Citibank 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

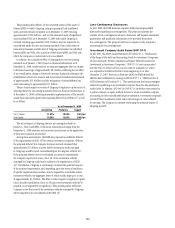

152

shares of Citigroup common stock. The number of shares to be delivered

will equal the CSE award value divided by the then fair market value of the

common stock. For CSEs awarded to certain employees whose compensation

structure was approved by the Special Master, 50% of the shares to be

delivered in April 2010 will be subject to restrictions on sale and transfer until

January 20, 2011. In lieu of 2010 CAP awards, certain retirement-eligible

employees were instead awarded CSEs payable in April 2010, but any shares

that are to be delivered in April 2010 (subject to stockholder approval) will be

subject to restrictions on sale or transfer that will lapse in four equal annual

installments beginning January 20, 2011. CSE awards have generally been

accrued as compensation expenses in the year 2009 and will be recorded as

a liability from the January 2010 grant date until the settlement date in April

2010. If stockholders approve delivery of Citigroup stock for the CSE awards,

CSE awards will likely be paid as new issues of common stock as an exception

to the Company’s practice of delivering shares from treasury stock, and the

recorded liability will be reclassified as equity at that time.

In January 2009, members of the Management Executive Committee

(except the CEO and CFO) received 30% of their incentive awards for 2008

as performance vesting-equity awards. These awards vest 50% if the price

of Citigroup common stock meets a price target of $10.61, and 50% for a

price target of $17.85, in each case on or prior to January 14, 2013. The

price target will be met only if the NYSE closing price equals or exceeds

the applicable price target for at least 20 NYSE trading days within any

period of 30 consecutive NYSE trading days ending on or before January 14,

2013. Any shares that have not vested by such date will vest according to

a fraction, the numerator of which is the share price on the delivery date

and the denominator of which is the price target of the unvested shares. No

dividend equivalents are paid on unvested awards. Fair value of the awards is

recognized as compensation expense ratably over the vesting period.

On July 17, 2007, the Committee approved the Management Committee

Long-Term Incentive Plan (MC LTIP) (pursuant to the terms of the

shareholder-approved 1999 Stock Incentive Plan) under which participants

received an equity award that could be earned based on Citigroup’s

performance against various metrics relative to peer companies and publicly-

stated return on equity (ROE) targets measured at the end of each calendar

year beginning with 2007. The final expense for each of the three consecutive

calendar years was adjusted based on the results of the ROE tests. No awards

were earned for 2009, 2008 or 2007 and no shares were issued because

performance targets were not met. No new awards were made under the MC

LTIP since the initial award in July 2007.

CAP participants in 2008, 2007, 2006 and 2005, and FA CAP participants

in those years and in 2009, could elect to receive all or part of their award in

stock options. The figures presented in the stock option program tables (see

“Stock Option Programs” below) include options granted in lieu of CAP and

FA CAP stock awards in those years.

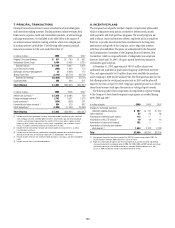

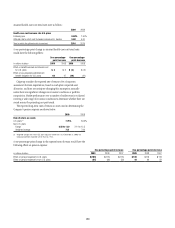

A summary of the status of Citigroup’s unvested stock awards at

December 31, 2009 and changes during the 12 months ended December 31,

2009 are presented below:

Unvested stock awards Shares

Weighted-average

grant date

fair value

Unvested at January 1, 2009 226,210,859 $36.23

New awards 162,193,923 $ 4.35

Cancelled awards (51,873,773) $26.59

Deleted awards (568,377) $13.91

Vested awards (1) (148,011,884) $25.96

Unvested at December 31, 2009 187,950,748 $19.53

(1) The weighted-average market value of the vestings during 2009 was approximately $3.64 per share.

At December 31, 2009, there was $1.6 billion of total unrecognized

compensation cost related to unvested stock awards net of the forfeiture

provision. That cost is expected to be recognized over a weighted-average

period of 1.3 years.