 2010.