Citibank 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.89

MARKET RISK

Market risk encompasses liquidity risk and price risk, both of which arise in

the normal course of business of a global financial intermediary. Liquidity

risk is the risk that an entity may be unable to meet a financial commitment

to a customer, creditor, or investor when due. See “Capital Resources and

Liquidity” for further discussion.

Price risk is the earnings risk from changes in interest rates, foreign exchange

rates, and equity and commodity prices, and in their implied volatilities. Price

risk arises in non-trading portfolios, as well as in trading portfolios.

Market risks are measured in accordance with established standards to

ensure consistency across businesses and the ability to aggregate risk. Each

business is required to establish, with approval from independent market

risk management, a market risk limit framework for identified risk factors

that clearly defines approved risk profiles and is within the parameters of

Citigroup’s overall risk appetite. In all cases, the businesses are ultimately

responsible for the market risks they take and for remaining within their

defined limits.

Non-Trading Portfolios Interest Rate Risk

One of Citigroup’s primary business functions is providing financial products

that meet the needs of its customers. Loans and deposits are tailored to the

customers’ requirements with regard to tenor, index (if applicable), and rate

type. Net interest revenue (NIR) is the difference between the yield earned on

the non-trading portfolio assets (including customer loans) and the rate paid

on the liabilities (including customer deposits or company borrowings). NIR

is affected by changes in the level of interest rates. For example:

At any given time, there may be an unequal amount of assets and •

liabilities that are subject to market rates due to maturation or repricing.

Whenever the amount of liabilities subject to repricing exceeds the

amount of assets subject to repricing, a company is considered “liability

sensitive.” In this case, a company’s NIR will deteriorate in a rising

rate environment.

The assets and liabilities of a company may reprice at different speeds or •

mature at different times, subjecting both “liability-sensitive” and “asset-

sensitive” companies to NIR sensitivity from changing interest rates. For

example, a company may have a large amount of loans that are subject

to repricing in the current period, but the majority of deposits are not

scheduled for repricing until the following period. That company would

suffer from NIR deterioration if interest rates were to fall.

NIR in the current period is the result of customer transactions and

the related contractual rates originated in prior periods as well as new

transactions in the current period; those prior-period transactions will be

impacted by changes in rates on floating-rate assets and liabilities in the

current period.

Due to the long-term nature of portfolios, NIR will vary from quarter to

quarter even assuming no change in the shape or level of the yield curve

as assets and liabilities reprice. These repricings are a function of implied

forward interest rates, which represent the overall market’s estimate of future

interest rates and incorporate possible changes in the Federal Funds rate as

well as the shape of the yield curve.

Interest Rate Risk Governance

The risks in Citigroup’s non-traded portfolios are estimated using a common

set of standards that define, measure, limit and report the market risk. Each

business is required to establish, with approval from independent market risk

management, a market risk limit framework that clearly defines approved

risk profiles and is within the parameters of Citigroup’s overall risk appetite.

In all cases, the businesses are ultimately responsible for the market risks

they take and for remaining within their defined limits. These limits are

monitored by independent market risk, country and business Asset and

Liability Committees (ALCOs) and the Global Finance and Asset and Liability

Committee (FinALCO).

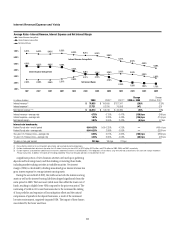

Interest Rate Risk Measurement

Citigroup’s principal measure of risk to NIR is interest rate exposure (IRE).

IRE measures the change in expected NIR in each currency resulting solely

from unanticipated changes in forward interest rates. Factors such as

changes in volumes, spreads, margins and the impact of prior-period pricing

decisions are not captured by IRE. IRE assumes that businesses make no

additional changes in pricing or balances in response to the unanticipated

rate changes.

IRE tests the impact on NIR resulting from unanticipated changes in

forward interest rates. For example, if the current 90-day LIBOR rate is 3%

and the one-year-forward rate is 5% (i.e., the estimated 90-day LIBOR rate

in one year), the +100 bps IRE scenario measures the impact on the

company’s NIR of a 100 bps instantaneous change in the 90-day LIBOR

to 6% in one year.

The impact of changing prepayment rates on loan portfolios is

incorporated into the results. For example, in the declining interest rate

scenarios, it is assumed that mortgage portfolios prepay faster and income is

reduced. In addition, in a rising interest rate scenario, portions of the deposit

portfolio are assumed to experience rate increases that may be less than the

change in market interest rates.

Mitigation and Hedging of Risk

Financial institutions’ financial performance is subject to some degree of risk

due to changes in interest rates. In order to manage these risks effectively,

Citigroup may modify pricing on new customer loans and deposits, enter into

transactions with other institutions or enter into off-balance-sheet derivative

transactions that have the opposite risk exposures. Therefore, Citigroup

regularly assesses the viability of strategies to reduce unacceptable risks to

earnings and implements such strategies when it believes those actions are

prudent. As information becomes available, Citigroup formulates strategies

aimed at protecting earnings from the potential negative effects of changes in

interest rates.

Citigroup employs additional measurements, including stress testing the

impact of non-linear interest rate movements on the value of the balance

sheet; the analysis of portfolio duration and volatility, particularly as they

relate to mortgage loans and mortgage-backed securities; and the potential

impact of the change in the spread between different market indices.