Citibank 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

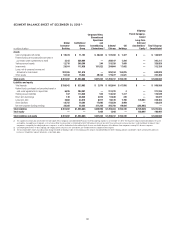

BALANCE SHEET REVIEW

The following sets forth a general discussion of the changes in certain of the more significant line items of Citi’s Consolidated Balance Sheet. For additional

information on Citigroup’s aggregate liquidity resources, including its deposits, short-term and long-term debt and secured financing transactions, see “Capital

Resources and Liquidity—Funding and Liquidity” below.

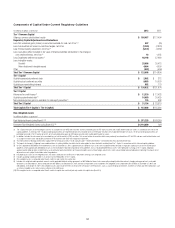

In billions of dollars

December 31,

2012

September 30,

2012

December 31,

2011

EOP

4Q12 vs. 3Q12

Increase

(decrease)

%

Change

EOP

4Q12 vs.

4Q11 Increase

(decrease)

%

Change

Assets

Cash and deposits with banks $ 139 $ 204 $ 184 $(65) (32)% $ (45)(24)%

Federal funds sold and securities borrowed

or purchased under agreements to resell 261 278 276 (17) (6) (15)(5)

Trading account assets 321 315 292 6 2 29 10

Investments 312 295 293 17 6 19 6

Loans, net of unearned income and

allowance for loan losses 630 633 617 (3) — 13 2

Other assets 202 206 212 (4) (2) (10)(5)

Total assets $ 1,865 $1,931 $1,874 $(66) (3)% $ (9)—%

Liabilities

Deposits $ 931 $ 945 $ 866 $(14) (1)% $ 65 8%

Federal funds purchased and securities loaned or sold

under agreements to repurchase 211 224 198 (13) (6) 13 7

Trading account liabilities 116 130 126 (14) (11) (10)(8)

Short-term borrowings 52 49 54 3 6 (2)(4)

Long-term debt 239 272 324 (33) (12) (85)(26)

Other liabilities 125 122 126 3 2 (1)(1)

Total liabilities $1,674 $1,742 $1,694 $(68) (4)% $ (20)(1)%

Total equity 191 189 180 2 1 11 6

Total liabilities and equity $1,865 $1,931 $1,874 $(66) (3)% $ (9)—%

ASSETS

Cash and Deposits with Banks

Cash and deposits with banks is composed of both Cash and due from

banks and Deposits with banks. Cash and due from banks includes

(i) cash on hand at Citi’s domestic and overseas offices, and (ii) non-

interest-bearing balances due from banks, including non-interest-bearing

demand deposit accounts with correspondent banks, central banks (such

as the Federal Reserve Bank), and other banks or depository institutions for

normal operating purposes. Deposits with banks includes interest-bearing

balances, demand deposits and time deposits held in or due from banks

(including correspondent banks, central banks and other banks or depository

institutions) maintained for, among other things, normal operating and

regulatory reserve requirement purposes.

During 2012, cash and deposits with banks decreased $45 billion, or 24%,

driven by a $53 billion, or 34%, decrease in deposits with banks offset by an

$8 billion, or 27%, increase in cash and due from banks. The purposeful

reduction in cash and deposits with banks was in keeping with Citi’s

continued strategy to deleverage the balance sheet and deploy excess cash

into investments. The overall decline resulted from cash used to repay long-

term debt maturities (net of modest issuances) and to reduce other long-term

debt and short-term borrowings (including the redemption of trust preferred

securities and debt repurchases), the funding of asset growth in the Citicorp

businesses (including continued lending to both Consumer and Corporate

clients), as well as the reinvestment of cash into higher yielding available-

for-sale (AFS) securities. These uses of cash were partially offset by the cash

generated by the $65 billion increase in customer deposits over the course of

2012, as well as cash generated from asset sales, primarily in Citi Holdings

(including the $1.89 billion paid to Citi by Morgan Stanley for the 14%

interest in MSSB, as described under “Citi Holdings—Brokerage and Asset

Management” and in Note 15 to the Consolidated Financial Statements),

and from Citi’s operations.

The $65 billion, or 32%, decline in cash and deposits with banks during

the fourth quarter of 2012 was similarly driven by cash used to repay short-

term borrowings and long-term debt obligations and the redeployment

of excess cash into investments. The reduction during the fourth quarter

also reflected a net decline in client deposits that was expected during the

quarter and reflected the run-off of episodic deposits that came in at the end

of the third quarter and the outflows of deposits related to the Transaction

Account Guarantee (TAG) program, partially offset by deposit growth in the

normal course of business. These deposit changes are discussed further under

“Capital Resources and Liquidity—Funding and Liquidity” below.