Citibank 2009 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

189

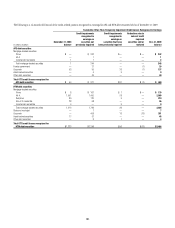

20. DEBT

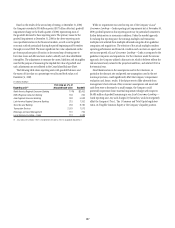

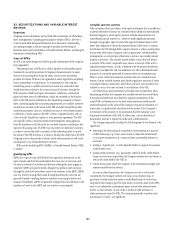

Short-Term Borrowings

Short-term borrowings consist of commercial paper and other borrowings

with weighted average interest rates as follows:

2009 2008

In millions of dollars

at December 31, Balance

Weighted

average Balance

Weighted

average

Commercial paper

Citigroup Funding Inc. $ 9,846 0.33% $ 28,654 1.66%

Other Citigroup subsidiaries 377 0.51 471 2.02

$10,223 $ 29,125

Other borrowings 58,656 0.66% 97,566 2.40%

Total $68,879 $126,691

Borrowings under bank lines of credit may be at interest rates based on

LIBOR, CD rates, the prime rate, or bids submitted by the banks. Citigroup

pays commitment fees for its lines of credit.

Some of Citigroup’s non-bank subsidiaries have credit facilities with

Citigroup’s subsidiary depository institutions, including Citibank, N.A.

Borrowings under these facilities must be secured in accordance with

Section 23A of the Federal Reserve Act.

CGMHI has committed financing with an unaffiliated bank. At

December 31, 2009, CGMHI had drawn down the full $125 million

available, which is guaranteed by Citigroup. It also has substantial

borrowing agreements consisting of facilities that CGMHI has been advised

are available, but where no contractual lending obligation exists. These

arrangements are reviewed on an ongoing basis to ensure flexibility in

meeting CGMHI’s short-term requirements.

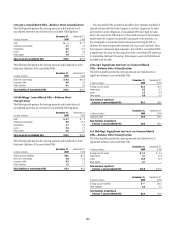

Long-Term Debt

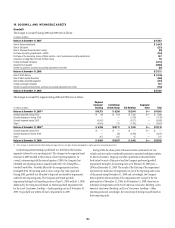

Balances

In millions of dollars

at December 31,

Weighted

average

coupon Maturities 2009 2008

Citigroup parent company

Senior notes (1) 4.11% 2010-2098 $149,751 $138,014

Subordinated notes 5.25 2010-2036 28,708 30,216

Junior subordinated notes

relating to trust preferred

securities 7.19 2031-2067 19,345 24,060

Other Citigroup subsidiaries

Senior notes (2) 2.12 2010-2043 93,909 105,620

Subsidiary

subordinated notes 1.63 2010-2038 3,060 3,395

Secured debt 1.79 2010-2017 325 290

Citigroup Global Markets

Holdings Inc.

Senior notes 1.94 2010-2097 13,422 20,619

Subordinated notes —4

Citigroup Funding Inc. (3)

Senior notes 3.21 2010-2051 55,499 37,375

Total $364,019 $359,593

Senior notes $312,581 $301,628

Subordinated notes 31,768 33,615

Junior subordinated notes

relating to trust preferred

securities 19,345 24,060

Other 325 290

Total $364,019 $359,593

(1) Includes $250 million of notes maturing in 2098.

(2) At December 31, 2009 and 2008, collateralized advances from the Federal Home Loan Bank are

$24.1 billion and $67.4 billion, respectively.

(3) Includes Principal-Protected Trust Securities (Safety First Trust Securities) with carrying values of $528

million issued by Safety First Trust Series 2006-1, 2007-1, 2007-2, 2007-3, 2007-4, 2008-1, 2008-2,

2008-3, 2008-4, 2008-5, 2008-6, 2009-1, 2009-2, and 2009-3 (collectively, the “Safety First Trusts”)

at December 31, 2009 and $452 million issued by Safety First Trust Series 2006-1, 2007-1, 2007-2,

2007-3, 2007-4, 2008-1, 2008-2, 2008-3, 2008-4, 2008-5 and 2008-6 at December 31, 2008.

CFI owns all of the voting securities of the Safety First Trusts. The Safety First Trusts have no assets,

operations, revenues or cash flows other than those related to the issuance, administration, and

repayment of the Safety First Trust Securities and the Safety First Trusts’ common securities. The Safety

First Trusts’ obligations under the Safety First Trust Securities are fully and unconditionally guaranteed by

CFI, and CFI’s guarantee obligations are fully and unconditionally guaranteed by Citigroup.

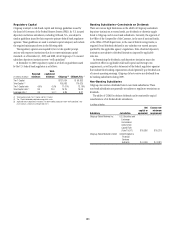

CGMHI has a syndicated five-year committed uncollateralized revolving

line of credit facility with unaffiliated banks totaling $3.0 billion, which

was undrawn at December 31, 2009 and matures in 2011. CGMHI also

has committed long-term financing facilities with unaffiliated banks. At

December 31, 2009, CGMHI had drawn down the full $900 million available

under these facilities, of which $150 million is guaranteed by Citigroup.

Generally, a bank can terminate these facilities by giving CGMHI one year

prior notice.