Citibank 2012 Annual Report Download - page 305

Download and view the complete annual report

Please find page 305 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.283

in these actions generally seek rescission of their investments, recovery of

their investment losses, or other damages. Other purchasers of MBS and

CDOs sold or underwritten by Citigroup have threatened to file additional

suits, for some of which Citigroup has agreed to toll (extend) the statute

of limitations.

The filed actions generally are in the early stages of proceedings, and

certain of the actions or threatened actions have been resolved through

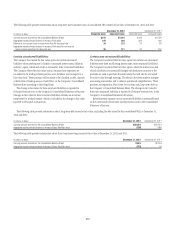

settlement or otherwise. The aggregate original purchase amount of the

purchases at issue in the filed suits is approximately $10.8 billion, and

the aggregate original purchase amount of the purchases covered by

tolling agreements with investors threatening litigation is approximately

$6.4 billion. The largest MBS investor claim against Citigroup and Related

Parties, as measured by the face value of purchases at issue, has been asserted

by the Federal Housing Finance Agency, as conservator for Fannie Mae

and Freddie Mac. This suit was filed on September 2, 2011, and has been

coordinated in the United States District Court for the Southern District of

New York with 15 other related suits brought by the same plaintiff against

various other financial institutions. Motions to dismiss in the coordinated

suits have been denied in large part, and discovery is proceeding. An

interlocutory appeal currently is pending in the United States Court of

Appeals for the Second Circuit on issues common to all of the coordinated

suits. Additional information concerning certain of these actions is publicly

available in court filings under the docket numbers 11 Civ. 6196 (S.D.N.Y.)

(Cote, J.), 12 Civ. 4000 (S.D.N.Y.) (Swain, J.), 12 Civ. 00790 (M.D. Al.)

(Watkins, C.J.), 12 Civ. 4354 (C.D. Cal.) (Pfaezler, J.), 650212/12 (N.Y.

Sup. Ct.) (Oing, J.), 652607/2012 (N.Y. Sup. Ct.) (Schweitzer, J.), and

CGC-10-501610 (Cal. Super. Ct.) (Kramer, J.).

In addition to these actions, various parties to MBS securitizations and

other interested parties have asserted that certain Citigroup affiliates breached

representations and warranties made in connection with mortgage loans sold

into securitization trusts (private-label securitizations). In connection with

such assertions, Citi has received significant levels of inquiries and demands

for loan files, as well as requests to toll (extend) the applicable statutes of

limitation for, among others, representation and warranty claims relating to

its private-label securitizations. These inquiries, demands and requests have

come from trustees of securitization trusts and others.

Among these requests, in December 2011, Citigroup received a letter from the

law firm Gibbs & Bruns LLP, which purports to represent a group of investment

advisers and holders of MBS issued or underwritten by Citigroup affiliates.

Through that letter and subsequent discussions, Gibbs & Bruns LLP has asserted

that its clients collectively hold certificates in 87 MBS trusts purportedly issued

and/or underwritten by Citigroup affiliates, and that Citigroup affiliates have

repurchase obligations for certain mortgages in these trusts.

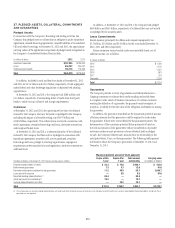

Citi has also received repurchase claims for breaches of representations

and warranties related to private-label securitizations. These claims have

been received at an unpredictable rate, although the number of claims

increased substantially during 2012 and is expected to remain elevated,

particularly given the level of inquiries, demands and requests noted

above. Upon receipt of a claim, Citi typically requests that it be provided

with the underlying detail supporting the claim; however, to date, Citi has

received little or no response to these requests for information. As a result,

the vast majority of the repurchase claims received on Citi’s private-label

securitizations remain unresolved. Citi expects unresolved repurchase claims

for private-label securitizations to continue to increase because new claims

and requests for loan files continue to be received, while there has been little

progress to date in resolving these repurchase claims.

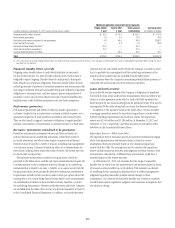

Independent Foreclosure Review: On January 7, 2013, Citi, along with

other major mortgage servicers operating under consent orders dated April

13, 2011 with the Federal Reserve Board and the Office of the Comptroller

of the Currency (OCC), entered into a settlement agreement with those

regulators to modify the requirements of the independent foreclosure

review mandated by the consent orders. Under the settlement, Citi agreed

to pay approximately $305 million into a qualified settlement fund and to

offer $487 million of mortgage assistance to borrowers in accordance with

agreed criteria. Upon completion of Citi’s payment and mortgage assistance

obligations under the agreement, the Federal Reserve Board and the OCC

have agreed to deem the requirements of the independent foreclosure review

under the consent orders to be satisfied.

Abu Dhabi Investment Authority

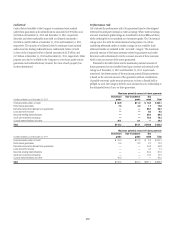

In 2010, Abu Dhabi Investment Authority (ADIA) commenced an arbitration

against Citigroup and Related Parties alleging statutory and common

law claims in connection with its $7.5 billion investment in Citigroup in

December 2007. ADIA sought rescission of the investment agreement or, in

the alternative, more than $4 billion in damages. Following a hearing in

May 2011 and post-hearing proceedings, on October 14, 2011, the arbitration

panel issued a final award and statement of reasons finding in favor of

Citigroup on all claims asserted by ADIA. On January 11, 2012, ADIA filed a

petition to vacate the award in New York state court. On January 13, 2012,

Citigroup removed the petition to the United States District Court for the

Southern District of New York. On April 3, 2012, Citigroup filed an opposition

to ADIA’s petition and a cross-petition to confirm the award. Both ADIA’s

petition and Citigroup’s cross-petition are pending. Additional information

concerning this matter is publicly available in court filings under the docket

number 12 Civ. 283 (S.D.N.Y.) (Daniels, J.).

Alternative Investment Fund–Related Litigation and Other

Matters

The SEC is investigating the management and marketing of the ASTA/

MAT and Falcon funds, alternative investment funds managed and

marketed by certain Citigroup affiliates that suffered substantial losses

during the credit crisis. In addition to the SEC inquiry, on June 11, 2012,

the New York Attorney General served a subpoena on a Citigroup affiliate

seeking documents and information concerning certain of these funds,

and on August 1, 2012, the Massachusetts Attorney General served a Civil

Investigative Demand on a Citigroup affiliate seeking similar documents and

information. Citigroup is cooperating fully with these inquiries.

In October 2012, Citigroup Alternative Investments LLC (CAI) was

named as a defendant in a putative class action lawsuit filed on behalf of

investors in CSO Ltd., CSO US Ltd., and Corporate Special Opportunities Ltd.,

whose investments were managed indirectly by a CAI affiliate. The plaintiff