Citibank 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

As of December 31, 2009, approximately $6.7 billion of stock repurchases

remained under Citi’s authorized repurchase programs. No material

repurchases were made in 2009 or 2008. In addition, for so long as the U.S.

government holds any Citigroup common stock or trust preferred securities

acquired pursuant to the preferred stock exchange offers, Citigroup has

agreed not to acquire, repurchase, or redeem any Citigroup equity or trust

preferred securities, other than pursuant to administering its employee

benefit plans or other customary exceptions, or with the consent of the U.S.

government. See also “Supervision and Regulation.”

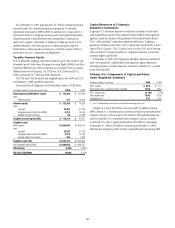

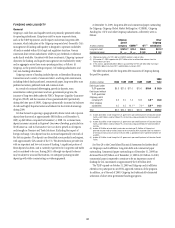

Tangible Common Equity

TCE, as defined by Citigroup, represents Common equity less Goodwill and

Intangible assets (other than Mortgage Servicing Rights (MSRs)) net of the

related net deferred taxes. Other companies may calculate TCE in a manner

different from that of Citigroup. Citi’s TCE was $118.2 billion and $31.1

billion at December 31, 2009 and 2008, respectively.

The TCE ratio (TCE divided by risk-weighted assets) was 10.9% and 3.1%

at December 31, 2009 and 2008, respectively.

A reconciliation of Citigroup’s total stockholders’ equity to TCE follows:

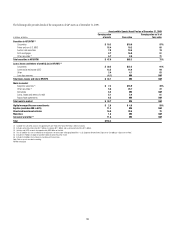

In millions of dollars at year end, except ratios 2009 2008

Total Citigroup stockholders’ equity $ 152,700 $ 141,630

Less:

Preferred stock 312 70,664

Common equity $ 152,388 $ 70,966

Less:

Goodwill 25,392 27,132

Intangible assets (other than MSRs) 8,714 14,159

Related net deferred taxes 68 (1,382)

Tangible common equity (TCE) $ 118,214 $ 31,057

Tangible assets

GAAP assets $1,856,646 $1,938,470

Less:

Goodwill 25,392 27,132

Intangible assets (other than MSRs) 8,714 14,159

Related deferred tax assets 386 1,285

Tangible assets (TA) $1,822,154 $1,895,894

Risk-weighted assets (RWA) $1,088,526 $ 996,247

TCE/TA ratio 6.49% 1.64%

TCE ratio (TCE/RWA) 10.86% 3.12%

Capital Resources of Citigroup’s

Depository Institutions

Citigroup’s U.S. subsidiary depository institutions are subject to risk-based

capital guidelines issued by their respective primary federal bank regulatory

agencies, which are similar to the guidelines of the Federal Reserve Board.

To be “well capitalized” under these regulatory definitions, Citigroup’s

depository institutions must have a Tier 1 Capital ratio of at least 6%, a Total

Capital (Tier 1 Capital + Tier 2 Capital) ratio of at least 10%, and a Leverage

ratio of at least 5%, and not be subject to a regulatory directive to meet and

maintain higher capital levels.

At December 31, 2009, all of Citigroup’s subsidiary depository institutions

were “well capitalized” under federal bank regulatory agency definitions,

including Citigroup’s primary depository institution, Citibank, N.A., as noted

in the following table:

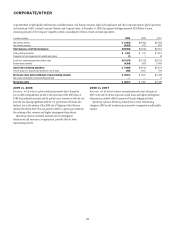

Citibank, N.A. Components of Capital and Ratios

Under Regulatory Guidelines

In billions of dollars at year end 2009 2008

Tier 1 Capital $ 96.8 $ 71.0

Total Capital (Tier 1 Capital and Tier 2 Capital) 110.6 108.4

Tier 1 Capital ratio 13.16% 9.94%

Total Capital ratio 15.03 15.18

Leverage ratio (1) 8.31 5.82

(1) Tier 1 Capital divided by each period’s quarterly adjusted average total assets.

Citibank, N.A. had a $2.8 billion net loss for 2009. In addition, during

2009, Citibank, N.A. received capital contributions from its immediate parent

company, Citicorp, in the amount of $33.0 billion. Total subordinated notes

issued to Citibank, N.A.’s immediate parent company, Citicorp, included

in Citibank, N.A.’s Tier 2 Capital declined from $28.2 billion outstanding

at December 31, 2008 to $4.0 billion outstanding at December 31, 2009,

reflecting the redemption of $24.2 billion of subordinated notes during 2009.