Citibank 2012 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

165

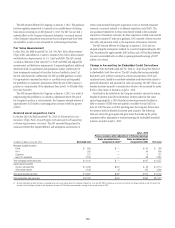

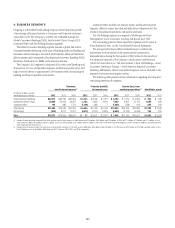

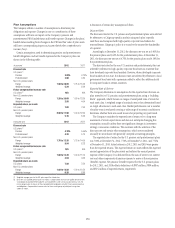

7. PRINCIPAL TRANSACTIONS

Principal transactions revenue consists of realized and unrealized gains and

losses from trading activities. Trading activities include revenues from fixed

income, equities, credit and commodities products, and foreign exchange

transactions. Not included in the table below is the impact of net interest

revenue related to trading activities, which is an integral part of trading

activities’ profitability. See Note 5 to the Consolidated Financial Statements

for information about net interest revenue related to trading activity.

Principal transactions include CVA and DVA.

The following table presents principal transactions revenue for the years

ended December 31:

In millions of dollars 2012 2011 2010

Global Consumer Banking $ 812 $ 716 $ 533

Institutional Clients Group 4,130 4,873 5,566

Corporate/Other (192) 45 (406)

Subtotal Citicorp $4,750 $ 5,634 $ 5,693

Local Consumer Lending $ (69) $ (102) $ (217)

Brokerage and Asset Management 5(11) (37)

Special Asset Pool 95 1,713 2,078

Subtotal Citi Holdings $ 31 $ 1,600 $ 1,824

Total Citigroup $4,781 $ 7,234 $ 7,517

Interest rate contracts (1) $ 2,301 $ 5,136 $ 3,231

Foreign exchange contracts (2) 2,403 2,309 1,852

Equity contracts (3) 158 3 995

Commodity and other contracts (4) 92 76 126

Credit derivatives (5) (173) (290) 1,313

Total $ 4,781 $ 7,234 $ 7,517

(1) Includes revenues from government securities and corporate debt, municipal securities, preferred

stock, mortgage securities and other debt instruments. Also includes spot and forward trading of

currencies and exchange-traded and over-the-counter (OTC) currency options, options on fixed

income securities, interest rate swaps, currency swaps, swap options, caps and floors, financial

futures, OTC options and forward contracts on fixed income securities.

(2) Includes revenues from foreign exchange spot, forward, option and swap contracts, as well as FX

translation gains and losses.

(3) Includes revenues from common, preferred and convertible preferred stock, convertible corporate

debt, equity-linked notes and exchange-traded and OTC equity options and warrants.

(4) Primarily includes revenues from crude oil, refined oil products, natural gas and other commodities trades.

(5) Includes revenues from structured credit products.

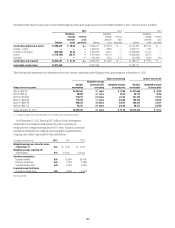

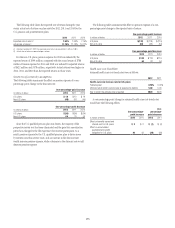

8. INCENTIVE PLANS

Overview

The Company makes restricted or deferred stock and/or deferred cash awards,

as well as stock payments, as part of its discretionary annual incentive award

programs involving a large segment of Citigroup’s employees worldwide.

Stock awards and grants of stock options may also be made at various

times during the year as sign-on awards to induce new hires to join the

Company, or to high-potential employees as long-term retention awards.

Long-term restricted stock awards and salary stock payments have also

been used to fulfill specific regulatory requirements to deliver annual salary

and incentive awards to certain officers and highly-compensated employees

in the form of equity.

Consistent with long-standing practice, a portion of annual compensation

for non-employee directors is also delivered in the form of equity awards.

In addition, equity awards are made occasionally as additional incentives

to retain and motivate officers or employees. Various other incentive award

programs are made on an annual or other regular basis to retain and

motivate certain employees who do not participate in Citigroup’s annual

discretionary incentive awards.

Recipients of Citigroup stock awards generally do not have any

stockholder rights until shares are delivered upon vesting or exercise, or

after the expiration of applicable restricted periods. Recipients of restricted

or deferred stock awards, however, may be entitled to receive dividends or

dividend-equivalent payments during the vesting period, unless the award

is subject to performance criteria. (Citigroup’s 2009 Stock Incentive Plan

currently does not permit the payment or accrual of dividend equivalents on

stock awards subject to performance criteria.) Additionally, because unvested

shares of restricted stock are considered issued and outstanding, recipients of

such awards are generally entitled to vote the shares in their award during

the vesting period. Once a stock award vests, the shares are freely transferable,

unless they are subject to a restriction on sale or transfer for a specified

period. Pursuant to a stock ownership commitment, certain executives have

committed to holding most of their vested shares indefinitely.

All equity awards granted since April 19, 2005, have been made pursuant

to stockholder-approved stock incentive plans that are administered by

the Personnel and Compensation Committee of the Citigroup Board of

Directors (the Committee), which is composed entirely of independent

non-employee directors.

At December 31, 2012, approximately 86.9 million shares of Citigroup

common stock were authorized and available for grant under Citigroup’s

2009 Stock Incentive Plan, the only plan from which equity awards are

currently granted.

The 2009 Stock Incentive Plan and predecessor plans permit the use of

treasury stock or newly issued shares in connection with awards granted

under the plans. Until recently, Citigroup’s practice has been to deliver shares

from treasury stock upon the exercise or vesting of equity awards. However,

newly issued shares were issued to settle certain awards in April 2010, and the

vesting of annual deferred stock awards in January 2011, 2012 and 2013. The

newly issued shares in April 2010 and January 2011 were specifically intended

to increase the Company’s equity capital. The practice of issuing new shares