Citibank 2009 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.169

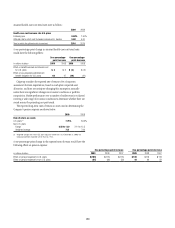

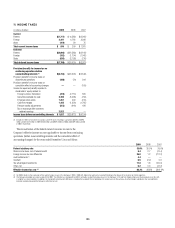

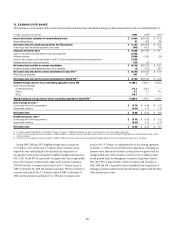

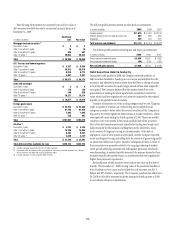

With respect to the New York NOLs, the Company has recorded a net

deferred tax asset of $0.9 billion, along with less significant net operating

losses in various other states for which the Company has recorded a

deferred tax asset of $0.4 billion and which expire between 2012 and

2029. In addition, the Company has recorded deferred tax assets in foreign

subsidiaries, for which an assertion has been made that the earnings have

been indefinitely reinvested, for net operating loss carryforwards of $607

million (which expire 2012 - 2019) and $69 million (with no expiration).

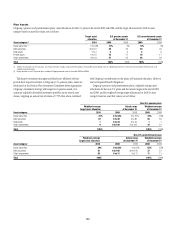

Although realization is not assured, the Company believes that the

realization of the recognized net deferred tax asset of $46.1 billion is more

likely than not based on expectations as to future taxable income in the

jurisdictions in which the DTAs arise and available tax planning strategies,

as defined in ASC 740, Income Taxes, (formerly SFAS 109) that could be

implemented if necessary to prevent a carryforward from expiring. Included

in the net U.S. Federal DTA of $36.3 billion are $5 billion in DTLs that will

reverse in the relevant carryforward period and may be used to support the

DTA , and $0.5 billion in compensation deductions, which reduced additional

paid-in capital in January, 2010 and for which no adjustment was permitted

to such DTA at December 31, 2009 because the related stock compensation

was not yet deductible to the Company. In general, the Company would

need to generate approximately $86 billion of taxable income during the

respective carryforward periods to fully realize its U.S. Federal, state and local

DTAs.

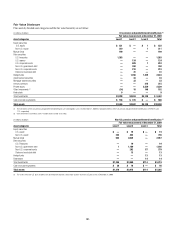

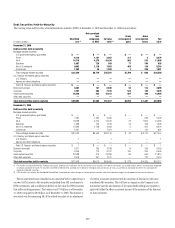

As a result of the recent losses incurred, the Company is in a three-

year cumulative pretax loss position at December 31, 2009. A cumulative

loss position is considered significant negative evidence in assessing the

realizability of a DTA. The Company has concluded that there is sufficient

positive evidence to overcome this negative evidence. The positive evidence

includes two means by which the Company is able to fully realize its DTA.

First, the Company forecasts sufficient taxable income in the carryforward

period, exclusive of tax planning strategies, even under stressed scenarios.

Secondly, the Company has sufficient tax planning strategies, including

potential sales of businesses and assets, in which it could realize the excess

of appreciated value over the tax basis of its assets, in an amount sufficient

to fully realize its DTA. The amount of the DTA considered realizable,

however, could be significantly reduced in the near term if estimates of future

taxable income during the carryforward period are significantly lower than

forecasted due to deterioration in market conditions.

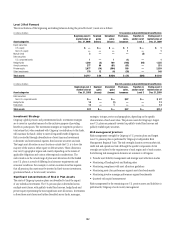

Based upon the foregoing discussion, as well as tax planning

opportunities and other factors discussed below, the U.S. Federal and New

York State and City net operating loss carryforward period of 20 years provides

enough time to utilize the DTAs pertaining to the existing net operating loss

carryforwards and any NOL that would be created by the reversal of the future

net deductions which have not yet been taken on a tax return.

The U.S. foreign tax credit carryforward period is 10 years. In addition,

utilization of foreign tax credits in any year is restricted to 35% of foreign

source taxable income in that year. Further, overall domestic losses that

the Company has incurred of approximately $45 billion are allowed to be

reclassified as foreign source income to the extent of 50% of domestic source

income produced in subsequent years and such resulting foreign source

income is in fact sufficient to cover the foreign tax credits being carried

forward. As such, the foreign source taxable income limitation will not be

an impediment to the foreign tax credit carryforward usage as long as the

Company can generate sufficient domestic taxable income within the 10-year

carryforward period.

Regarding the estimate of future taxable income, the Company has

projected its pretax earnings, predominantly based upon the “core”

businesses that the Company intends to conduct going forward. These “core”

businesses have produced steady and strong earnings in the past. During

2008 and 2009, the “core” businesses were negatively affected by the large

increase in consumer credit losses during this sharp economic downturn

cycle. The Company has already taken steps to reduce its cost structure.

Taking these items into account, the Company is projecting that it will

generate sufficient pretax earnings within the 10-year carryforward period

alluded to above to be able to fully utilize the foreign tax credit carryforward,

in addition to any foreign tax credits produced in such period.