Citibank 2012 Annual Report Download - page 272

Download and view the complete annual report

Please find page 272 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.250

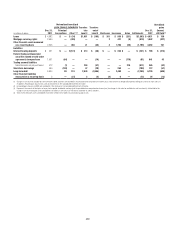

24. CONCENTRATIONS OF CREDIT RISK

Concentrations of credit risk exist when changes in economic, industry or

geographic factors similarly affect groups of counterparties whose aggregate

credit exposure is material in relation to Citigroup’s total credit exposure.

Although Citigroup’s portfolio of financial instruments is broadly diversified

along industry, product, and geographic lines, material transactions are

completed with other financial institutions, particularly in the securities

trading, derivatives and foreign exchange businesses.

In connection with the Company’s efforts to maintain a diversified

portfolio, the Company limits its exposure to any one geographic region,

country or individual creditor and monitors this exposure on a continuous

basis. At December 31, 2012, Citigroup’s most significant concentration of

credit risk was with the U.S. government and its agencies. The Company’s

exposure, which primarily results from trading assets and investments issued

by the U.S. government and its agencies, amounted to $190.7 billion and

$177.9 billion at December 31, 2012 and 2011, respectively. The Japanese

and Mexican governments and their agencies, which are rated investment

grade by both Moody’s and S&P, were the next largest exposures. The

Company’s exposure to Japan amounted to $38.7 billion and $33.2 billion at

December 31, 2012 and 2011, respectively, and was composed of investment

securities, loans and trading assets. The Company’s exposure to Mexico

amounted to $33.6 billion and $29.5 billion at December 31, 2012 and

2011, respectively, and was composed of investment securities, loans and

trading assets.

The Company’s exposure to states and municipalities amounted to

$35.8 billion and $39.5 billion at December 31, 2012 and 2011, respectively,

and was composed of trading assets, investment securities, derivatives and

lending activities.

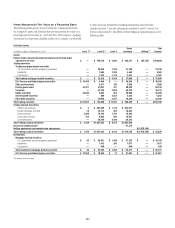

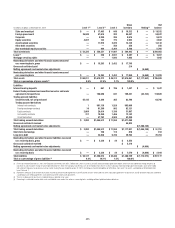

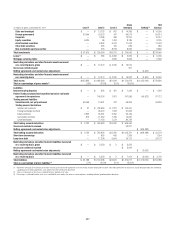

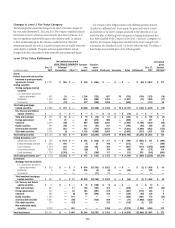

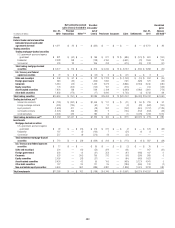

25. FAIR VALUE MEASUREMENT

ASC 820-10 (formerly SFAS 157) Fair Value Measurement, defines fair

value, establishes a consistent framework for measuring fair value and

requires disclosures about fair value measurements. Fair value is defined as

the price that would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants at the measurement

date. Among other things, the standard requires the Company to maximize

the use of observable inputs and minimize the use of unobservable inputs

when measuring fair value.

Under ASC 820-10, the probability of default of a counterparty is factored

into the valuation of derivative positions and includes the impact of

Citigroup’s own credit risk on derivatives and other liabilities measured at

fair value.

Fair Value Hierarchy

ASC 820-10 specifies a hierarchy of inputs based on whether the inputs are

observable or unobservable. Observable inputs reflect market data obtained

from independent sources, while unobservable inputs reflect the Company’s

market assumptions. These two types of inputs have created the following fair

value hierarchy:

• Level1:Quotedpricesforidentical instruments in active markets.

• Level2:Quotedpricesforsimilar instruments in active markets; quoted

prices for identical or similar instruments in markets that are not

active; and model-derived valuations in which all significant inputs and

significant value drivers are observable in active markets.

• Level3:Valuationsderivedfromvaluationtechniquesinwhichoneor

more significant inputs or significant value drivers are unobservable.

This hierarchy requires the use of observable market data when available.

The Company considers relevant and observable market prices in its

valuations where possible. The frequency of transactions, the size of the bid-

ask spread and the amount of adjustment necessary when comparing similar

transactions are all factors in determining the liquidity of markets and the

relevance of observed prices in those markets.

The Company’s policy with respect to transfers between levels of the fair

value hierarchy is to recognize transfers into and out of each level as of the

end of the reporting period.

Determination of Fair Value

For assets and liabilities carried at fair value, the Company measures such

value using the procedures set out below, irrespective of whether these assets

and liabilities are carried at fair value as a result of an election or whether

they are required to be carried at fair value.

When available, the Company generally uses quoted market prices to

determinefairvalueandclassifiessuchitemsasLevel1.Insomecases

where a market price is available, the Company will make use of acceptable

practical expedients (such as matrix pricing) to calculate fair value, in which

casetheitemsareclassifiedasLevel2.