Citibank 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164

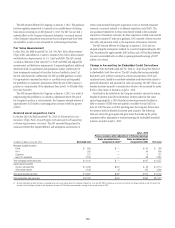

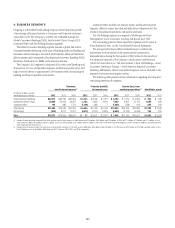

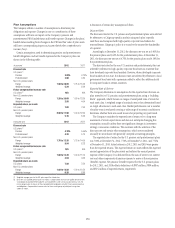

5. INTEREST REVENUE AND EXPENSE

For the years ended December 31, 2012, 2011 and 2010, respectively, Interest

revenue and Interest expense consisted of the following:

In millions of dollars 2012 2011 2010

Interest revenue

Loan interest, including fees $48,544 $50,281 $55,056

Deposits with banks 1,269 1,750 1,252

Federal funds sold and securities borrowed or

purchased under agreements to resell 3,418 3,631 3,156

Investments, including dividends 7,525 8,320 11,004

Trading account assets (1) 6,802 8,186 8,079

Other interest 580 513 735

Total interest revenue $68,138 $72,681 $79,282

Interest expense

Deposits (2) $ 7,613 $ 8,556 $ 8,371

Federal funds purchased and securities loaned or

sold under agreements to repurchase 2,817 3,197 2,808

Trading account liabilities (1) 190 408 379

Short-term borrowings 727 650 917

Long-term debt 9,188 11,423 12,621

Total interest expense $20,535 $24,234 $25,096

Net interest revenue $47,603 $48,447 $54,186

Provision for loan losses 10,848 11,773 25,194

Net interest revenue after

provision for loan losses $36,755 $36,674 $28,992

(1) Interest expense on Trading account liabilities of ICG is reported as a reduction of interest revenue

from Trading account assets.

(2) Includes deposit insurance fees and charges of $1,262 million, $1,332 million and $981 million for

the years ended December 31, 2012, December 31, 2011 and December 31, 2010, respectively.

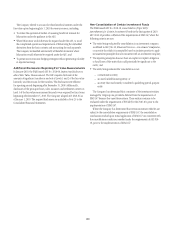

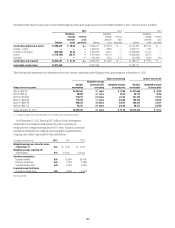

6. COMMISSIONS AND FEES

The table below sets forth Citigroup’s Commissions and fees revenue

for the years ended December 31, 2012, 2011 and 2010, respectively. The

primary components of Commissions and fees revenue for the year ended

December 31, 2012 were credit card and bank card fees, investment banking

fees and trading-related fees.

Credit card and bank card fees are primarily composed of interchange

revenue and certain card fees, including annual fees, reduced by reward

program costs. Interchange revenue and fees are recognized when earned,

except for annual card fees, which are deferred and amortized on a straight-

line basis over a 12-month period. Reward costs are recognized when points

are earned by the customers.

Investment banking fees are substantially composed of underwriting and

advisory revenues. Investment banking fees are recognized when Citigroup’s

performance under the terms of the contractual arrangements is completed,

which is typically at the closing of the transaction. Underwriting revenue

is recorded in Commissions and fees, net of both reimbursable and non-

reimbursable expenses, consistent with the AICPA Audit and Accounting Guide

for Brokers and Dealers in Securities (codified in ASC 940-605-05-1). Expenses

associated with advisory transactions are recorded in Other operating expenses,

net of client reimbursements. Out-of-pocket expenses are deferred and

recognized at the time the related revenue is recognized. In general, expenses

incurred related to investment banking transactions that fail to close (are not

consummated) are recorded gross in Other operating expenses.

Trading-related fees primarily include commissions and fees from the

following: executing transactions for clients on exchanges and over-the-

counter markets; sale of mutual funds, insurance and other annuity

products; and assisting clients in clearing transactions, providing brokerage

services and other such activities. Trading-related fees are recognized

when earned in Commissions and fees. Gains or losses, if any, on these

transactions are included in Principal transactions (see Note 7 to the

Consolidated Financial Statements).

The following table presents Commissions and fees revenue for the years

ended December 31:

In millions of dollars 2012 2011 2010

Credit cards and bank cards $ 3,526 $ 3,603 $ 3,774

Investment banking 2,991 2,451 2,977

Trading-related 2,296 2,587 2,368

Transaction services 1,441 1,520 1,454

Other Consumer (1) 878 931 1,156

Checking-related 907 926 1,023

Primerica —— 91

Loan servicing 313 251 353

Corporate finance (2) 516 519 439

Other 58 62 23

Total commissions and fees $12,926 $12,850 $13,658

(1) Primarily consists of fees for investment fund administration and management, third-party collections,

commercial demand deposit accounts and certain credit card services.

(2) Consists primarily of fees earned from structuring and underwriting loan syndications.