Citibank 2009 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

201

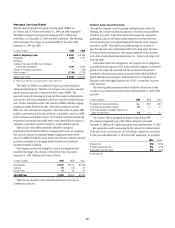

Managed Loans—Citicorp

After securitization of credit card receivables, the Company continues to

maintain credit card customer account relationships and provides servicing

for receivables transferred to the trusts. As a result, the Company considers the

securitized credit card receivables to be part of the business it manages.

Managed-basis (Managed) presentations are non-GAAP financial

measures. Managed presentations include results from both the on-balance-

sheet loans and off-balance-sheet loans, and exclude the impact of card

securitization activity. Managed presentations assume that securitized loans

have not been sold and present the results of the securitized loans in the

same manner as Citigroup's owned loans. Citigroup’s management believes

that Managed presentations provide a greater understanding of ongoing

operations and enhance comparability of those results in prior periods as

well as demonstrating the effects of unusual gains and charges in the current

period. Management further believes that a meaningful analysis of the

Company’s financial performance requires an understanding of the factors

underlying that performance and that investors find it useful to see these

non-GAAP financial measures to analyze financial performance without the

impact of unusual items that may obscure trends in Citigroup’s underlying

performance.

The following tables present a reconciliation between the Managed basis

and on-balance-sheet credit card portfolios and the related delinquencies

(loans which are 90 days or more past due) and credit losses, net of

recoveries.

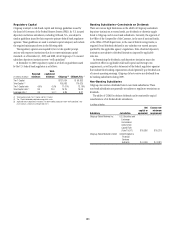

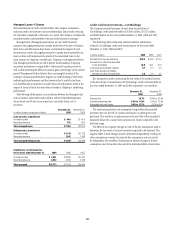

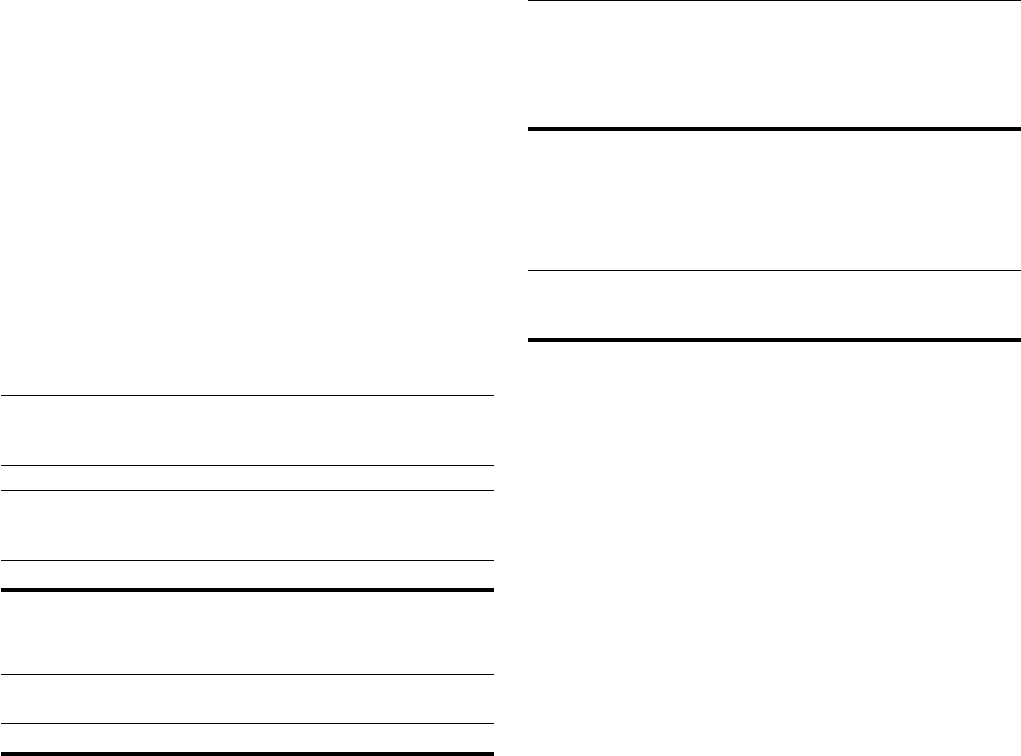

In millions of dollars, except loans in billions

December 31,

2009

December 31,

2008

Loan amounts, at period end

On balance sheet $ 44.0 $ 45.5

Securitized amounts 71.6 69.5

Total managed loans $115.6 $ 115.0

Delinquencies, at period end

On balance sheet $ 1,146 $ 1,126

Securitized amounts 1,902 1,543

Total managed delinquencies $ 3,048 $ 2,669

Credit losses, net of recoveries,

for the years ended December 31, 2009 2008 2007

On balance sheet $ 3,841 $ 2,866 $ 1,921

Securitized amounts 6,932 4,300 2,733

Total managed $10,773 $ 7,166 $ 4,654

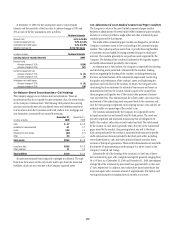

Credit Card Securitizations—Citi Holdings

The Company recorded net gains (losses) from securitization of

Citi Holdings’ credit card receivables of $(586) million, $(527) million,

and $668 million for the years ended December 31, 2009, 2008 and 2007,

respectively.

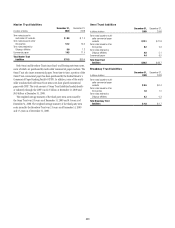

The following table summarizes selected cash flow information

related to Citi Holdings’ credit card securitizations for the years ended

December 31, 2009, 2008 and 2007:

In billions of dollars 2009 2008 2007

Proceeds from new securitizations $29.4 $16.9 $17.0

Proceeds from collections reinvested

in new receivables 46.0 49.1 41.3

Contractual servicing fees received 0.7 0.7 0.9

Cash flows received on retained

interests and other net cash flows 2.6 3.3 2.5

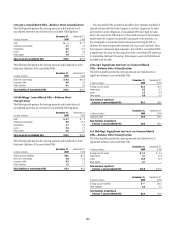

Key assumptions used in measuring the fair value of the residual interest

at the date of sale or securitization of Citi Holdings’ credit card receivables for

the years ended December 31, 2009 and 2008, respectively, are as follows:

December 31,

2009

December 31,

2008

Discount rate 19.7% 16.8% to 20.9%

Constant prepayment rate 6.0% to 11.0% 6.4% to 12.4%

Anticipated net credit losses 9.9% to 13.2% 6.6% to 9.9%

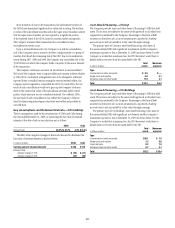

The constant prepayment rate assumption range reflects the projected

payment rates over the life of a credit card balance, excluding new card

purchases. This results in a high payment in the early life of the securitized

balances followed by a much lower payment rate, which is depicted in the

disclosed range.

The effect of two negative changes in each of the key assumptions used to

determine the fair value of retained interests is required to be disclosed. The

negative effect of each change must be calculated independently, holding all

other assumptions constant. Because the key assumptions may not in fact

be independent, the net effect of simultaneous adverse changes in the key

assumptions may be less than the sum of the individual effects shown below.