Citibank 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

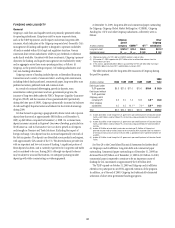

In addition to growing its deposit base and engaging in long-term debt

funding, Citi has been actively building its structural liquidity by reducing

total assets. Total assets as of December 31, 2009 have declined 4% as

compared to December 31, 2008. Loans (net of allowance), which are one

of Citi’s most illiquid assets, are down $109 billion, or approximately 15%.

Deposits as a percentage of loans have increased to 150% as of December 31,

2009 from 116% as of December 31, 2008. Structural liquidity, defined as the

sum of deposits, long-term debt and stockholders’ equity as a percentage of

total assets, has increased steadily through 2008 and 2009 and was 73% at

December 31, 2009, as compared with 66% at December 31, 2008.

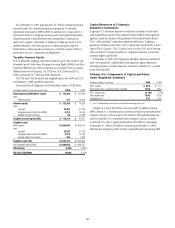

Aggregate Liquidity Resources

Parent and broker-dealer Significant bank entities Total

In billions of dollars at year end 2009 2008 2009 2008 2009 2008

Cash at major central banks $10.4 $49.2 $105.1 $ 74.5 $ 115.5 $ 123.7

Liquid securities and assets pledged at major central banks 76.4 22.8 123.6 53.8 200.0 76.6

Total $86.8 $72.0 $228.7 $128.3 $ 315.5 $ 200.3

As noted in the table above, Citigroup’s aggregate liquidity resources

totaled $315.5 billion as of December 31, 2009, compared with $200.3

billion as of December 31, 2008. As of December 31, 2009, Citigroup’s and

its affiliates’ liquidity portfolio and broker-dealer “cash box” totaled $86.8

billion as compared with $72.0 billion at December 31, 2008. This includes

the liquidity portfolio and cash box held in the U.S. as well as government

bonds held by Citigroup’s broker-dealer entities in the United Kingdom and

Japan. Further, at December 31, 2009, Citigroup’s bank subsidiaries had an

aggregate of approximately $105.1 billion of cash on deposit with major

Central Banks (including the U.S. Federal Reserve Bank of New York, the

European Central Bank, Bank of England, Swiss National Bank, Bank of

Japan, the Monetary Authority of Singapore, and the Hong Kong Monetary

Authority), compared with approximately $74.5 billion at December 31,

2008. Citigroup’s bank subsidiaries also have significant additional liquidity

resources through unencumbered highly liquid securities available for

secured funding through private markets or that are, or could be, pledged to

the major Central Banks and the U.S. Federal Home Loan Banks. The value

of these liquid securities was $123.6 billion at December 31, 2009 compared

with $53.8 billion at December 31, 2008. Significant amounts of cash and

liquid securities are also available in other Citigroup entities.

Consistent with the strategic reconfiguration of Citi’s balance sheet, the

build-up of liquidity resources and the shift in focus on increasing structural

liabilities, Citigroup entered 2010 with much of its required long-term debt

funding already in place. As a consequence, it is currently expected that the

direct long-term funding requirements for Citigroup and CFI in 2010 will be

$15 billion, which is well below the $39 billion of expected maturities.

Banking Subsidiaries—Constraints

on Supplying Funds

There are various legal and regulatory limitations on the ability of

Citigroup’s subsidiary depository institutions to pay dividends, extend credit

or otherwise supply funds to Citigroup and its non-bank subsidiaries. In

determining the declaration of dividends, each depository institution must

also consider its effect on applicable risk-based capital and leverage ratio

requirements, as well as policy statements of the federal regulatory agencies

that indicate that banking organizations should generally pay dividends out

of current operating earnings. Citigroup did not receive any dividends from

its banking subsidiaries during 2009.

Some of Citigroup’s non-bank subsidiaries have credit facilities with

Citigroup’s subsidiary depository institutions, including Citibank, N.A.

Borrowings under these facilities must be secured in accordance with

Section 23A of the Federal Reserve Act. There are various legal restrictions on

the extent to which Citi’s subsidiary depository institutions can lend or extend

credit to or engage in certain other transactions with Citigroup and certain of

its non-bank subsidiaries. In general, transactions must be on arm’s-length

terms and be secured by designated amounts of specified collateral. See Note

20 to the Consolidated Financial Statements.

Management of Liquidity

Management of liquidity at Citigroup is the responsibility of the Treasurer.

Citigroup runs a centralized treasury model where the overall balance sheet

is managed by Citigroup Treasury through Global Franchise Treasurers

and Regional Treasurers. Day-to-day liquidity and funding are managed by

treasurers at the country and business level and are monitored by Corporate

Treasury and independent risk management.

A uniform liquidity risk management policy exists for Citigroup, its

consolidated subsidiaries and managed affiliates. Under this policy, there

is a single set of standards for the measurement of liquidity risk in order to

ensure consistency across businesses, stability in methodologies, transparency

of risk, and establishment of appropriate risk appetite.