Citibank 2009 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

200

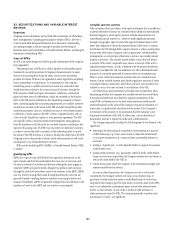

Credit Card Securitizations

The Company securitizes credit card receivables through trusts that are

established to purchase the receivables. Citigroup sells receivables into the

QSPE trusts on a non-recourse basis. Credit card securitizations are revolving

securitizations; that is, as customers pay their credit card balances, the cash

proceeds are used to purchase new receivables and replenish the receivables

in the trust. The Company relies on securitizations to fund a significant

portion of its managed North America Cards business.

The following table reflects amounts related to the Company’s securitized

credit card receivables:

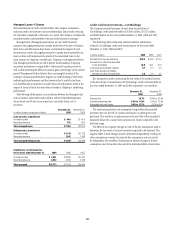

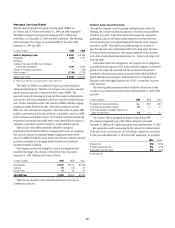

Citicorp Citi Holdings

In billions of dollars at December 31 2009 2008 2009 2008

Principal amount of credit card receivables in trusts $78.8 $78.3 $42.3 $45.7

Ownership interests in principal amount of trust credit card receivables

Sold to investors via trust-issued securities 66.5 68.2 28.2 30.0

Retained by Citigroup as trust-issued securities 5.0 1.2 10.1 5.4

Retained by Citigroup via non-certificated interests recorded as consumer loans 7.3 8.9 4.0 10.3

Total ownership interests in principal amount of trust credit card receivables $78.8 $78.3 $42.3 $45.7

Other amounts recorded on the balance sheet related to interests retained in the trusts

Other retained interests in securitized assets $ 1.4 $ 1.2 $ 1.6 $ 2.0

Residual interest in securitized assets (1) 0.3 0.3 1.2 1.4

Amounts payable to trusts 1.2 1.0 0.8 0.7

(1) 2009 balances include net unbilled interest of $0.3 billion for Citicorp and $0.4 billion for Citi Holdings. December 31, 2008 balances included net unbilled interest of $0.3 billion for Citicorp and $0.3 billion for Citi

Holdings.

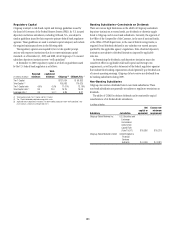

Credit Card Securitizations—Citicorp

In the years ended December 31, 2009, 2008 and 2007, the Company

recorded net gains (losses) from securitization of Citicorp’s credit card

receivables of $349 million, $(1,007) million and $416 million, respectively.

Net gains (losses) reflect the following:

incremental gains (losses) from new securitizations; •

the reversal of the allowance for loan losses associated with •

receivables sold;

net gains on replenishments of the trust assets offset by other-than-•

temporary impairments; and

changes in fair value for the portion of the residual interest classified as •

trading assets.

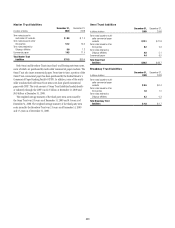

The following table summarizes selected cash flow information related to

Citicorp’s credit card securitizations for the years ended December 31, 2009,

2008 and 2007:

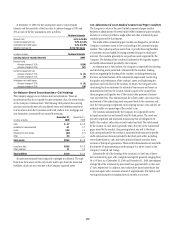

In billions of dollars 2009 2008 2007

Proceeds from new securitizations $ 16.3 $ 11.8 $ 19.3

Proceeds from collections reinvested in

new receivables 144.4 165.6 176.7

Contractual servicing fees received 1.3 1.3 1.2

Cash flows received on retained

interests and other net cash flows 3.1 3.9 5.1

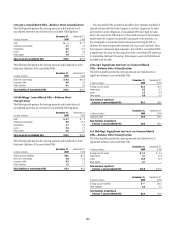

As of December 31, 2009 and December 31, 2008, the residual interest in

securitized credit card receivables was valued at $0 for Citicorp. Considering

the residual interest was written down to $0 at December 31, 2008,

key assumptions used in measuring its fair value at the date of sale or

securitization are not provided for 2009, but are provided for 2008. The below

table reflects these assumptions:

2009 2008

Discount rate N/A 13.3% to 17.4%

Constant prepayment rate N/A 5.8% to 21.1%

Anticipated net credit losses N/A 4.7% to 7.4%

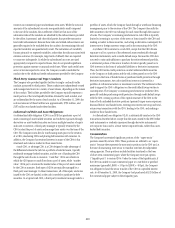

At December 31, 2009, the sensitivity of the fair value to adverse changes

of 10% and 20% in each of the key assumptions were as follows:

In millions of dollars

Residual

interest

Retained

certificates

Other

retained

interests

Carrying value of retained interests $ — $5,008 $ 1,650

Discount rates

Adverse change of 10% $ — $ (4) $ (1)

Adverse change of 20% — (8) (2)

Constant prepayment rate

Adverse change of 10% $ — $ — $ —

Adverse change of 20% — — —

Anticipated net credit losses

Adverse change of 10% $ — $ — $ (35)

Adverse change of 20% — — (69)