Citibank 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

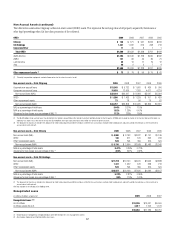

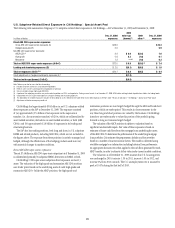

Second Lien Mortgages: December 31, 2009

For second lien mortgages, approximately 49% of the loans were originated

through third-party channels. As these mortgages have demonstrated

a higher incidence of delinquencies, Citi no longer originates second

mortgages through third-party channels.

CHANNELS

($ in billions)

SECOND LIEN

MORTGAGES

CHANNEL

% TOTAL

90+DPD% *FICO < 620 *LTV > 100%

RETAIL $25.2 51.0% 1.7% $3.9 $6.9

BROKER $12.4 25.0% 3.9% $2.2 $6.8

CORRESPONDENT $11.8 24.0% 5.0% $2.9 $7.0

* Refreshed FICO and LTV.

Note: Excludes Canada and Puerto Rico and loans subject to LTSCs.

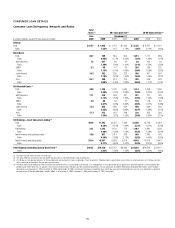

By state

Approximately half of Citi’s U.S. consumer mortgage portfolio is located in

five states: California, New York, Florida, Texas and Illinois. Those states

represent 50% of first lien mortgages and 54% of second lien mortgages.

Florida and Illinois have above-average 90+DPD delinquency rates.

Florida has 55% of its first lien mortgage portfolio with refreshed LTV>100%,

compared to 28% overall for first lien mortgages. Illinois has 35% of its loan

portfolio with refreshed LTV>100%. Texas, despite having 40% of its portfolio

with FICO<620, has a lower delinquency rate relative to the overall portfolio.

Texas has less than 0.5% of its loan portfolio with refreshed LTV>100%.

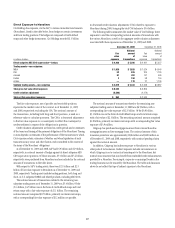

First Lien Mortgages: December 31, 2009

STATES

($ in billions)

FIRST LIEN

MORTGAGES

STATE

% TOTAL

90+DPD % *FICO < 620 *LTV > 100%

CALIFORNIA $29.6 27.6% 10.4% $ 4.8 $12.6

NEW YORK $ 8.9 8.3% 7.1% $ 1.6 $ 0.5

FLORIDA $ 6.6 6.2% 18.1% $ 2.5 $ 3.7

ILLINOIS $ 4.5 4.2% 12.3% $ 1.5 $ 1.6

TEXAS $ 4.2 3.9% 6.2% $ 1.7 $ 0.0

OTHERS $53.5 49.9% 10.4% $19.8 $11.5

* Refreshed FICO and LTV.

Note: First lien mortgage table excludes Canada and Puerto Rico, deferred fees/costs, loans guaranteed by

U.S. government sponsored agencies and loans subject to LTSCs.

In the second lien mortgage portfolio, Florida continues to experience

above-average delinquencies, with approximately 72% of their loans with

LTV > 100% compared to 42% overall for second lien mortgages.

Second Lien Mortgages: December 31, 2009

STATES

($ in billions)

SECOND LIEN

MORTGAGES

STATE

% TOTAL

90+DPD % *FICO < 620 *LTV > 100%

CALIFORNIA $13.7 27.8% 3.4% $1.9 $7.3

NEW YORK $ 6.6 13.4% 2.0% $0.8 $1.1

FLORIDA $ 3.2 6.6% 5.4% $0.8 $2.3

ILLINOIS $ 1.9 3.9% 2.9% $0.4 $1.1

TEXAS $ 1.4 2.8% 1.5% $0.2 $0.0

OTHERS $22.5 45.5% 2.9% $4.8 $8.7

* Refreshed FICO and LTV.

Note: Excludes Canada and Puerto Rico and loans subject to LTSCs.

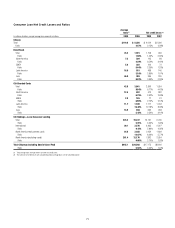

By vintage

For Citigroup’s combined U.S. consumer mortgage portfolio (first and second

lien mortgages), approximately half of the portfolio consists of 2006 and

2007 vintages, which demonstrate above-average delinquencies. In first

mortgages, approximately 43% of the portfolio is of 2006 and 2007 vintages,

which have 90+DPD rates well above the overall portfolio rate. In second

mortgages, 62% of the portfolio is of 2006 and 2007 vintages, which again

have higher delinquencies compared to the overall portfolio rate.

First Lien Mortgages: December 31, 2009

VINTAGES

($ in billions)

FIRST LIEN

MORTGAGES

VINTAGE

% TOTAL

90+DPD % *FICO < 620 *LTV > 100%

2009 $ 4.5 4.2% 0.6% $ 0.6 $ 0.1

2008 $13.8 12.8% 5.5% $ 3.0 $ 2.1

2007 $27.2 25.4% 16.9% $10.2 $11.5

2006 $19.5 18.1% 14.3% $ 6.4 $ 8.4

2005 $18.6 17.4% 7.8% $ 4.4 $ 5.9

≤ 2004 $23.7 22.1% 6.9% $ 7.4 $ 1.8

* Refreshed FICO and LTV.

Note: First lien mortgage table excludes Canada and Puerto Rico, deferred fees/costs, loans guaranteed by

U.S. government sponsored agencies and loans subject to LTSCs.

Second Lien Mortgages: December 31, 2009

VINTAGES

($ in billions)

SECOND LIEN

MORTGAGES

VINTAGE

% TOTAL

90+DPD % *FICO < 620 *LTV > 100%

2009 $ 0.6 1.2% 0.5% $0.0 $0.0

2008 $ 4.3 8.7% 1.1% $0.6 $0.7

2007 $14.6 29.5% 3.6% $2.9 $6.8

2006 $16.1 32.6% 3.7% $3.2 $8.4

2005 $ 9.5 19.3% 2.7% $1.5 $4.0

≤ 2004 $ 4.3 8.6% 1.9% $0.7 $0.6

* Refreshed FICO and LTV.

Note: Excludes Canada and Puerto Rico and loans subject to LTSCs.