Citibank 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73

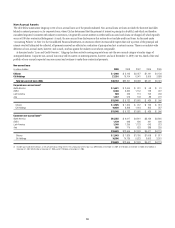

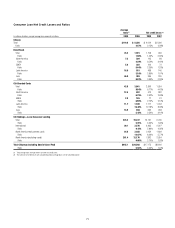

U.S. CONSUMER LENDING

Mortgage Lending

Overview

Citi’s North America consumer mortgage portfolio consists of both first lien

and second lien mortgages. As of December 31, 2009, the first lien mortgage

portfolio in LCL totaled approximately $118 billion while the second lien

mortgage portfolio in LCL was approximately $54 billion. Although the

majority of the mortgage portfolio is managed by LCL within Citi Holdings,

there are $0.5 billion of first lien mortgages and $1.7 billion of second lien

mortgages reported in Citicorp. Additionally, as mentioned above, in the

first quarter of 2010, approximately $34 billion of U.S. mortgages will be

transferred from LCL within Citi Holdings to NA RCB within Citicorp.

Citi’s first lien mortgage portfolio includes $9.0 billion of loans with

Federal Housing Administration or Veterans Administration guarantees.

These portfolios consist of loans originated to low-to-moderate-income

borrowers with lower FICO (Fair Isaac Corporation) scores and generally

have higher loan-to-value ratios (LTVs). These loans have high delinquency

rates but, given the guarantees, Citi has experienced negligible credit losses

on these loans. The first lien mortgage portfolio also includes $1.8 billion of

loans with LTVs above 80%, which have insurance through private mortgage

insurance (PMI) companies, and $3.5 billion of loans subject to Long-Term

Standby Commitments1 with U.S. government sponsored enterprises (GSE),

for which Citi has limited exposure to credit losses.

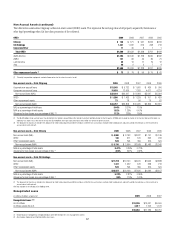

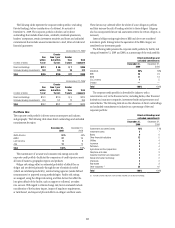

The following charts detail the quarterly trends in delinquencies and

net credit losses for Citi’s first and second North America consumer

mortgage portfolios.

For first mortgages, both delinquencies and net credit losses are impacted

by the HAMP trial loans in the U.S. mortgage portfolio. As set forth in the

first chart, first mortgage delinquencies rates continued to increase in

2009, exacerbated in part by the reduction in loan balances. The continued

increase in first mortgage delinquencies during the third and fourth

quarters of 2009 was primarily attributable to both the growing backlog of

foreclosures in process and HAMP modifications.

The growing amount of foreclosures in process, which is related to an

industry-wide phenomenon resulting from foreclosure moratoria and other

efforts to prevent or forestall foreclosure, have specific implications on

the portfolio:

• It tends to inflate the amount of 180+ day delinquencies in our mortgage

statistics.

It can result in increasing levels of consumer non-accrual loans, as we are •

unable to take possession of the underlying assets and sell these properties

on a timely basis.

It may have a dampening effect on NIM as non-accrual assets build on •

the Company’s balance sheet.

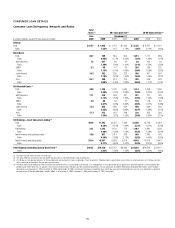

As discussed in “Consumer Loan Modification Programs” above,

Citigroup offers short-term and long-term real estate loan modification

programs. Citi monitors the performance of its real estate loan modification

programs by tracking credit loss rates by vintage. At 18 months after

modifying an account, in Citi’s experience to date, we typically reduce credit

loss rates by approximately one-third compared to similar accounts that were

not modified.

Currently, Citi’s efforts are concentrated on the HAMP. Contractual

modifications of loans that successfully completed the HAMP trial period

began in September 2009; accordingly, this is the earliest HAMP vintage

available for comparison. While early indications of the performance of

these HAMP modifications are encouraging, Citi remains cautious and

will continue to monitor the performance of these HAMP and non-HAMP

modification programs and their impact on reducing Citi’s credit losses.

As previously disclosed, loans in the HAMP trial modification period that

do not make their original contractual payment are reported as delinquent,

even if the reduced payments agreed to under the program are made by the

borrower. Further, HAMP trial modifications have the effect of marginally

reducing our net credit losses and increasing our required loan loss reserves.

Specifically, the HAMP impacted Citi’s net credit losses in the first mortgage

portfolio during the third and fourth quarters of 2009 as loans in the trial

period are not charged off at 180 DPD as long as they have made at least one

payment. Citigroup has increased its loan loss provisions to appropriately

reserve for this risk.

Citigroup believes that the success rate of the HAMP will be a key factor

influencing net credit losses from delinquent first mortgage loans, at least

during the first half of 2010, and the outcome of the program will largely

depend on the success rates of borrowers completing the trial period and

meeting the documentation requirements.

By contrast, second mortgages continue to show positive trends in

both net credit losses and delinquencies, reflecting the impact of portfolio

re-positioning and loss mitigation. Citi continues to actively manage

this exposure by reducing the riskiest accounts, including by tightening

credit requirements through higher FICOs, lower LTVs, and increased

documentation and verifications. As discussed under “Risk Factors,”

Citigroup is actively engaged in discussions with the U.S. Treasury for the

second lien program under HAMP.

1 A Long-Term Standby Commitment (LTSC) is a structured transaction in which Citi transfers

the credit risk of certain eligible loans to an investor in exchange for a fee. These loans remain

on balance sheet unless they reach a certain delinquency level (between 120 and 180 days), in

which case the LTSC investor is required to buy the loan at par.