Citibank 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

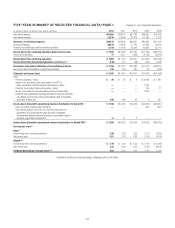

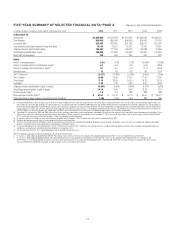

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA—PAGE 2 Citigroup Inc. and Consolidated Subsidiaries

In millions of dollars, except per-share amounts, ratios and direct staff 2012 2011 2010 2009 2008

At December 31:

Total assets $1,864,660 $1,873,878 $1,913,902 $1,856,646 $1,938,470

Total deposits 930,560 865,936 844,968 835,903 774,185

Long-term debt 239,463 323,505 381,183 364,019 359,593

Trust preferred securities (included in long-term debt) 10,110 16,057 18,131 19,345 24,060

Citigroup common stockholders’ equity 186,487 177,494 163,156 152,388 70,966

Total Citigroup stockholders’ equity 189,049 177,806 163,468 152,700 141,630

Direct staff (in thousands) 259 266 260 265 323

Ratios

Return on average assets 0.4% 0.6% 0.5% (0.08)% (1.28)%

Return on average common stockholders’ equity (5) 4.1 6.3 6.8 (9.4) (28.8)

Return on average total stockholders’ equity (5) 4.1 6.3 6.8 (1.1) (20.9)

Efficiency ratio 72 65 55 60 134

Tier 1 Common (6) 12.67% 11.80% 10.75% 9.60% 2.30%

Tier 1 Capital 14.06 13.55 12.91 11.67 11.92

Total Capital 17.26 16.99 16.59 15.25 15.70

Leverage (7) 7.48 7.19 6.60 6.87 6.08

Citigroup common stockholders’ equity to assets 10.00% 9.47% 8.52% 8.21% 3.66%

Total Citigroup stockholders’ equity to assets 10.14 9.49 8.54 8.22 7.31

Dividend payout ratio (4) 1.6 0.8 NM NM NM

Book value per common share (3) $ 61.57 $ 60.70 $ 56.15 $ 53.50 $ 130.21

Ratio of earnings to fixed charges and preferred stock dividends 1.38x 1.59x 1.51x NM NM

(1) Discontinued operations in 2012 includes a carve-out of Citi’s liquid strategies business within Citi Capital Advisors, the sale of which is expected to close in the first half of 2013. Discontinued operations in 2012 and

2011 reflect the sale of the Egg Banking PLC credit card business. Discontinued operations for 2008 to 2009 reflect the sale of Nikko Cordial Securities to Sumitomo Mitsui Banking Corporation, the sale of Citigroup’s

German retail banking operations to Crédit Mutuel, and the sale of CitiCapital’s equipment finance unit to General Electric. Discontinued operations for 2008 to 2010 also include the operations and associated gain on

sale of Citigroup’s Travelers Life & Annuity, substantially all of Citigroup’s international insurance business, and Citigroup’s Argentine pension business sold to MetLife Inc. Discontinued operations for the second half of

2010 also reflect the sale of The Student Loan Corporation. See Note 3 to the Consolidated Financial Statements for additional information on Citi’s discontinued operations.

(2) The diluted EPS calculation for 2009 and 2008 utilizes basic shares and income allocated to unrestricted common stockholders (Basic) due to the negative income allocated to unrestricted common stockholders. Using

diluted shares and income allocated to unrestricted common stockholders (Diluted) would result in anti-dilution. As of December 31, 2012, primarily all stock options were out of the money and did not impact diluted

EPS. The year-end share price was $39.56. See Note 11 to the Consolidated Financial Statements.

(3) All per share amounts and Citigroup shares outstanding for all periods reflect Citigroup’s 1-for-10 reverse stock split, which was effective May 6, 2011.

(4) Dividends declared per common share as a percentage of net income per diluted share.

(5) The return on average common stockholders’ equity is calculated using net income less preferred stock dividends divided by average common stockholders’ equity. The return on average total Citigroup stockholders’

equity is calculated using net income divided by average Citigroup stockholders’ equity.

(6) As currently defined by the U.S. banking regulators, the Tier 1 Common ratio represents Tier 1 Capital less non-common elements, including qualifying perpetual preferred stock, qualifying noncontrolling interests in

subsidiaries and qualifying trust preferred securities divided by risk-weighted assets.

(7) The leverage ratio represents Tier 1 Capital divided by quarterly adjusted average total assets.

Note: The following accounting changes were adopted by Citi during the respective years:

• On January 1, 2010, Citigroup adopted SFAS 166/167. Prior periods have not been restated as the standards were adopted prospectively. See Note 1 to the Consolidated Financial Statements.

• On January 1, 2009, Citigroup adopted SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements (now ASC 810-10-45-15, Consolidation: Noncontrolling Interest in a Subsidiary), and

FSP EITF 03-6-1, “Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities” (now ASC 260-10-45-59A, Earnings Per Share: Participating Securities and the

Two-Class Method). All prior periods have been restated to conform to the current period’s presentation.