Citibank 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

Basel III NPR

The Basel III NPR, as with the Basel Committee Basel III rules, is intended to

raise the quantity and quality of regulatory capital by formally introducing

not only Tier 1 Common Capital and mandating that it be the predominant

form of regulatory capital, but by also narrowing the definition of qualifying

capital elements at all three regulatory capital tiers as well as imposing

broader and more constraining regulatory adjustments and deductions.

The Basel III NPR would modify the regulations implementing the

capital floor provision of the Collins Amendment of the Dodd-Frank

Act that were adopted in June 2011 (as discussed above). This provision

would require “Advanced Approaches” banking organizations (generally

those with consolidated total assets of at least $250 billion or consolidated

total on-balance sheet foreign exposures of at least $10 billion), which

includes Citi and Citibank, N.A., to calculate each of the three risk-based

capital ratios (Tier 1 Common, Tier 1 Capital and Total Capital) under

both the proposed “Standardized Approach” and the proposed “Advanced

Approaches” and report the lower of each of the resulting capital ratios. The

principal differences between these two approaches are in the composition

and calculation of total risk-weighted assets, as well as in the definition of

Total Capital. Compliance with the Basel III NPR stated minimum Tier 1

Common, Tier 1 Capital, and Total Capital ratio requirements of 4.5%, 6%,

and 8%, respectively, would be assessed based upon each of the reported

ratios. The newly established Tier 1 Common and increased Tier 1 Capital

stated minimum ratio requirements have been proposed to be phased in

over a three-year period. Under the Basel III NPR, consistent with the Basel

Committee Basel III rules, there would be no change in the stated minimum

Total Capital ratio requirement.

Additionally, the Basel III NPR establishes a 2.5% Capital Conservation

Buffer applicable to substantially all U.S. banking organizations and, for

Advanced Approaches banking organizations, a potential Countercyclical

Capital Buffer of up to 2.5%. The Countercyclical Capital Buffer would be

invoked upon a determination by the U.S. banking agencies that the market

is experiencing excessive aggregate credit growth, and would be an extension

of the Capital Conservation Buffer (i.e., an aggregate combined buffer of

potentially between 2.5% and 5%). Citi would be subject to both the Capital

Conservation Buffer and, if invoked, the Countercyclical Capital Buffer.

Consistent with the Basel Committee Basel III rules, both of these buffers

would be required to be comprised entirely of Tier 1 Common Capital.

The calculation of the Capital Conservation Buffer for Advanced

Approaches banking organizations, including Citi, would be based on a

comparison of each of the three risk-based capital ratios as calculated under

the Advanced Approaches and the stated minimum required ratios for each

(i.e., 4.5% Tier 1 Common and 6% Tier 1 Capital, both as fully phased-in,

and 8% Total Capital), with the reportable Capital Conservation Buffer being

the smallest of the three differences. If a banking organization failed to

comply with the proposed buffers, it would be subject to increasingly onerous

restrictions (depending upon the extent of the shortfall) regarding capital

distributions and discretionary executive bonus payments. The buffers are

proposed to be phased in from January 1, 2016 through January 1, 2019.

Unlike the Basel Committee’s final rules for global systemically important

banks (G-SIBs), the Basel III NPR does not include measures for G-SIBs,

such as those addressing the methodology for assessing global systemic

importance, the imposition of additional Tier 1 Common capital surcharges,

and the phase-in period regarding these requirements. The Federal Reserve

Board is required by the Dodd-Frank Act to issue rules establishing a

quantitative risk-based capital surcharge for financial institutions deemed to

be systemically important and posing risk to market-wide financial stability,

such as Citi, and the Federal Reserve Board has indicated that it intends for

these rules to be consistent with the Basel Committee’s final G-SIB rules.

Although these rules have not yet been proposed, Citi anticipates that it will

likely be subject to a 2.5% initial additional capital surcharge.

The Basel III NPR, consistent with the Basel Committee’s Basel III rules,

provides that certain capital instruments, such as trust preferred securities,

would no longer qualify as non-common components of Tier 1 Capital.

Furthermore, the Collins Amendment of the Dodd-Frank Act generally

requires a phase-out of these securities over a three-year period beginning

January 1, 2013 for bank holding companies, such as Citi, that had

$15 billion or more in total consolidated assets as of December 31, 2009.

Accordingly, the U.S. banking agencies have proposed that trust preferred

securities and other non-qualifying Tier 1 Capital instruments, as well as

non-qualifying Tier 2 Capital instruments, be phased out by these bank

holding companies, including Citi, at a 25% per year incremental phase-

out beginning on January 1, 2013 (i.e., 75% of these capital instruments

would be includable in Tier 1 Capital on January 1, 2013, 50% on January 1,

2014, and 25% on January 1, 2015), with a full phase-out of these capital

instruments by January 1, 2016. However, the timing of the phase-out of

trust preferred securities and other non-qualifying Tier 1 and Tier 2 Capital

instruments is currently uncertain, given the delay in finalization and

implementation of the U.S. Basel III rules. For additional information on

Citi’s outstanding trust preferred securities, see Note 19 to the Consolidated

Financial Statements. See also “Funding and Liquidity” below.

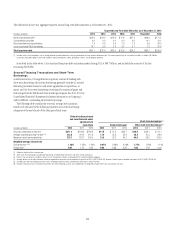

Under the Basel III NPR, Advanced Approaches banking organizations

would also be required to calculate two leverage ratios, a “Tier 1” Leverage

ratio and a “Supplementary” Leverage ratio. The Tier 1 Leverage ratio would

be a modified version of the current U.S. leverage ratio and would reflect

the more restrictive proposed Basel III definition of Tier 1 Capital in the

numerator, but with the same current denominator consisting of average

total on-balance sheet assets less amounts deducted from Tier 1 Capital.

Citi, as with substantially all U.S. banking organizations, would be required

to maintain a minimum Tier 1 Leverage ratio of 4%. The Supplementary

Leverage ratio would significantly differ from the Tier 1 Leverage ratio

regarding the inclusion of certain off-balance sheet exposures within the

denominator of the ratio. Advanced Approaches banking organizations, such

as Citi, would be required to maintain a minimum Supplementary Leverage

ratio of 3%, commencing on January 1, 2018, although it was proposed

that reporting commence on January 1, 2015. The Basel Committee’s

Basel III rules only require that banking organizations calculate a similar

Supplementary Leverage ratio.